Important Recognitions For W D Gann And His Nine Squares Theory

The Summary S Definitive Guide To Forecasting Using W D Gann S Square He went so far as to call this theory the “golden key” and claimed recognition from some economics and statistical trade journals of the era. references to the square root theory as a predictor of stock prices pops up every now and then in financial writings. "after his death, we found his drawings are all in one orbit, which is a draw lines transverse and longitudinal created nine boxes on a paper prices (chart) and are areas of resistance and subsidies that do not deviate in price".

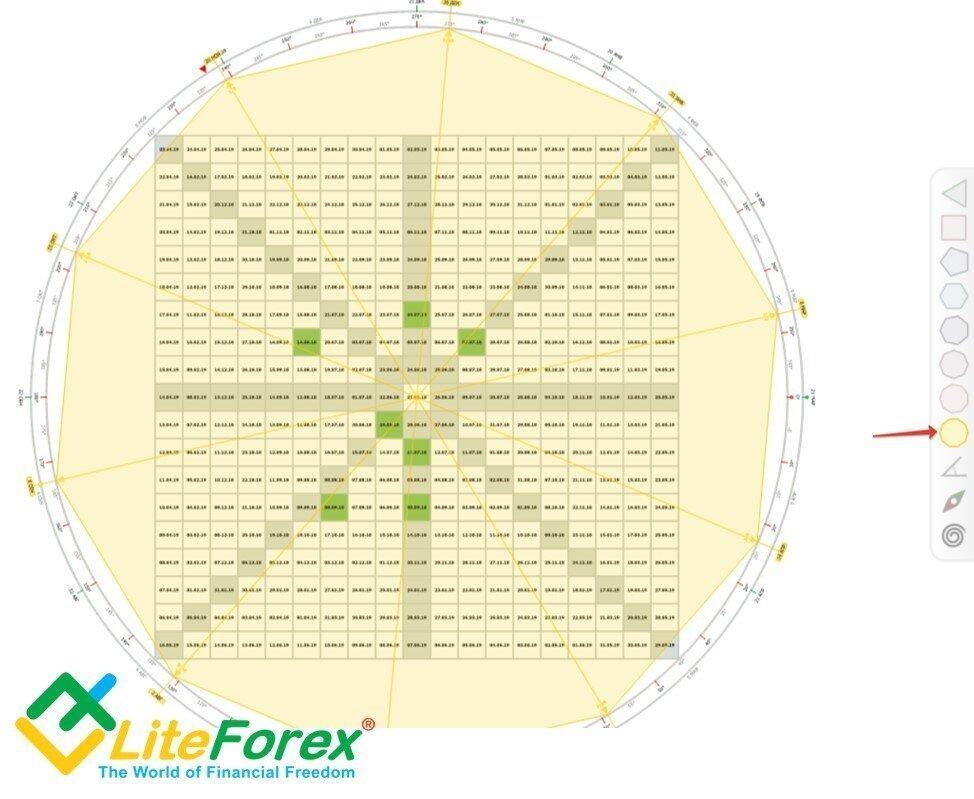

William Gann Theory Square Of 9 As Analytical Framework Litefinance Practitioners of the gann square of 9 seek to identify ‘gann angles,’ among other pivotal points derived from the chart, to predict price action. these angles are intended to show significant levels of support and resistance and can be translated into time and price. How khit interprets gann's original script in the wd gann master commodity course. this has helped me to decode the square of nine and provides students with significant new insights into gann theory and practical trading applications. Gann’s work reveals the importance of geometric shapes in trading—from gann angles to the squares and much more. his methods prove that market forecasting is as much about natural order as it is about technical analysis. Gann believed that markets moved in geometric and cyclical patterns that could be measured and anticipated. the square of 9 became one of his signature tools, used by traders to detect where and when significant price action may occur.

Wd Gann Time Squaring Technique Divesh S Technical Analysis Gann’s work reveals the importance of geometric shapes in trading—from gann angles to the squares and much more. his methods prove that market forecasting is as much about natural order as it is about technical analysis. Gann believed that markets moved in geometric and cyclical patterns that could be measured and anticipated. the square of 9 became one of his signature tools, used by traders to detect where and when significant price action may occur. Square of nine is not an indicator; it is merely a form of calculator developed by w d gann. there was no calculator available in 1909, so he created a mathematical grid and called it gann square of nine, inspired by the pyramid of egypt. The article explores gann's legendary trading career and remarkable performance record, delves into the working principles of the square of nine, methods for identifying price support and resistance levels, and strategies for selecting step sizes in different market conditions. This document discusses gann analysis techniques for analyzing stock prices, including gann angles and the square of nine. it cautions that gann analysis provides probabilities, not certainties, and that trends should be confirmed on price charts. Traders who use gann theory will often use tools such as gann angles, gann fans, and gann squares to identify key levels of support and resistance in the market.

W D Gann Square Of Nine Square of nine is not an indicator; it is merely a form of calculator developed by w d gann. there was no calculator available in 1909, so he created a mathematical grid and called it gann square of nine, inspired by the pyramid of egypt. The article explores gann's legendary trading career and remarkable performance record, delves into the working principles of the square of nine, methods for identifying price support and resistance levels, and strategies for selecting step sizes in different market conditions. This document discusses gann analysis techniques for analyzing stock prices, including gann angles and the square of nine. it cautions that gann analysis provides probabilities, not certainties, and that trends should be confirmed on price charts. Traders who use gann theory will often use tools such as gann angles, gann fans, and gann squares to identify key levels of support and resistance in the market.

Comments are closed.