How Should Your Asset Allocation Change In Retirement

Asset Allocation For Retirement Good Life Asset Strategies Design a retirement asset allocation that fits with your timeline and the amount of risk you can handle. then, implement a rebalancing strategy so you're not adding risk over time. As you progress through your retirement investing journey, consider altering your asset allocation by age as your time horizon, investment goals, and risk tolerance change.

Asset Allocation For Retirement Planning Your asset allocation as you save for retirement will likely be different from your asset allocation when you’re retired. below, we take a brief look at what retirement asset allocation is and why it’s important. Use anticipated spending needs and probabilities of a positive return over your time horizon to back into the right mix of cash, bonds, and stocks. off the shelf asset allocation guidance. A well laid out asset allocation strategy helps retirees balance their growth, income, and safety needs throughout retirement. the right portfolio asset allocation can ensure financial independence, regardless of whether you’re just starting retirement or enjoying your golden years. Learn how to set up a balanced portfolio based on an asset allocation model for your age. get asset allocation examples for different age groups.

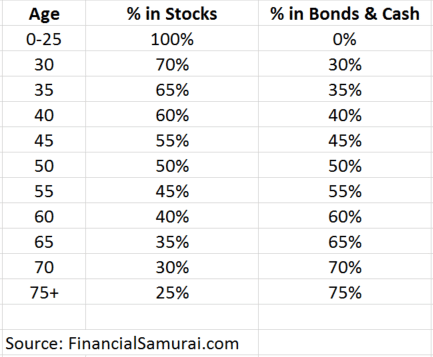

Should Your Asset Allocation Change As You Near Retirement A well laid out asset allocation strategy helps retirees balance their growth, income, and safety needs throughout retirement. the right portfolio asset allocation can ensure financial independence, regardless of whether you’re just starting retirement or enjoying your golden years. Learn how to set up a balanced portfolio based on an asset allocation model for your age. get asset allocation examples for different age groups. Begin discussions with your financial planner at least a year or two, preferably five years, before retirement; a portfolio review is needed that includes rebalancing and strategic reallocation . Consider scaling back expenses, making strategic use of cash, and increasing dependable sources of income. annuities, bonds, and cds can provide dependable income in times of uncertainty. the first few years of retirement can be a critical time for your portfolio. Think of asset allocation as the load bearing walls of your financial house in retirement. it’s how you divide your investment dollars among different types of assets. primarily stocks (ownership in companies, for growth), bonds (loans to governments or companies, for stability and income), and cash (for immediate needs and safety). There are several variables that determine your ideal stock bond cash allocation, such as your age, risk tolerance, and more. here's a quick guide to help you determine the optimal allocation.

Retirement Asset Allocation How To Build Your Perfect One Begin discussions with your financial planner at least a year or two, preferably five years, before retirement; a portfolio review is needed that includes rebalancing and strategic reallocation . Consider scaling back expenses, making strategic use of cash, and increasing dependable sources of income. annuities, bonds, and cds can provide dependable income in times of uncertainty. the first few years of retirement can be a critical time for your portfolio. Think of asset allocation as the load bearing walls of your financial house in retirement. it’s how you divide your investment dollars among different types of assets. primarily stocks (ownership in companies, for growth), bonds (loans to governments or companies, for stability and income), and cash (for immediate needs and safety). There are several variables that determine your ideal stock bond cash allocation, such as your age, risk tolerance, and more. here's a quick guide to help you determine the optimal allocation.

Comments are closed.