6 Asset Allocation Strategies For A Diversified Portfolio Secvolt Spreading investments across different asset classes, rather than relying on one, is a key strategy to balance risk and potential returns over time. known as asset allocation, this approach. Morningstar categories help sort investments by factors such as sector exposure, geographic region, or asset allocation. this system can help you search for investments that suit your needs.

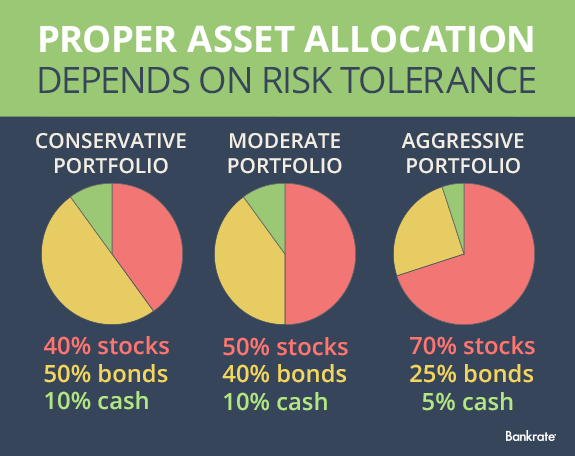

How To Set Up Your Investment Portfolio Proper Asset Allocation How do you choose how much you want to invest in stocks or bonds? asset allocation models can help you understand different goal based investment strategies. to find the asset allocation that's right for your investment portfolio, it's important to have a clear understanding of your goals, time frame, and risk tolerance. Taking things one step at a time, you'll be prepared to design and implement a simple, yet sophisticated, investment portfolio yourself—or at least gain the skills and knowledge necessary to know when an advisor is “selling you down the river.” step 1 – set goals. step 2 – develop an asset allocation. step 3 – implement the asset allocation. Asset allocation is an investing strategy that divides an investment portfolio among various asset classes. this process creates a diverse mix of assets designed to offset riskier assets with. In general, investors with long term time horizons, low near term cash needs, and moderate to high risk capacity and tolerance will have an asset allocation that emphasizes equity investments.

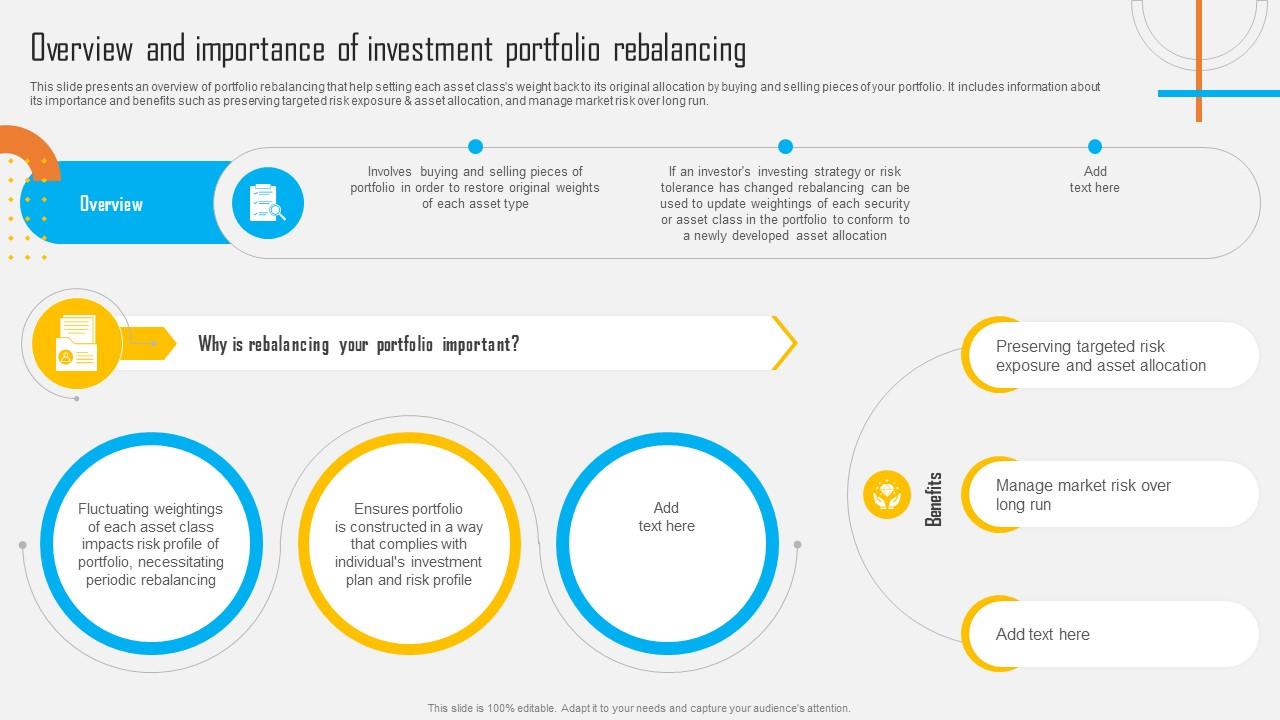

Asset Allocation Investment Overview And Importance Of Investment Asset allocation is an investing strategy that divides an investment portfolio among various asset classes. this process creates a diverse mix of assets designed to offset riskier assets with. In general, investors with long term time horizons, low near term cash needs, and moderate to high risk capacity and tolerance will have an asset allocation that emphasizes equity investments. Introduction. imagine building a house with only bricks and no cement—strong in parts, but vulnerable overall. that’s what an unbalanced investment portfolio looks like. while high return assets like equities may promise growth, relying solely on them can expose you to unnecessary risk. The next step in building an investment portfolio is to choose your asset allocation. this involves deciding what percentage of your portfolio you want to allocate to different investments, such as stocks, bonds, and real estate. once you have built your investment portfolio, it is important to monitor it regularly and make necessary adjustments. Transparent: simplify allocations to ensure they’re clear, easy to explain and free from unnecessary complexity. cost efficient: keep fees and expenses low to maximize the potential of clients’ investments. globally diversified: create balance with portfolios that span geographies, asset classes and investment styles. designed for the long term: prioritize sustained growth potential while. Invest in a broad, diverse portfolio of stocks and bonds using simple asset allocation or target date funds and automate your investments as much as possible. about the author: david shotwell, cfp.