Introduction To Weighted Average Costing Managerial Accounting

Weighted Average Method Of Material Costing Pros Cons In this video, we're delving into the weighted average costing method, a technique used by companies to simplify the valuation of inventory and cost of goods. In this section, we will explore the principles of the weighted average method, its applications, and its significance in managerial accounting. before delving into the weighted average method, it’s crucial to understand the broader context of process costing.

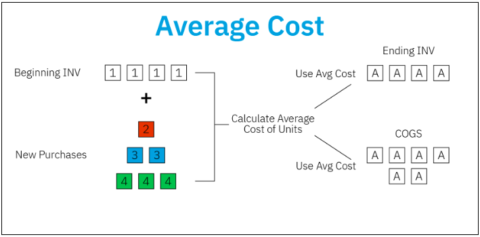

Weighted Average Method Of Material Costing Pros Cons In accounting, the weighted average cost (wac) method of inventory valuation uses a weighted average to determine the amount that goes into cogs and inventory. the weighted average cost method divides the cost of goods available for sale by the number of units available for sale. Compute the equivalent units of production using the weighted average method. to compute unit costs for a department, the department's output in terms of equivalent units must be determined. The weighted average method in accounting is an inventory costing approach that assigns average costs to units of inventory. this method operates on the principle that each individual cost or data point is multiplied by its corresponding “weight,” typically representing its quantity or significance. Use four steps to assign costs to products using the weighted average method. most companies use either the weighted average or first in first out (fifo) method to assign costs to inventory in a process costing environment.

Weighted Average Costing Feature Why You Need It Accounting Seed The weighted average method in accounting is an inventory costing approach that assigns average costs to units of inventory. this method operates on the principle that each individual cost or data point is multiplied by its corresponding “weight,” typically representing its quantity or significance. Use four steps to assign costs to products using the weighted average method. most companies use either the weighted average or first in first out (fifo) method to assign costs to inventory in a process costing environment. More specifically, the chapter combines normal historical, full absorption costing with process cost accumulation and the weighted average and first in, first out (fifo) cost flow assumptions. There are two methods for using process costs: weighted average and fifo (first in, first out). each method uses equivalent units and cost per equivalent units but calculates them just a little differently. When cost accounting, you use the weighted average costing method to calculate costs in a process costing environment. now incorporate weighted average analysis into calculating spoilage costs. to keep it simple, you analyze only the material units and material costs for a product. Use four steps to assign costs to products using the weighted average method. most companies use either the weighted average or first in first out (fifo) method to assign costs to inventory in a process costing environment.

Solution Process Costing Weighted Average Cost Accounting Studypool More specifically, the chapter combines normal historical, full absorption costing with process cost accumulation and the weighted average and first in, first out (fifo) cost flow assumptions. There are two methods for using process costs: weighted average and fifo (first in, first out). each method uses equivalent units and cost per equivalent units but calculates them just a little differently. When cost accounting, you use the weighted average costing method to calculate costs in a process costing environment. now incorporate weighted average analysis into calculating spoilage costs. to keep it simple, you analyze only the material units and material costs for a product. Use four steps to assign costs to products using the weighted average method. most companies use either the weighted average or first in first out (fifo) method to assign costs to inventory in a process costing environment.

Solution Process Costing Weighted Average Cost Accounting Studypool When cost accounting, you use the weighted average costing method to calculate costs in a process costing environment. now incorporate weighted average analysis into calculating spoilage costs. to keep it simple, you analyze only the material units and material costs for a product. Use four steps to assign costs to products using the weighted average method. most companies use either the weighted average or first in first out (fifo) method to assign costs to inventory in a process costing environment.

Solution Process Costing Weighted Average Cost Accounting Studypool

Comments are closed.