6 Asset Allocation Strategies For A Diversified Portfolio Secvolt Spreading investments across different asset classes, rather than relying on one, is a key strategy to balance risk and potential returns over time. known as asset allocation, this approach. Proper asset allocation can help you navigate market fluctuations, protect wealth, and optimize long term performance. in this article, we’ll explore the importance of asset allocation, the different asset classes, and strategies for adjusting your portfolio over time. what is asset allocation and why does it matter?.

Asset Allocation Investment Steps To Formulate An Asset Allocation Asset allocation balances risk by mixing investment types to optimize returns and stability. diversified portfolios, even with different investments, perform similarly if their asset mix is. Establishing an appropriate asset mix of stocks, bonds, cash, and real estate in your portfolio is a dynamic process. as such, the asset mix should reflect your goals at any point in. Proper asset allocation allows you to balance risk and return based on your financial goals, time horizon, and risk tolerance. for proper asset allocation, it is imperative to understand the different types of assets you can invest in. these include stocks, bonds, real estate, commodities, and cash equivalents. Developing a personalized asset allocation strategy involves understanding your risk tolerance, investment horizon, and financial goals. this section will guide you through creating a strategy that aligns with your unique needs. how do i determine my asset allocation?.

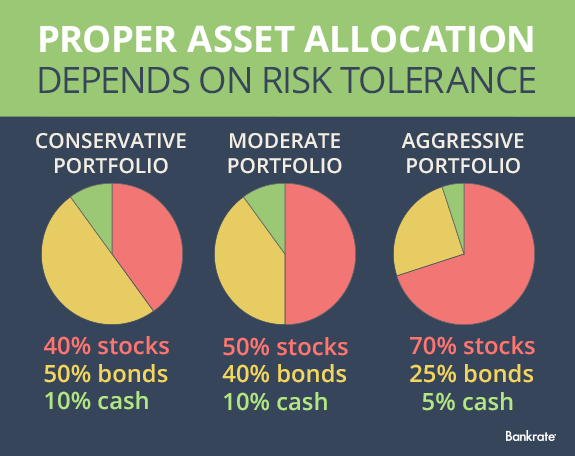

How To Set Up Your Investment Portfolio Proper Asset Allocation Proper asset allocation allows you to balance risk and return based on your financial goals, time horizon, and risk tolerance. for proper asset allocation, it is imperative to understand the different types of assets you can invest in. these include stocks, bonds, real estate, commodities, and cash equivalents. Developing a personalized asset allocation strategy involves understanding your risk tolerance, investment horizon, and financial goals. this section will guide you through creating a strategy that aligns with your unique needs. how do i determine my asset allocation?. Aligning your portfolio with your true risk appetite helps you stay committed, avoid impulsive decisions, and stay on track with your financial goals. 3.diversify across asset classes: true portfolio balance comes from spreading your investments across different asset classes—not just within equity. each asset plays a unique role in managing. In this extensive guide, we will delve into the concept of asset allocation, explore its benefits, and provide actionable tips on how to potentially optimize your investment portfolio. whether you’re a novice investor or a seasoned pro, understanding asset allocation is crucial for building a potentially successful investment strategy. Effective asset allocation is a crucial part of investment management. your asset allocation determines the overall risk and return profile of your portfolio and ensures your investments align with your financial goals and risk tolerance. without proper asset allocation, an investor might take too much risk (leading to large losses) or too. Learn how to create an effective asset allocation strategy tailored to your goals, time horizon, and risk tolerance. understand the importance of stocks, bonds, and cash in your portfolio, and how.

How To Set Up Your Investment Portfolio Proper Asset Allocation Aligning your portfolio with your true risk appetite helps you stay committed, avoid impulsive decisions, and stay on track with your financial goals. 3.diversify across asset classes: true portfolio balance comes from spreading your investments across different asset classes—not just within equity. each asset plays a unique role in managing. In this extensive guide, we will delve into the concept of asset allocation, explore its benefits, and provide actionable tips on how to potentially optimize your investment portfolio. whether you’re a novice investor or a seasoned pro, understanding asset allocation is crucial for building a potentially successful investment strategy. Effective asset allocation is a crucial part of investment management. your asset allocation determines the overall risk and return profile of your portfolio and ensures your investments align with your financial goals and risk tolerance. without proper asset allocation, an investor might take too much risk (leading to large losses) or too. Learn how to create an effective asset allocation strategy tailored to your goals, time horizon, and risk tolerance. understand the importance of stocks, bonds, and cash in your portfolio, and how.

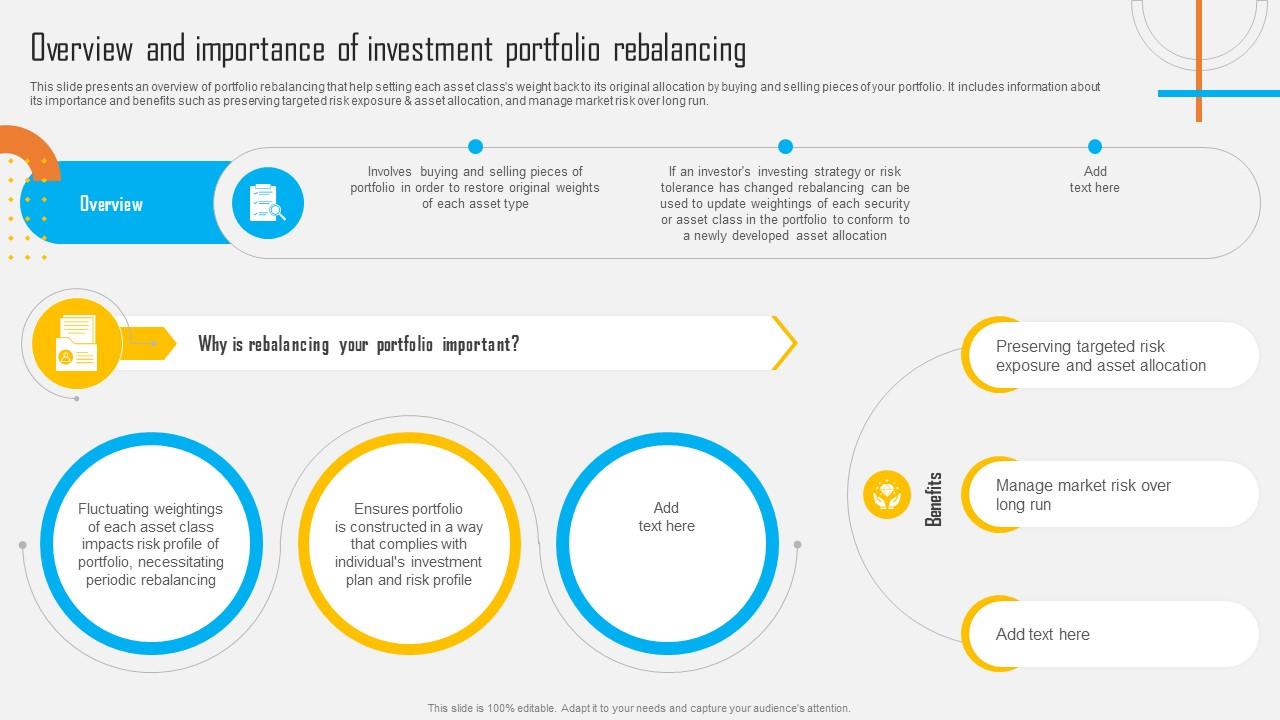

Asset Allocation Investment Overview And Importance Of Investment Effective asset allocation is a crucial part of investment management. your asset allocation determines the overall risk and return profile of your portfolio and ensures your investments align with your financial goals and risk tolerance. without proper asset allocation, an investor might take too much risk (leading to large losses) or too. Learn how to create an effective asset allocation strategy tailored to your goals, time horizon, and risk tolerance. understand the importance of stocks, bonds, and cash in your portfolio, and how.

Investment Portfolio Showing Asset Allocation By Investor Profile