Hypothesis Driven Development Part Iii Monte Carlo In Asset Allocation This post will show how to use monte carlo to test for signal intelligence. although i had rejected this strategy in the last post, i was asked to do a monte carlo analysis of a thousand random portfolios to see how the various signal processes performed against said distribution. essentially, the process is quite simple: as…. Monte carlo simulations enable investment advisers to deal with practical issues that are difficult or impossible to analyze analytically. it may be appropriate for a taxable investor to rebalance their assets into a strategic asset allocation. it is easy to calculate the tax impact during a single period.

Github Lucs12 Montecarlo Assetallocation Implementations Of Monte It uses risk tolerance, client age, and an optional asset class constraints feature to create a target allocation. the forecasting wealth section runs a monte carlo simulation assessing the. 以讲义上的这张图为例:mvo方法只考虑一期,所以站在65岁这个时间点做最优化求解,可以求出66岁时最大化效用的资产组合。 但是monte carlo假设某些变量在未来是随机发生的,比如税率、利率等,受这些变量影响,预期的return, variance, covariance都会变化,因此投资业绩的变化也会随机分布,但是66岁的投资业绩基于65岁,67岁的投资业绩基于66岁,因此每一个时间点就会有无数种投资业绩的可能。 最后如果要预测90岁时的投资结果,形成的就是一个概率分布。 所以monte carlo 解决single period不是说它保证有更好的e(r),而是它呈现了每个时期可能发生的情况,并且基于不同的情况生成不同的路径。. First 3 steps in asset allocation selection process: 1) determine portfolio objectives 2) build understanding of risk tolerance 3) develop time horizon. these will all work in tandem to develop the saa. goals based aa, each sub portfolio is built using an asset only mvo. Implementations of monte carlo simulations for asset allocation solutions and examinations. specifically, includes the analysis of the significance of diversification in asset allocation and the construction of portfolios while exhibiting the utility of the technique for portfolio optimization.

Github Lucs12 Montecarlo Assetallocation Implementations Of Monte First 3 steps in asset allocation selection process: 1) determine portfolio objectives 2) build understanding of risk tolerance 3) develop time horizon. these will all work in tandem to develop the saa. goals based aa, each sub portfolio is built using an asset only mvo. Implementations of monte carlo simulations for asset allocation solutions and examinations. specifically, includes the analysis of the significance of diversification in asset allocation and the construction of portfolios while exhibiting the utility of the technique for portfolio optimization. Asset allocators employ various approaches to address these challenges: monte carlo simulation involves generating numerous portfolio scenarios simulating different future outcomes. it’s like a statistical crystal ball. Recently alternative implementations of the martingale approach based on monte carlo methods have been proposed. this paper describes one of these methods which involves the numerical computation of stochastic integrals. it is often possible to improve the efficiency of these computations by using deterministic numbers rather than random numbers. The aim of this paper is to propose a general monte carlo simulation approach in order to solve an asset allocation problem with shortfall constraint, and to evaluate the exact portfolio risk level when managers assume a misspecified tails behaviour. In a monte carlo simulation for alternative asset allocation, the researcher selects the variables of interest (or the risk factors if using those), and is free to design any distribution desired so that the model can run these assumptions forward and see what sort of asset class return scenarios occur.

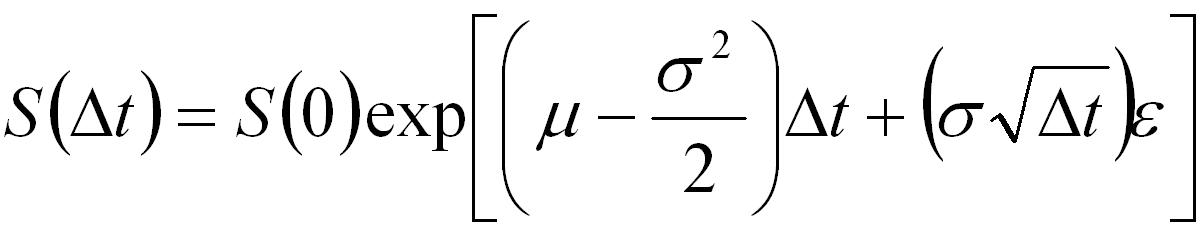

Matlab Tutorial Monte Carlo Asset Paths Asset allocators employ various approaches to address these challenges: monte carlo simulation involves generating numerous portfolio scenarios simulating different future outcomes. it’s like a statistical crystal ball. Recently alternative implementations of the martingale approach based on monte carlo methods have been proposed. this paper describes one of these methods which involves the numerical computation of stochastic integrals. it is often possible to improve the efficiency of these computations by using deterministic numbers rather than random numbers. The aim of this paper is to propose a general monte carlo simulation approach in order to solve an asset allocation problem with shortfall constraint, and to evaluate the exact portfolio risk level when managers assume a misspecified tails behaviour. In a monte carlo simulation for alternative asset allocation, the researcher selects the variables of interest (or the risk factors if using those), and is free to design any distribution desired so that the model can run these assumptions forward and see what sort of asset class return scenarios occur.

Hypothesis Driven Development Part Iii Monte Carlo In Asset Allocation The aim of this paper is to propose a general monte carlo simulation approach in order to solve an asset allocation problem with shortfall constraint, and to evaluate the exact portfolio risk level when managers assume a misspecified tails behaviour. In a monte carlo simulation for alternative asset allocation, the researcher selects the variables of interest (or the risk factors if using those), and is free to design any distribution desired so that the model can run these assumptions forward and see what sort of asset class return scenarios occur.

Pdf Accelerating Monte Carlo Method For Pricing Multi Asset