Importance Of Asset Allocation In Your Investment Portfolio

Role Of Asset Allocation In Portfolio Management Pdf Asset Asset allocation is how investors divide their portfolios among different assets that might include equities, fixed income assets, and cash and its equivalents. investors ordinarily aim to. According to a 2012 vanguard study, asset allocation is the most important factor when it comes to an investor's total experience their overall returns and the volatility of those returns .

Importance Of Investment Portfolio Allocation Assignment Point Asset allocation is a crucial aspect of investment planning that involves dividing your investment portfolio across different asset classes such as stocks, bonds, real estate, and cash. the purpose of asset allocation is to minimize risk and maximize returns by diversifying your investments. Just as choosing the right layout is crucial for a functional home, selecting the right asset allocation is essential for a sound investment portfolio. in this article we’ll review the basic tenets of asset allocation and why it’s important for long term investment success. Asset allocation plays a vital role in achieving your investment objectives while managing risk. by diversifying your investments across different asset classes, you can minimize the impact of market volatility and increase the potential for long term returns. Whether you are a seasoned investor or just starting, understanding asset allocation is essential to building a resilient investment portfolio that can weather market fluctuations and achieve your financial goals.

Importance Of Asset Allocation In Your Investment Portfolio Asset allocation plays a vital role in achieving your investment objectives while managing risk. by diversifying your investments across different asset classes, you can minimize the impact of market volatility and increase the potential for long term returns. Whether you are a seasoned investor or just starting, understanding asset allocation is essential to building a resilient investment portfolio that can weather market fluctuations and achieve your financial goals. Asset allocation is nothing but another name for diversification. it is how you spread your investments across asset classes— stocks, fixed income, property and gold. it ensures all your eggs are not in one basket. the principle of asset allocation requires rebalancing if there is a portfolio drift. A well structured asset allocation strategy is the foundation of a resilient investment portfolio. it determines how your investments are distributed across different asset classes, balancing risk and return to align with your financial goals. Asset allocation is the cornerstone to long term financial success. by tailoring your portfolio to your risk tolerance and goals, you can achieve your desired results. a diverse portfolio also helps you weather changes in the market and other economic trends. Investing is a concoction of both art and a science, and one of the staples in that concoction is asset allocation. let’s delve into the key aspects of utilizing asset allocation and why it’s indispensable for portfolio performance. what is asset allocation?.

Portfolio Allocation Asset Correlation Its Importance Asset allocation is nothing but another name for diversification. it is how you spread your investments across asset classes— stocks, fixed income, property and gold. it ensures all your eggs are not in one basket. the principle of asset allocation requires rebalancing if there is a portfolio drift. A well structured asset allocation strategy is the foundation of a resilient investment portfolio. it determines how your investments are distributed across different asset classes, balancing risk and return to align with your financial goals. Asset allocation is the cornerstone to long term financial success. by tailoring your portfolio to your risk tolerance and goals, you can achieve your desired results. a diverse portfolio also helps you weather changes in the market and other economic trends. Investing is a concoction of both art and a science, and one of the staples in that concoction is asset allocation. let’s delve into the key aspects of utilizing asset allocation and why it’s indispensable for portfolio performance. what is asset allocation?.

The Only Thing That Matters In Investing Asset Allocation Portfolio Asset allocation is the cornerstone to long term financial success. by tailoring your portfolio to your risk tolerance and goals, you can achieve your desired results. a diverse portfolio also helps you weather changes in the market and other economic trends. Investing is a concoction of both art and a science, and one of the staples in that concoction is asset allocation. let’s delve into the key aspects of utilizing asset allocation and why it’s indispensable for portfolio performance. what is asset allocation?.

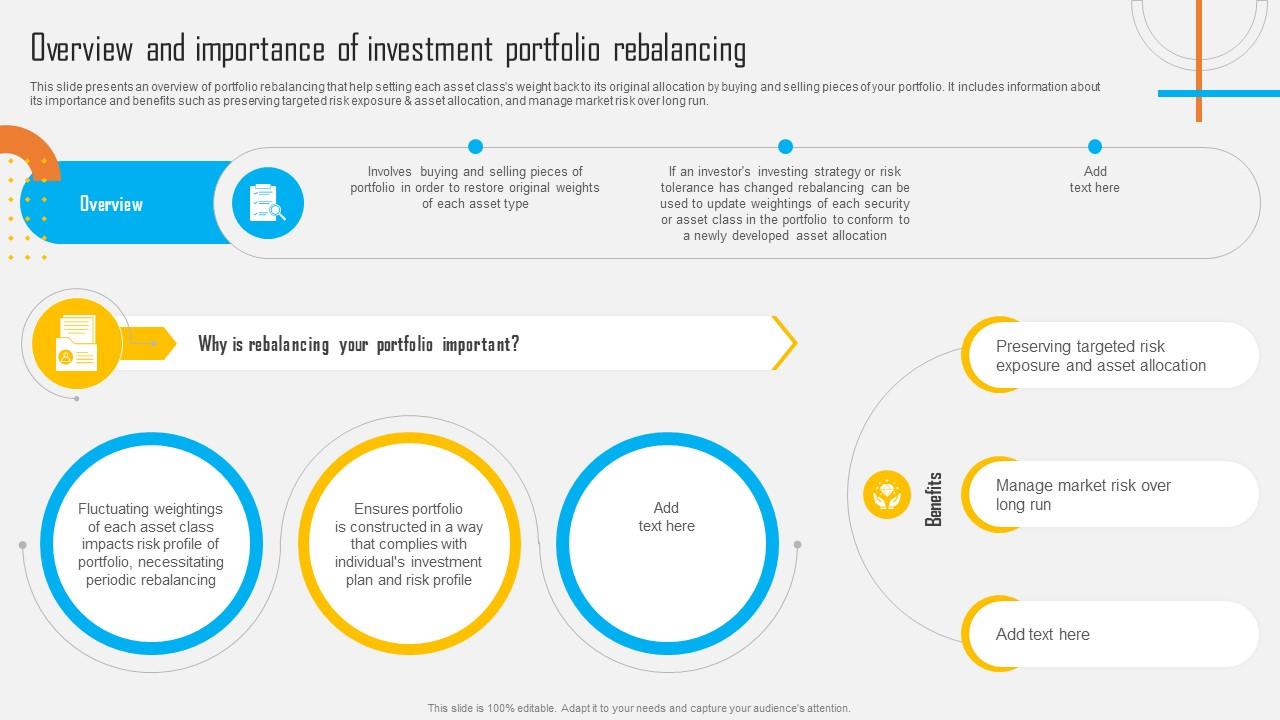

Asset Allocation Investment Overview And Importance Of Investment

Comments are closed.