How Much Money Can You Make Under The Table Without Paying Taxes Leia It’s not illegal to pay someone in cash, but it is illegal to pay them without tracking the income and paying taxes on it. if you’re an employee, you should expect to receive a w 2 from your employer at tax time—if you’re an independent contractor who’s been paid over $600, you should expect a 1099 nec. See the 2024 tax tables (for money you earned in 2024). find the 2025 tax rates (for money you earn in 2025). see current federal tax brackets and rates based on your income and filing status.

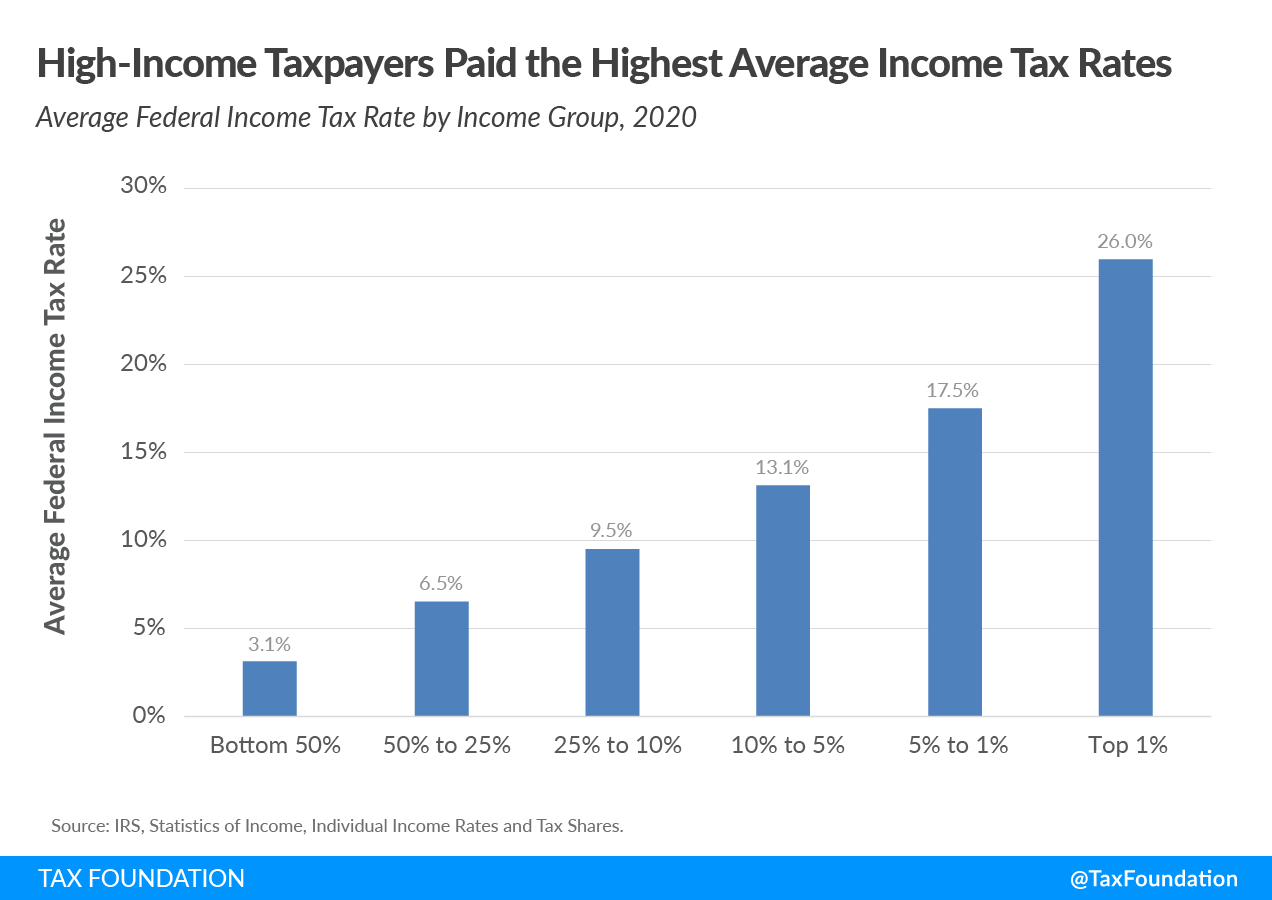

How Much Income Can A Small Business Make Without Paying Taxes Leia How much cash can you make without paying taxes? there’s a common myth that as long as you make under $600, you don’t have to report it to the irs. the truth is that all the money you make is taxable. Generally, self employed taxpayers and independent contractors receive 1099s for non salaried work. but, if you receive income under the table from odd jobs or tips, you may still be required to file income taxes, even without a 1099. Understanding how much income you can earn without needing to file taxes is crucial for financial planning. this knowledge helps individuals avoid unnecessary filings and ensures compliance with federal regulations, potentially saving time and money. How much money can you make under the table without paying taxes 2021? earn less than $75,000? you may pay nothing in federal income taxes for 2021. at least half of taxpayers have income under $75,000, according to the most recent data available.

How Do You File Taxes If You Get Paid Under The Table Sirmabekian Understanding how much income you can earn without needing to file taxes is crucial for financial planning. this knowledge helps individuals avoid unnecessary filings and ensures compliance with federal regulations, potentially saving time and money. How much money can you make under the table without paying taxes 2021? earn less than $75,000? you may pay nothing in federal income taxes for 2021. at least half of taxpayers have income under $75,000, according to the most recent data available. How much do you have to make to file taxes in 2025? the requirement to file a tax return primarily depends on your age, filing status, income level, and dependency status. in most cases, if your income does not meet the income threshold, you don’t have to file a tax return. Unreported employment is estimated to be a $2 trillion economy, and the irs claims that the government loses $500 billion in tax revenue annually due to unpaid taxes from both the employer and employee. How much money can you make under the table without paying taxes? single, under the age of 65 and not older or blind, you must file your taxes if: unearned income was more than $1,050. earned income was more than $12,000. So, no, getting paid under the table won't let you avoid paying income taxes and keep you out of criminal charges. it really makes it more difficult to pay them. if you find yourself in this situation, here's how to make things as simple for yourself as possible while still ensuring you're not in trouble with the irs.

How Do You File Taxes If You Get Paid Under The Table Sirmabekian How much do you have to make to file taxes in 2025? the requirement to file a tax return primarily depends on your age, filing status, income level, and dependency status. in most cases, if your income does not meet the income threshold, you don’t have to file a tax return. Unreported employment is estimated to be a $2 trillion economy, and the irs claims that the government loses $500 billion in tax revenue annually due to unpaid taxes from both the employer and employee. How much money can you make under the table without paying taxes? single, under the age of 65 and not older or blind, you must file your taxes if: unearned income was more than $1,050. earned income was more than $12,000. So, no, getting paid under the table won't let you avoid paying income taxes and keep you out of criminal charges. it really makes it more difficult to pay them. if you find yourself in this situation, here's how to make things as simple for yourself as possible while still ensuring you're not in trouble with the irs.

Should You Pay Employees Under The Table Prn Funding How much money can you make under the table without paying taxes? single, under the age of 65 and not older or blind, you must file your taxes if: unearned income was more than $1,050. earned income was more than $12,000. So, no, getting paid under the table won't let you avoid paying income taxes and keep you out of criminal charges. it really makes it more difficult to pay them. if you find yourself in this situation, here's how to make things as simple for yourself as possible while still ensuring you're not in trouble with the irs.

How Do I File Taxes If I M Paid Under The Table The Accountants For