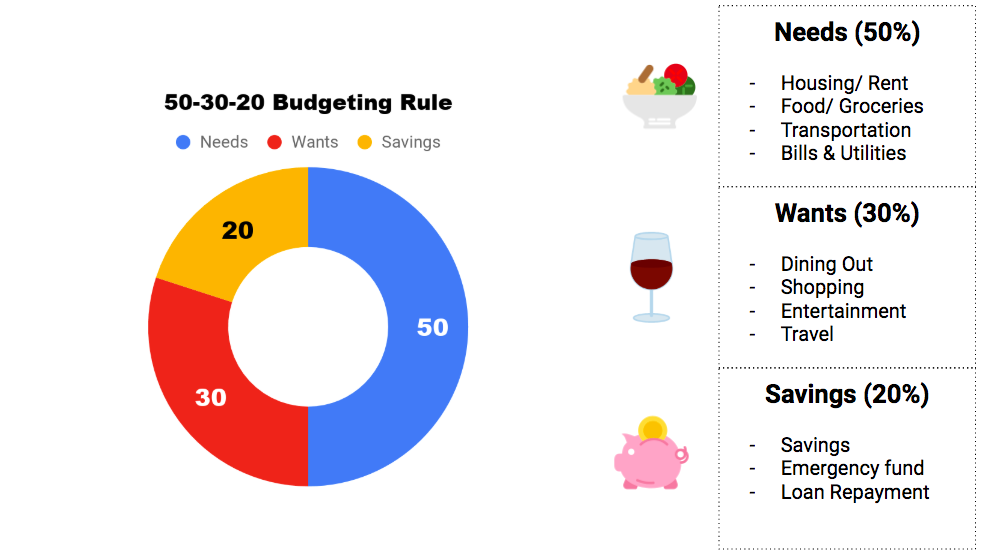

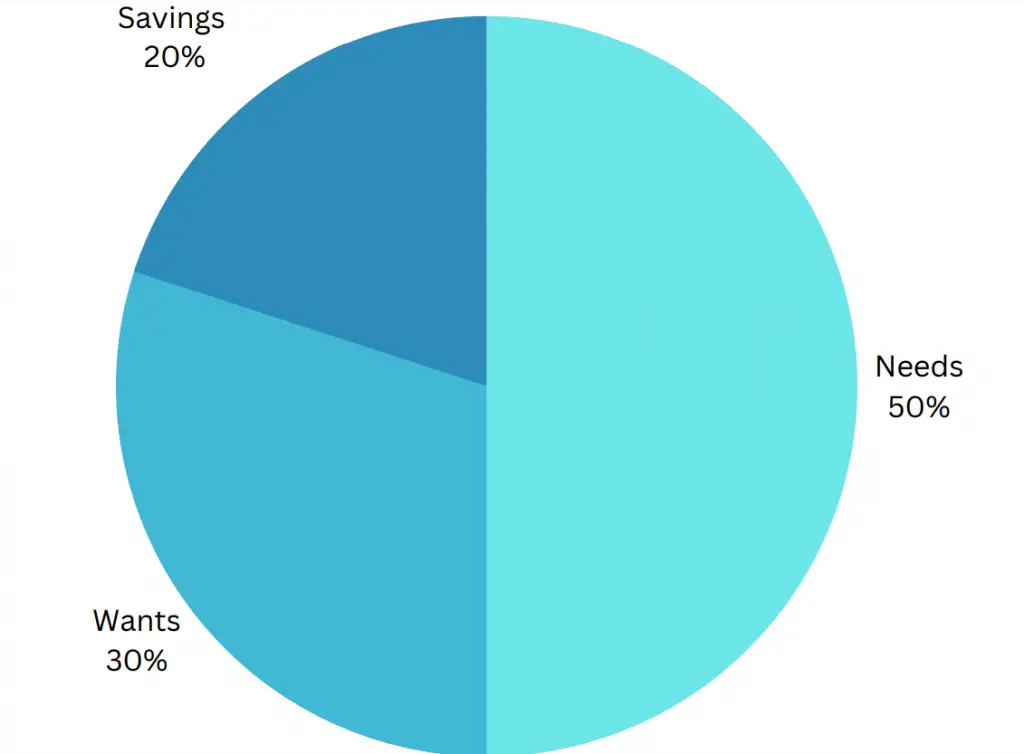

Hack To Better Manage Your Finances The 50 30 20 Rule Learn About What is the 50 30 20 rule? the 50 30 20 rule involves splitting your after tax income into three categories of spending: 50% goes to needs, 30% goes to wants, and 20% goes to savings. The first step in creating a 50 30 20 budget is to figure out your net income since that’s the figure you’ll be dividing from. your net income is how much you take home after payroll taxes are deducted.

How To Manage Your Money 50 30 20 Rule Financial Post Inside: learn what the 50 30 20 money rule is and how you can use it to improve your finances. when you’re trying to get a handle on your finances, the sheer number of budgeting methods, money saving tips, and personal finance tools can feel overwhelming. from detailed spreadsheets to fancy budgeting apps, it’s easy to feel like managing your money is more complicated than it needs to be. The 50 30 20 budget rule (aka the 50 30 20 rule) is a simple budgeting technique that involves dividing your money into three basic buckets. it can be an effective way to manage your earnings, allocating 50% of your take home income to “musts,” 30% to “wants,” and 20% to saving for your future. What is the 50 30 20 rule? learn how this simple budgeting method divides your income into needs, wants, and savings, with examples, pros and cons, and flexible alternatives to help you succeed. But depending on your income and the cost of living in your area, there are a few things to consider before deciding if this approach is right for you. we talked to finance experts to better understand the pros and cons of the 50 30 20 rule and how realistic this method might be for you.

How To Manage Your Money Using The 50 30 20 Rule What is the 50 30 20 rule? learn how this simple budgeting method divides your income into needs, wants, and savings, with examples, pros and cons, and flexible alternatives to help you succeed. But depending on your income and the cost of living in your area, there are a few things to consider before deciding if this approach is right for you. we talked to finance experts to better understand the pros and cons of the 50 30 20 rule and how realistic this method might be for you. The 50 30 20 budget rule offers a simple solution. dividing your income into three straightforward categories—50% needs, 30% wants, and 20% savings—helps you balance priorities, control spending, and achieve your financial goals with confidence. How can you manage your budget? the 50 30 20 rule is simple, concise, and effective. image: getty almost 20 years ago, us senator elizabeth warren wrote a book titled all your worth: the ultimate lifetime money plan. in it, warren advises to use the ‘balanced money formula,’ also known as the ’50 30 20′ plan. Enter the 50 30 20 budgeting rule —a practical and easy to follow method that helps you balance your spending, savings, and financial goals. if you’ve been looking for a budgeting strategy that actually works, this guide will break down how the 50 30 20 rule can transform your finances. what is the 50 30 20 budgeting rule?. By allocating 50% of your income to needs, 30% to wants, and 20% to savings, you can gain better control over your finances. this approach is easy to understand and can be applied by anyone, regardless of financial knowledge.

Money Lover Spending Manager App Understand 50 30 20 A Simple The 50 30 20 budget rule offers a simple solution. dividing your income into three straightforward categories—50% needs, 30% wants, and 20% savings—helps you balance priorities, control spending, and achieve your financial goals with confidence. How can you manage your budget? the 50 30 20 rule is simple, concise, and effective. image: getty almost 20 years ago, us senator elizabeth warren wrote a book titled all your worth: the ultimate lifetime money plan. in it, warren advises to use the ‘balanced money formula,’ also known as the ’50 30 20′ plan. Enter the 50 30 20 budgeting rule —a practical and easy to follow method that helps you balance your spending, savings, and financial goals. if you’ve been looking for a budgeting strategy that actually works, this guide will break down how the 50 30 20 rule can transform your finances. what is the 50 30 20 budgeting rule?. By allocating 50% of your income to needs, 30% to wants, and 20% to savings, you can gain better control over your finances. this approach is easy to understand and can be applied by anyone, regardless of financial knowledge.

Video Summary How To Manage Your Money 50 30 20 Rule Enter the 50 30 20 budgeting rule —a practical and easy to follow method that helps you balance your spending, savings, and financial goals. if you’ve been looking for a budgeting strategy that actually works, this guide will break down how the 50 30 20 rule can transform your finances. what is the 50 30 20 budgeting rule?. By allocating 50% of your income to needs, 30% to wants, and 20% to savings, you can gain better control over your finances. this approach is easy to understand and can be applied by anyone, regardless of financial knowledge.

How To Manage Your Money 50 30 20 Rule New Trader U