Interest Rates Rising Brixton Real Estate Why is this a good sign? interest rates rising 0.25% is not a sign of a looming doomsday, it is actually a great sign that our economy is healthy! yes, it may mean a reduction in the amounts borrowed for many but a rise in interest rates actually. Housing prices fell over a seven month period in 2022 and early 2023 and housing demand dropped when mortgage rates first began to rise. however, housing prices recovered to new record levels in late 2023.

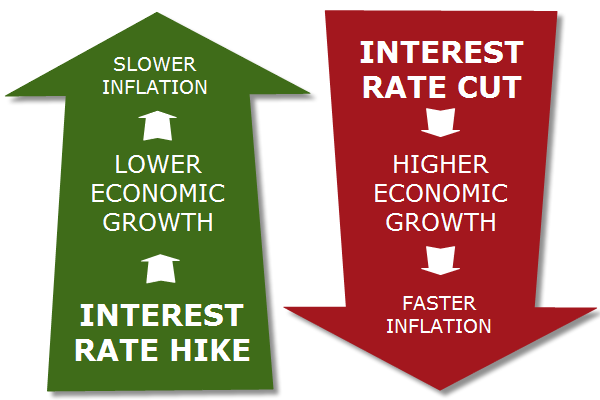

Rising Interest Rates Mindy Hibbard Real Estate Team Strong rental growth combined with stagnant property prices have boosted yields to an all time high. the average flat in brixton achieved a 5.7% gross yield last year, up from 5.0% in 2022. and since mortgage rates have fallen into 2024 following their peaks in 2023, profit margins once again appear to be widening. Mortgage rates are ticking up, even after the federal reserve has started cutting interest rates. here's why, and where rates — and home sales — could go from here. Mortgage rates surged over 7% to end the week, after massive volatility in bond markets surrounding president donald trump's tariff agenda. Interest rates significantly influence the real estate market, from home affordability to investment. when interest rates rise, borrowing becomes more expensive, thus slowing down purchasing of homes and influencing property values. conversely, lower rates make mortgages affordable, increasing demand and driving house prices higher.

Real Estate Talk Rising Interest Rates Westmount Magazine Mortgage rates surged over 7% to end the week, after massive volatility in bond markets surrounding president donald trump's tariff agenda. Interest rates significantly influence the real estate market, from home affordability to investment. when interest rates rise, borrowing becomes more expensive, thus slowing down purchasing of homes and influencing property values. conversely, lower rates make mortgages affordable, increasing demand and driving house prices higher. In 2025, higher mortgage rates are forcing homebuyers to rethink budgets, locations, and timing—reshaping how homes are bought and sold across the u.s. For real estate investment trusts (reits), rising interest rates pose unique challenges. reits typically rely on debt financing to acquire and manage properties, so higher rates increase their cost of capital and reduce the profitability of new acquisitions. Rising interest rates profoundly impact the housing market by increasing the cost of borrowing, reducing buyer demand, and shifting market dynamics. for buyers, higher rates mean increased monthly payments, reduced purchasing power, and more significant long term costs. Dr. connor robertson explores the relationship between interest rates and real estate investment, providing insights into how changes in interest rates can affect property prices, rental income, and financing strategies.

How Rising Interest Rates Impact Real Estate Investors In 2025, higher mortgage rates are forcing homebuyers to rethink budgets, locations, and timing—reshaping how homes are bought and sold across the u.s. For real estate investment trusts (reits), rising interest rates pose unique challenges. reits typically rely on debt financing to acquire and manage properties, so higher rates increase their cost of capital and reduce the profitability of new acquisitions. Rising interest rates profoundly impact the housing market by increasing the cost of borrowing, reducing buyer demand, and shifting market dynamics. for buyers, higher rates mean increased monthly payments, reduced purchasing power, and more significant long term costs. Dr. connor robertson explores the relationship between interest rates and real estate investment, providing insights into how changes in interest rates can affect property prices, rental income, and financing strategies.