Investing Basics Why Asset Allocation Diversification Are Essential Asset allocation means deciding what portion of your portfolio to invest in different asset classes, like stocks, bonds and cash. diversification is the spreading of your investments both among and within different asset classes. and rebalancing means making regular adjustments to ensure you are hitting your target allocation. Why asset allocation is so important. by including asset categories with investment returns that move up and down under different market conditions within a portfolio, an investor can protect against significant losses. historically, the returns of the three major asset categories have not moved up and down at the same time.

Investing Asset Allocation Diversification Concept Human Stock Photo Whether you’re brand new to investing or you have been cultivating your investment portfolio for decades, asset allocation and diversification are two essential strategies to embrace. asset allocation—an investment strategy that dictates the proportion of stocks, bonds, and cash in your portfolio—is the primary factor determining. Constructing a diversified portfolio is a fundamental aspect of investment strategy that aims to manage risk while seeking potential returns. at its core, effective diversification involves asset allocation, which is the practice of distributing investments across various asset classes such as stocks, bonds, real estate, and commodities. Investing wisely necessitates understanding the pivotal strategies of diversification and asset allocation, which serve as cornerstones for managing risk and enhancing potential returns. this guide equips you with a thorough exploration of how to effectively structure your investment portfolio for financial success. We believe that you should have a diversified mix of stocks, bonds, and other investments, and should diversify your portfolio within those different types of investment. setting and maintaining your strategic asset allocation are among the most important ingredients in your long term investment success. then give your portfolio a regular checkup.

Back To Basics Diversification And Asset Allocation Wealth And Investing wisely necessitates understanding the pivotal strategies of diversification and asset allocation, which serve as cornerstones for managing risk and enhancing potential returns. this guide equips you with a thorough exploration of how to effectively structure your investment portfolio for financial success. We believe that you should have a diversified mix of stocks, bonds, and other investments, and should diversify your portfolio within those different types of investment. setting and maintaining your strategic asset allocation are among the most important ingredients in your long term investment success. then give your portfolio a regular checkup. Why asset allocation and diversification are important. asset allocation describes putting your money in different asset class baskets. diversification puts a mixture of the asset class in each basket. both strategies try to help you balance your desire for return with your need to manage your investment risk. Understanding the distinction between asset allocation and diversification is crucial for effective portfolio management. while asset allocation involves distributing investments across different asset categories to balance risk and reward, diversification focuses on spreading investments within an asset class to mitigate risk. Keep in mind that investing involves risk. the value of your investment will fluctuate over time, and you may gain or lose money. diversification and asset allocation do not ensure a profit or guarantee against loss. fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. 1201905.1.0. Understand the difference between diversification and asset allocation. learn how these key strategies help reduce risk and optimize your investment portfolio.

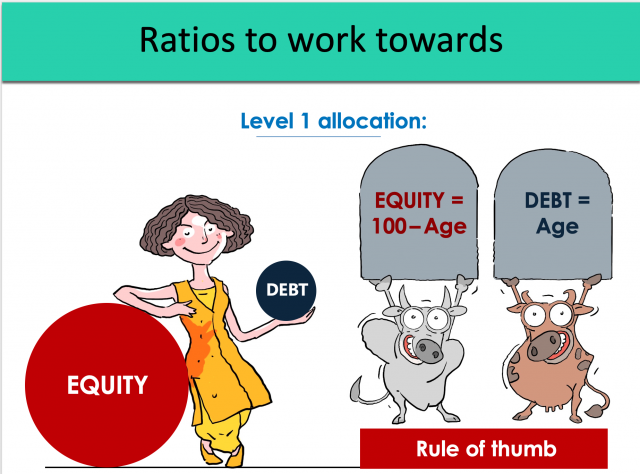

Diversification And Asset Allocation Monika Halan Why asset allocation and diversification are important. asset allocation describes putting your money in different asset class baskets. diversification puts a mixture of the asset class in each basket. both strategies try to help you balance your desire for return with your need to manage your investment risk. Understanding the distinction between asset allocation and diversification is crucial for effective portfolio management. while asset allocation involves distributing investments across different asset categories to balance risk and reward, diversification focuses on spreading investments within an asset class to mitigate risk. Keep in mind that investing involves risk. the value of your investment will fluctuate over time, and you may gain or lose money. diversification and asset allocation do not ensure a profit or guarantee against loss. fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. 1201905.1.0. Understand the difference between diversification and asset allocation. learn how these key strategies help reduce risk and optimize your investment portfolio.

Back To Basics Diversification And Asset Allocation Keep in mind that investing involves risk. the value of your investment will fluctuate over time, and you may gain or lose money. diversification and asset allocation do not ensure a profit or guarantee against loss. fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. 1201905.1.0. Understand the difference between diversification and asset allocation. learn how these key strategies help reduce risk and optimize your investment portfolio.