Inherited Iras What You Should Know Wealth And Investment Services Inherited iras offer financial opportunities to beneficiaries but you must understand the 10 year rule to optimize your inheritance and avoid penalties. When a loved one with a tax advantaged retirement account passes away, the account beneficiary must transfer the assets into a new account in the beneficiary’s name. this new account is known as an inherited ira or a beneficiary ira. the inherited ira must be the same type of account as the original account.

Inherited Iras What You Should Know Sherman Wealth Management First step, set up an inherited ira in your own name. you’ll need a copy of the decedent’s death certificate and information on the account you’ll be inheriting. your tiaa wealth advisor can help you through the process. once the new account is set up, you can then transfer the inherited funds from the original account. 2. While challenging, discussions around inheriting wealth are important. here are six strategies to foster open communication. what to consider as you take on the care of an elderly parent – and how you can prepare your kids to do the same someday. What is an inherited ira? an inherited ira is an account that is opened when an you inherit an ira or employer sponsored retirement plan after the original owner dies. the individual. If you’ve inherited an ira from a non spouse who passed away after 1 1 2020 and they were old enough to be taking required minimum distributions (rmds) at the time they passed, there’s an important change you need to be aware of.

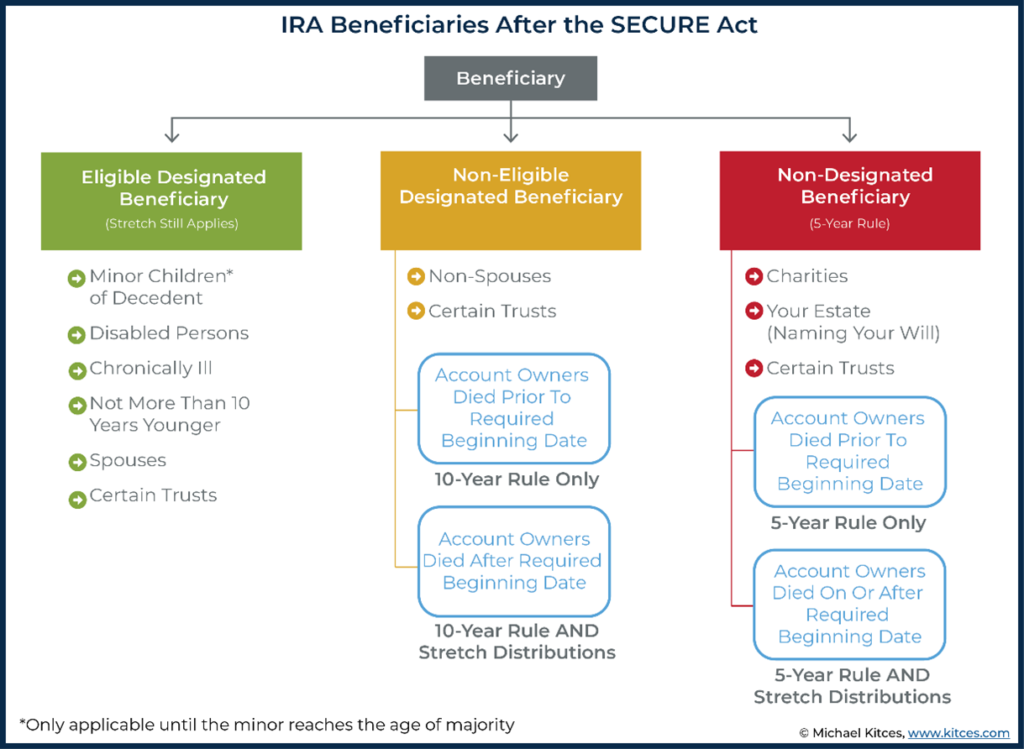

Inherited Iras Important Changes Proposed Smith And Howard Wealth What is an inherited ira? an inherited ira is an account that is opened when an you inherit an ira or employer sponsored retirement plan after the original owner dies. the individual. If you’ve inherited an ira from a non spouse who passed away after 1 1 2020 and they were old enough to be taking required minimum distributions (rmds) at the time they passed, there’s an important change you need to be aware of. Inherited iras are specifically designed for individuals who are named as beneficiaries on a retirement account, like an ira or workplace savings plan, such as a 401(k). why open an inherited ira continue the retirement account's tax deferred growth. Here's what you need to know 4 2 2025. the irs has now confirmed that many non edbs also have to take rmds from their inherited iras during the first nine years after the owner’s death, assuming the owner was subject to their own required minimum distributions before passing. robert w. baird & co. incorporated is not a legal or tax. Understanding inherited iras. an inherited ira is an account that receives funds from a deceased individual’s ira, transferred to a designated beneficiary. while it offers potential tax deferred growth, the way you manage it can significantly impact your financial future. key irs regulation changes. Key points to know. annual withdrawals now required for most beneficiaries. if you inherit an ira from someone who was already taking rmds when they passed away, you will need to withdraw some money each year over the next ten years. this 10 year rule spreads out the tax impact and ensures that the entire account is emptied by the end of the.

What To Know About Inherited Iras Inherited iras are specifically designed for individuals who are named as beneficiaries on a retirement account, like an ira or workplace savings plan, such as a 401(k). why open an inherited ira continue the retirement account's tax deferred growth. Here's what you need to know 4 2 2025. the irs has now confirmed that many non edbs also have to take rmds from their inherited iras during the first nine years after the owner’s death, assuming the owner was subject to their own required minimum distributions before passing. robert w. baird & co. incorporated is not a legal or tax. Understanding inherited iras. an inherited ira is an account that receives funds from a deceased individual’s ira, transferred to a designated beneficiary. while it offers potential tax deferred growth, the way you manage it can significantly impact your financial future. key irs regulation changes. Key points to know. annual withdrawals now required for most beneficiaries. if you inherit an ira from someone who was already taking rmds when they passed away, you will need to withdraw some money each year over the next ten years. this 10 year rule spreads out the tax impact and ensures that the entire account is emptied by the end of the.

Understanding Inherited Iras 5 Things You Should Know Approach Understanding inherited iras. an inherited ira is an account that receives funds from a deceased individual’s ira, transferred to a designated beneficiary. while it offers potential tax deferred growth, the way you manage it can significantly impact your financial future. key irs regulation changes. Key points to know. annual withdrawals now required for most beneficiaries. if you inherit an ira from someone who was already taking rmds when they passed away, you will need to withdraw some money each year over the next ten years. this 10 year rule spreads out the tax impact and ensures that the entire account is emptied by the end of the.

2024 Irs Update On Inherited Rmds