15 Crypto Leverage Trading Strategies To Boost Profits 2025 Crypto leverage trading has revolutionized the way traders interact with cryptocurrency markets, enabling them to amplify their potential gains by borrowing funds to trade larger positions than their initial investment allows. this powerful tool can unlock new opportunities but also carries increased risks. Leverage trading in crypto can enhance gains but also amplify risks. let’s explore examples of successful and failed leverage trades to understand the potential and pitfalls. example: successful leverage trade. imagine you decide to use 10x leverage on bitcoin (btc) when it’s priced at $30,000.

How To Trade Crypto With Leverage 2025 In this guide, we’ll break down everything you need to know about leveraging your crypto trades. what is leverage in crypto trading? leverage is essentially borrowed capital that allows you to control a larger position than what your account balance would typically permit. it’s a way to maximize your buying power and, potentially, your profits. This guide explores the best crypto leverage trading strategies for 2025, tailored to help traders navigate this dynamic landscape. from risk management techniques to advanced trading setups, these strategies are designed to empower both beginners and experienced traders to optimize their leverage use while minimizing potential losses. What leverage is best in crypto trading? choose a leverage ratio that is comfortable for you. this varies from trader to trader but it should be high enough so that you can increase profits without sacrificing too much risk. you don’t want to over leverage which can cause your stop losses to get hit over and over again. Crypto leverage trading involves these key steps to maximize returns and manage risk: deposit collateral: provide funds as a margin to secure borrowed capital for leveraged trades. choose leverage ratio: select an appropriate leverage level (e.g., 5x or 10x) based on risk tolerance, trading experience, and objectives within the crypto market.

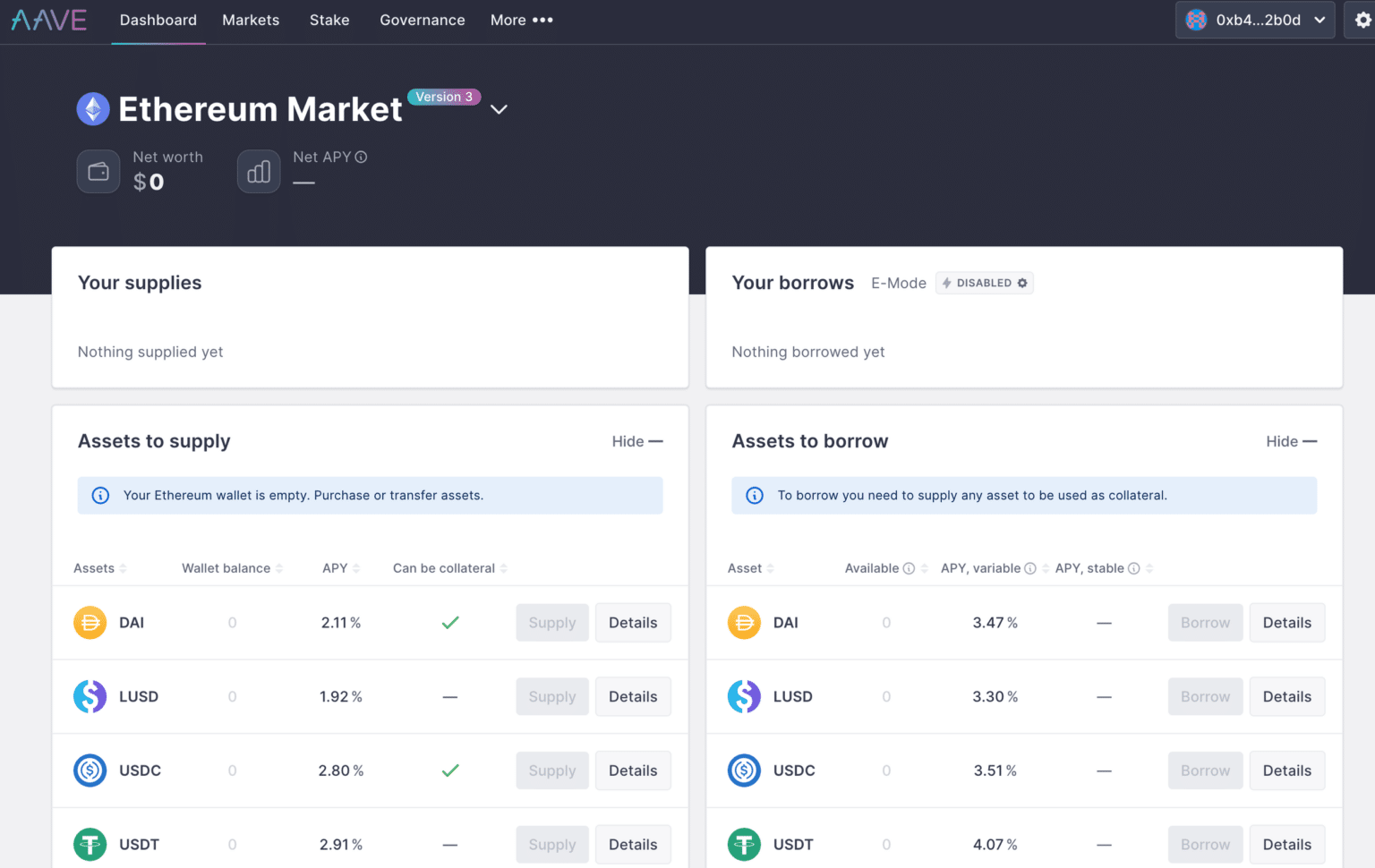

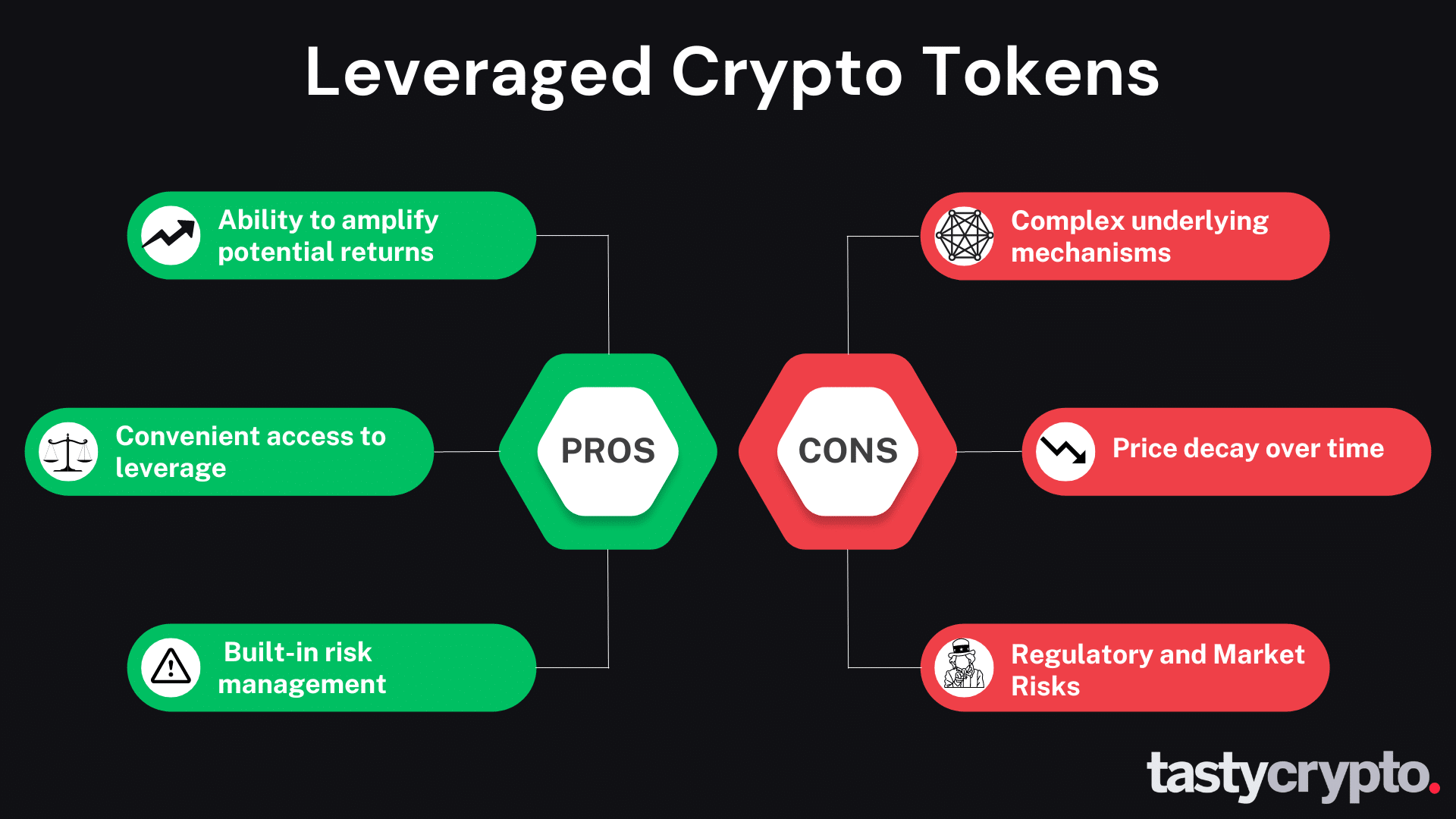

Leverage In Crypto Trading 6 Key Examples Tastycrypto What leverage is best in crypto trading? choose a leverage ratio that is comfortable for you. this varies from trader to trader but it should be high enough so that you can increase profits without sacrificing too much risk. you don’t want to over leverage which can cause your stop losses to get hit over and over again. Crypto leverage trading involves these key steps to maximize returns and manage risk: deposit collateral: provide funds as a margin to secure borrowed capital for leveraged trades. choose leverage ratio: select an appropriate leverage level (e.g., 5x or 10x) based on risk tolerance, trading experience, and objectives within the crypto market. In cryptocurrency, leverage trading refers to the process of borrowing funds in order to increase long or short exposure to a digital asset. in this article, we’ll explore leverage in the decentralized finance (defi) space. what is leverage in crypto trading? 1. leverage with defi borrowing. 2. leverage with defi margin. 3. leverage with perpetuals. Crypto leverage trading is a powerful tool for traders seeking to maximize their potential returns. this guide explores the intricacies of leveraging trading strategies, risk management techniques, and short term opportunities in cryptos like bitcoin and ethereum. 1. bydfi. 2. coinbase. 3. okx. 4. bingx. 5. bybit. 6. mexc. 7. kraken. 8. binance. When we first saw the how to leverage trade crypto in 2025 for huge gains! (what is leverage, profit taking, etc) video on the my financial friend channel, we knew our community would want to stream it as soon as possible. so we wrote this article to publish it as soon as possible.

Leverage In Crypto Trading 6 Key Examples Tastycrypto In cryptocurrency, leverage trading refers to the process of borrowing funds in order to increase long or short exposure to a digital asset. in this article, we’ll explore leverage in the decentralized finance (defi) space. what is leverage in crypto trading? 1. leverage with defi borrowing. 2. leverage with defi margin. 3. leverage with perpetuals. Crypto leverage trading is a powerful tool for traders seeking to maximize their potential returns. this guide explores the intricacies of leveraging trading strategies, risk management techniques, and short term opportunities in cryptos like bitcoin and ethereum. 1. bydfi. 2. coinbase. 3. okx. 4. bingx. 5. bybit. 6. mexc. 7. kraken. 8. binance. When we first saw the how to leverage trade crypto in 2025 for huge gains! (what is leverage, profit taking, etc) video on the my financial friend channel, we knew our community would want to stream it as soon as possible. so we wrote this article to publish it as soon as possible.

Leverage In Crypto Trading 6 Key Examples Tastycrypto When we first saw the how to leverage trade crypto in 2025 for huge gains! (what is leverage, profit taking, etc) video on the my financial friend channel, we knew our community would want to stream it as soon as possible. so we wrote this article to publish it as soon as possible.