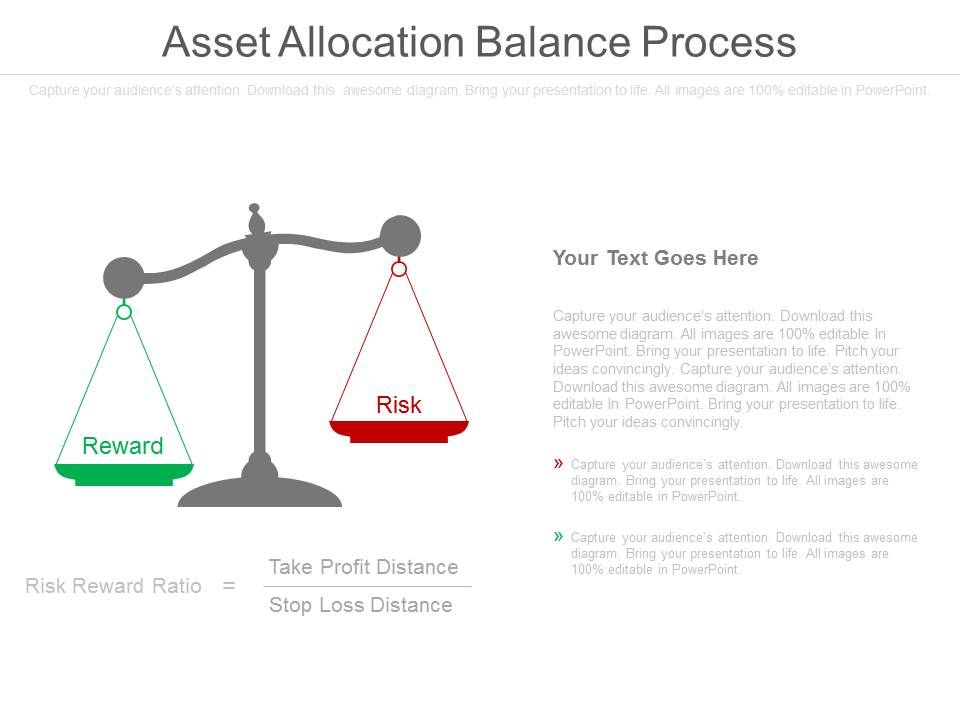

Asset Allocation Balance Process Ppt Slides It’s important to find the right balance, especially when it comes to asset allocation. it determines how much risk you’re willing to take and the pace of your progress. a well balanced asset allocation can help you ensure your portfolio can weather market storms while still reaching your destination. Some investment options combine these asset types into one, such as mutual funds or target date funds, which automatically adjust over time. these types of investments are common in employer 401(k) plans and can create a more hands off approach to managing your portfolio. finding the right balance: risk, reward and your investment mix.

Asset Allocation Balance Process Ppt Slides Learn how to achieve your ideal asset allocation through a mix of stocks, bonds, and cash that will earn the total return over time that you need. Find out how to achieve this delicate balance with a few optimal strategies for asset allocation. your portfolio’s asset mix is a key factor in its profitability. Modern asset allocation is no longer limited to just stocks and bonds. it is about engineering a portfolio that is both resilient and responsive, capable of withstanding shocks while seizing growth across a range of market scenarios. strategic asset allocation. strategic asset allocation represents the cornerstone of long term investing. A retirement asset allocation strategy aims to balance the right mix of stocks, bonds, cash and other assets in your investment portfolio to outline a glide path toward (or through) your retirement.

Asset Allocation Spreadsheet For How To Maintain Proper Asset Modern asset allocation is no longer limited to just stocks and bonds. it is about engineering a portfolio that is both resilient and responsive, capable of withstanding shocks while seizing growth across a range of market scenarios. strategic asset allocation. strategic asset allocation represents the cornerstone of long term investing. A retirement asset allocation strategy aims to balance the right mix of stocks, bonds, cash and other assets in your investment portfolio to outline a glide path toward (or through) your retirement. In general, investors with long term time horizons, low near term cash needs, and moderate to high risk capacity and tolerance will have an asset allocation that emphasizes equity investments. Effective asset allocation is a crucial part of investment management. your asset allocation determines the overall risk and return profile of your portfolio and ensures your investments align with your financial goals and risk tolerance. barbell asset allocation is another approach that seeks to balance risk with safety by investing in. Transparent: simplify allocations to ensure they’re clear, easy to explain and free from unnecessary complexity. cost efficient: keep fees and expenses low to maximize the potential of clients’ investments. globally diversified: create balance with portfolios that span geographies, asset classes and investment styles. designed for the long term: prioritize sustained growth potential while. An asset allocation strategy helps you distribute your investments across asset classes like stocks, bonds, cash, and alternatives. the goal is to balance risk and return. different asset classes perform differently in varying market conditions.