Irr Internal Rate Of Return

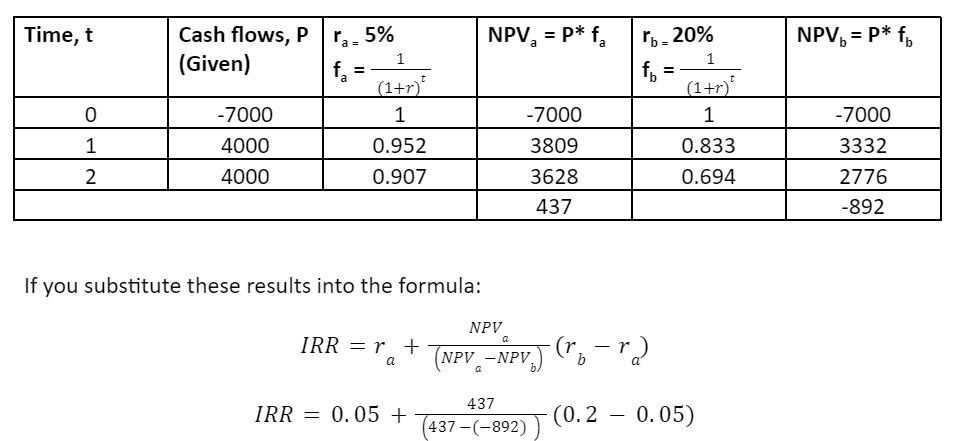

Internal Rate Of Return Irr Aikerja What is irr (internal rate of return)? internal rate of return, or irr, is the rate of return at which a project breaks even and is used by management to evaluate potential investments. irr functions as a return on investment (roi) calculation. Learn how to calculate and interpret the internal rate of return (irr) for projects or investments. irr is the discount rate that makes the net present value of all cash flows equal to zero.

Internal Rate Of Return Irr Definition Formula Calculation What is the internal rate of return (irr) rule? the internal rate of return rule states that a project or investment may be worth pursuing if its internal rate of return (irr) exceeds the minimum. The internal rate of return (irr) is a special discount rate (a rate of return) at which an investment's net present value equals 0. irr is used in finance, specifically in capital budgeting, as it is one of the most well known methods of evaluating the profitability of an investment. The internal rate of return (irr) measures the return of a potential investment. the calculation excludes external factors such as inflation and the cost of capital, which is why it’s called internal. Internal rate of return (irr) is a method of calculating an investment 's rate of return. the term internal refers to the fact that the calculation excludes external factors, such as the risk free rate, inflation, the cost of capital, or financial risk.

Internal Rate Of Return Irr Definition Formula Calculation The internal rate of return (irr) measures the return of a potential investment. the calculation excludes external factors such as inflation and the cost of capital, which is why it’s called internal. Internal rate of return (irr) is a method of calculating an investment 's rate of return. the term internal refers to the fact that the calculation excludes external factors, such as the risk free rate, inflation, the cost of capital, or financial risk. The internal rate of return (irr) is the annualized interest rate at which an initial capital investment grows to its ending value. the irr reflects the compounded return on an investment, per the size of the cash inflows (or outflows) and the coinciding timing. Internal rate of return (irr) is the expected average return of an investment. irr is commonly used in corporate finance and is similar to the compound annual growth rate (cagr), which is more. Learn what internal rate of return is, how irr is used to evaluate investments, and how to calculate it using formulas and examples to help business decisions. What is internal rate of return (irr)? internal rate of return (irr) is the discount rate at which a project's returns become equal to its initial investment. in other words, it attains a break even point where the total cash inflows completely meet the total cash outflow.

Comments are closed.