Ifn Prioritization Of Modernizing Risk Management And Enhancing Risk

Ifn Prioritization Of Modernizing Risk Management And Enhancing Risk With the drastic changes taking place in the digital transformation, islamic banks will be challenged to accelerate their process in automation and modernize their risk management infrastructure in the upcoming period. This approach helps accelerate the maturity of the risk function, boost automation, reduce inefficiencies, inspire insights that promote a proactive risk management posture, and embed a culture of risk awareness across the business.

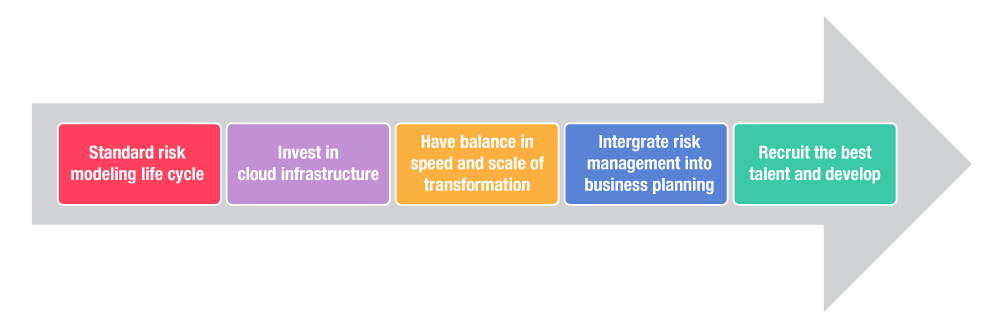

Risk Based Prioritization Modernizing Vulnerability Management By providing the basis for a more dynamic approach to risk assessment and risk management, the paper aims to strengthen the foundation for risk informed decision making. Find out how to modernize your risk strategy by taking a connected risk approach and leveraging data and technology to support your risk management efforts. By integrating risk management into the overall strategy, prioritizing responsiveness and adaptability, and fostering cross functional collaboration, organizations can build stronger resilience, ensure regulatory compliance, maintain competitiveness, and enable sustainable growth. The insight related to large scale risk transformation activities revealed in our research and our own work raises the question: what risk management capabilities deliver the greatest impact in building a trusted, resilient organization?.

Innovation And Risk Management Good Practice Guide Matrix By integrating risk management into the overall strategy, prioritizing responsiveness and adaptability, and fostering cross functional collaboration, organizations can build stronger resilience, ensure regulatory compliance, maintain competitiveness, and enable sustainable growth. The insight related to large scale risk transformation activities revealed in our research and our own work raises the question: what risk management capabilities deliver the greatest impact in building a trusted, resilient organization?. The use of models to evaluate risk, assess capital adequacy and liquidity requirements, monitor customer behavior, manage data analytics, and support investment decisions has become crucial to business eficiency, risk management and overall profitability in today’s environment. Risk priority plotting empowers risk management and selections. it structures risk assessment, segregating threats into ranks like high, mid, and minimal. this calibrates reaction allocation. prioritization spotlight risks meriting the speediest reaction. firms address chief dangers principally. Technology is indispensable for effective enterprise risk management. an enterprise risk management platform centralizes operations, providing clarity and efficiency. real time monitoring, advanced analytics, and automation further enhance an enterprise’s ability to manage challenges proactively. What outcomes are possible when you switch away from traditional risk management and elevate the role of risk management and your own contribution to organizational resilience and success?.

Modernizing Risk Management The use of models to evaluate risk, assess capital adequacy and liquidity requirements, monitor customer behavior, manage data analytics, and support investment decisions has become crucial to business eficiency, risk management and overall profitability in today’s environment. Risk priority plotting empowers risk management and selections. it structures risk assessment, segregating threats into ranks like high, mid, and minimal. this calibrates reaction allocation. prioritization spotlight risks meriting the speediest reaction. firms address chief dangers principally. Technology is indispensable for effective enterprise risk management. an enterprise risk management platform centralizes operations, providing clarity and efficiency. real time monitoring, advanced analytics, and automation further enhance an enterprise’s ability to manage challenges proactively. What outcomes are possible when you switch away from traditional risk management and elevate the role of risk management and your own contribution to organizational resilience and success?.

Comments are closed.