Introduction To Risk Quantification Communicate Risk In Dollars And

Introduction To Risk Quantification Communicate Risk In Dollars And You need a way to effectively communicate risk with key stakeholders. by converting risk into a common language that everyone in the organization can speak, dollars and cents, quantification puts risk into perspective and ensures it’s taken into account from the top down. You need a way to clearly and confidently communicate risk with key stakeholders. by converting risk into a common language that everyone in the organization can speak, dollars and cents, quantification puts risk into perspective and ensures it’s taken into account from the top down.

Risk Quantification 101 Communicate Risk In Dollars And Cents Bringing risk into financial language opens doors with leadership. boards and executives are used to thinking in terms of dollars, likelihood, and return on investment. when risks are described this way, it’s much more straightforward to make the case for action, whether that’s funding a new control, updating insurance, or changing a process. Risk quantification is the process of assigning numerical values to risks, enabling us to measure, compare, and manage them effectively. it bridges the gap between abstract notions of risk and concrete data driven assessments. Learn how to quantify risk with proven methods, tools, and real world applications. what is risk quantification? risk quantification is the method of translating potential risks into concrete numerical values to measure their likelihood and impact on an organization. At its core, risk quantification is the process of measuring the likelihood and impact of risks using quantitative methods. by assigning numerical values to the probability of risk events and.

Risk Assessment And Quantification Risk Control Learn how to quantify risk with proven methods, tools, and real world applications. what is risk quantification? risk quantification is the method of translating potential risks into concrete numerical values to measure their likelihood and impact on an organization. At its core, risk quantification is the process of measuring the likelihood and impact of risks using quantitative methods. by assigning numerical values to the probability of risk events and. Quantifying risk means you can weigh the pros and cons of underwriting the risk and make more informed decisions about where to invest. Risk quantification is a practice of using numerical values to measure impact of vulnerabilities on business operations and cost impact. the elements of risk quantification include identifying risks, analyzing their impact, and planning to minimize the impact. Learn how to align organisational risks, measure risk and articulate risk in monetary terms with risk measurement best practices. establish a comprehensive risk management framework to differentiate between compliance risk, financial risk, operational risk, and more. Risk quantification is the process of defining a risk’s impact on the business in terms of a specific value, often in terms of dollars. for example, take the risk of your business’s customer relationship management (crm) software losing all of its customer data.

Risk Quantification 101 Communicate Risk In Dollars And Cents Quantifying risk means you can weigh the pros and cons of underwriting the risk and make more informed decisions about where to invest. Risk quantification is a practice of using numerical values to measure impact of vulnerabilities on business operations and cost impact. the elements of risk quantification include identifying risks, analyzing their impact, and planning to minimize the impact. Learn how to align organisational risks, measure risk and articulate risk in monetary terms with risk measurement best practices. establish a comprehensive risk management framework to differentiate between compliance risk, financial risk, operational risk, and more. Risk quantification is the process of defining a risk’s impact on the business in terms of a specific value, often in terms of dollars. for example, take the risk of your business’s customer relationship management (crm) software losing all of its customer data.

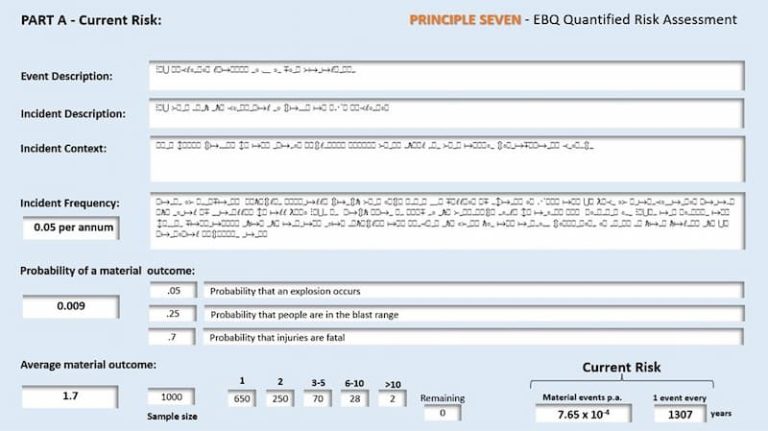

Quantification Of Risk Principle Seven Learn how to align organisational risks, measure risk and articulate risk in monetary terms with risk measurement best practices. establish a comprehensive risk management framework to differentiate between compliance risk, financial risk, operational risk, and more. Risk quantification is the process of defining a risk’s impact on the business in terms of a specific value, often in terms of dollars. for example, take the risk of your business’s customer relationship management (crm) software losing all of its customer data.

Comments are closed.