How To Use A Trailing Stop Loss Order Types Explained

What Is A Trailing Stop Order And How To Use It For Crypto Trading A trailing stop order is a variation on a standard stop order that can help stock traders who want to potentially follow the trend while managing their exit strategy. here we explain trailing stop orders, consider why, when, and how they might be used, and discuss their potential risks. Stop loss and stop limit orders can provide different types of protection for both long and short investors. stop loss orders guarantee execution while stop limit orders.

Trailing Stop Loss Order Strategies Explained 2023 In this stock market order types tutorial, we discuss the trailing stop loss order type, what it is, and how to use it when you are trading or buying stocks. A trailing stop loss order automatically adjusts as the price of a security moves in your favor. instead of setting a fixed stop price, you set a stop that “trails” the market price by a specific percentage or dollar amount. To understand how the trailing stop works, we need to understand how a trade is closed and how the stop loss orders work in achieving the target. closing a trade requires an equal but opposite order. in addition, traders may choose to use stop loss orders or trailing stop loss to automatically close their positions if the market moves against them. A trailing stop loss adjusts automatically when the market moves in a favorable direction. discover the pros and cons of the order type, & how to use them.

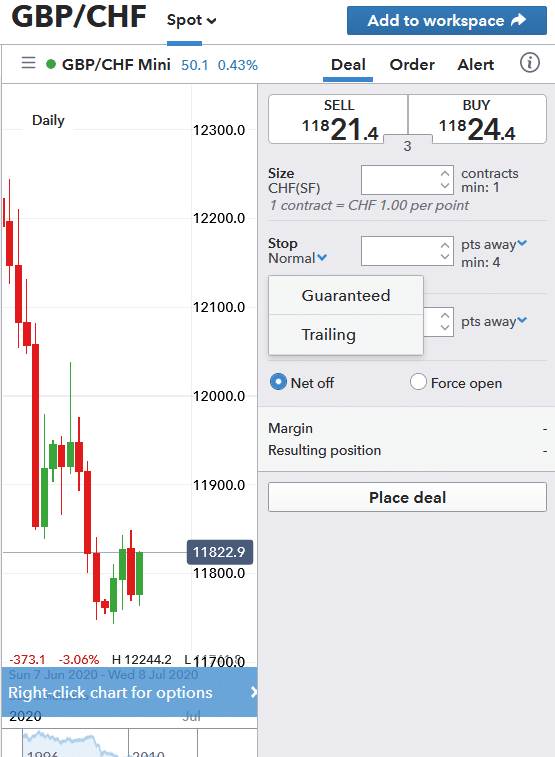

Trailing Stop Loss Order Strategies Explained 2023 To understand how the trailing stop works, we need to understand how a trade is closed and how the stop loss orders work in achieving the target. closing a trade requires an equal but opposite order. in addition, traders may choose to use stop loss orders or trailing stop loss to automatically close their positions if the market moves against them. A trailing stop loss adjusts automatically when the market moves in a favorable direction. discover the pros and cons of the order type, & how to use them. It’s important to know the difference between a stop loss order and a stop limit order. it can be the difference between having your order execute or being stuck with a growing loss. To place a trailing stop loss, log into your chosen broker and, in the case of a long position: then set a trailing amount or percentage to limit losses. to create the trailing amount,. Master trailing stop loss trading strategies to lock in profits automatically. learn the 5% method, atr based stops, and tradingview setup with step by step examples. Trailing stop orders for listed and otc equities and single leg options can be based on the security's last trade, bid or ask price at the discretion of the user. dollar trail amounts cannot exceed two decimal places.

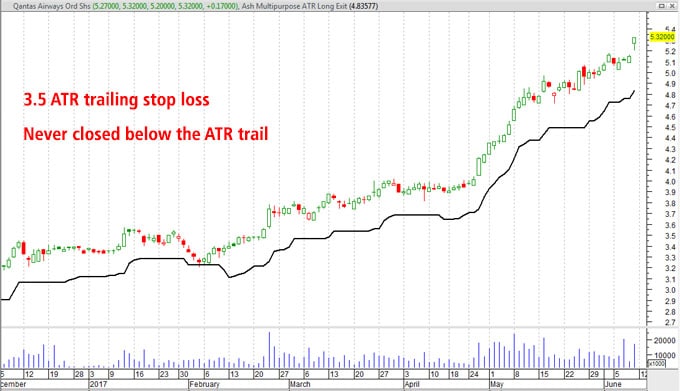

Trailing Stop Loss Order Strategies Explained 2023 It’s important to know the difference between a stop loss order and a stop limit order. it can be the difference between having your order execute or being stuck with a growing loss. To place a trailing stop loss, log into your chosen broker and, in the case of a long position: then set a trailing amount or percentage to limit losses. to create the trailing amount,. Master trailing stop loss trading strategies to lock in profits automatically. learn the 5% method, atr based stops, and tradingview setup with step by step examples. Trailing stop orders for listed and otc equities and single leg options can be based on the security's last trade, bid or ask price at the discretion of the user. dollar trail amounts cannot exceed two decimal places.

Trailingstoploss Education Tradingview India Master trailing stop loss trading strategies to lock in profits automatically. learn the 5% method, atr based stops, and tradingview setup with step by step examples. Trailing stop orders for listed and otc equities and single leg options can be based on the security's last trade, bid or ask price at the discretion of the user. dollar trail amounts cannot exceed two decimal places.

Comments are closed.