Inv2601 Assesssment 1 Semester 1 Of 2024 Expected Questions And Answers

Inv2601 Assessment 2 Sem 1 Of 2024 Expected Questions And Answers This document contains inv2601 assesssment 1 semester 1 of 2024 expected questions and answers. correct use as a guide can help you score above 85% in the assessment. Studying inv2601 introduction to investments at university of south africa? on studocu you will find 70 practice materials, tutorial work, lecture notes, mandatory.

Fac2601 Sem 1 Assessment 2 Expected Questions And Answers Gimmenote summary inv2601 inv2601 discussion class powerpoint slides 2012 s2 inv2601 oct nov 2010 exam answers inv2601 201 2013 1 e inv2601 2010 6 e 1 inv2601 2010 10 e 1 inv2601 2011 10 e 1 inv2601 2012 6 e 1 inv2601 2012 10 e 1 inv2601 discussion class powerpoint slides 2012 s2 inv2601 self assessment questions inv2601 self assessment. Inv2601 investments: an introduction looking for a study notes, exam packs and revision material to help you succeed in inv2601? studypass has the best resources to pass inv2601 at university of south africa. This document contains inv2601 assesssment 1 semester 1 of 2024 expected questions and answers. correct use as a guide can help you score above 85% in the assessment. It is an asset with a standard deviation of zero because its expected return will equal its actual return.

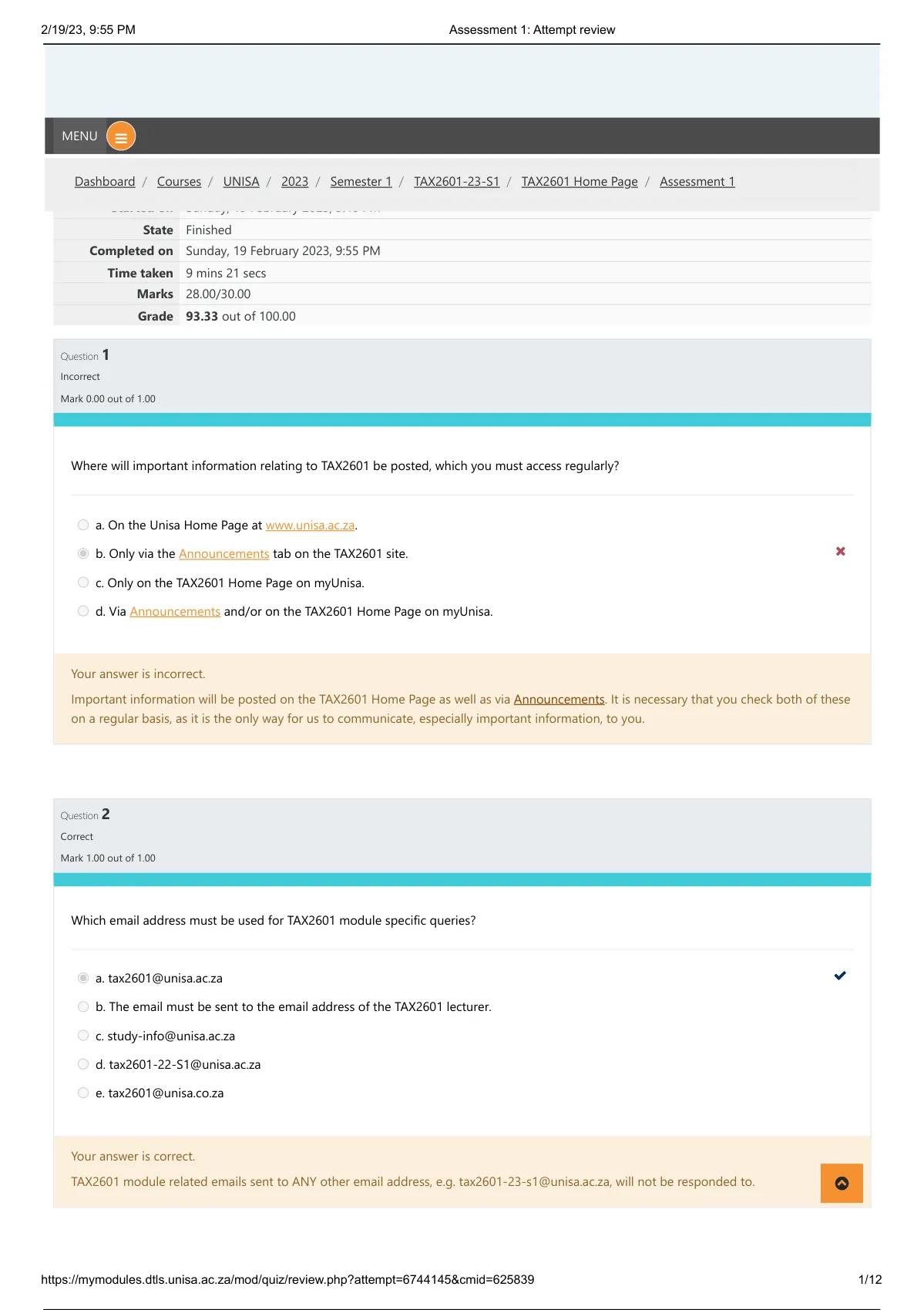

Tax2601 Assignment 1 Semester 1 2024 Tax2601 Principles Of Taxation This document contains inv2601 assesssment 1 semester 1 of 2024 expected questions and answers. correct use as a guide can help you score above 85% in the assessment. It is an asset with a standard deviation of zero because its expected return will equal its actual return. Course inv2601 investments: an introduction (inv2601) institution university of south africa (unisa). As you prepare for the exam, ensure that you have done all the assessment questions in the textbook and study guide from each chapter in order to cement your understanding of the concepts that are covered. Explanation a market order is executed at the best prevailing market conditions. calculation nrfr = [ (1 rrfr) (1 ei) –1] × 100 nrfr = ( (1 0) (1 0) – 1 ) x 100 = 13. explanation defensive stocks have low betas whilst speculation involves a great deal of risk. Inv2601 201 1 important information: this tutorial letter contains important informationabout your assignments and additional questions. dear student 1 examination information the examination paper will consist of 40 multiple choice questions. it is a two hourexamination paper for a total of 40 marks. you will be tested on study units 1 15 (topic 5, su 16 excluded). interest factor tables and.

Comments are closed.