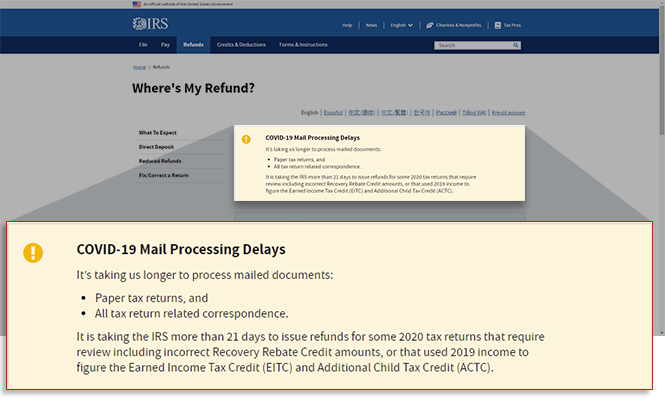

Irs Tax Payment Processing Delays Taxcaddy Find our current processing status and what to expect for the tax form types listed below. electronically filed form 1040 returns are generally processed within 21 days. we’re currently processing paper returns received during the months below. this does not include those that require error correction or other special handling. The irs shutdown has disrupted the tax filing process for both individuals and businesses. with operations curtailed, the processing of returns is expected to slow significantly, potentially affecting those who rely on timely refunds to meet financial obligations.

Video Irs Processing Times Usglobaltax The irs has historically faced significant challenges in processing tax returns, issuing refunds, and responding to taxpayer correspondence. these challenges are attributed to a combination of factors, including budget constraints and a diminishing workforce. With the 2025 tax season underway, tax experts have noticed signs of trouble at the irs, from a lack of customer service and delays to audit errors. Tax season is nearly over, and people who filed earlier in the window may wonder why a return is taking so long to process. the irs has received 1.7% fewer returns this tax season but has. Through mid march, tax professionals say they have not seen unusual or significant delays relating to tax refunds. the irs began accepting and processing tax returns for early filers on jan .

Irs Delays Tax Season Start Date Tax season is nearly over, and people who filed earlier in the window may wonder why a return is taking so long to process. the irs has received 1.7% fewer returns this tax season but has. Through mid march, tax professionals say they have not seen unusual or significant delays relating to tax refunds. the irs began accepting and processing tax returns for early filers on jan . Employee layoffs at the internal revenue service (irs) could impact the timely return of tax refunds and other services, experts have said. newsweek has contacted the irs for comment via email. While the internal revenue service has made significant progress in slashing the backlog of tax returns from 2021, it is now processing the filings at a slower clip and taxpayers are facing. The irs says it expects to tax refunds to be sent out on time. but experts say the disruption and backlog that the government shutdown created could cause delays for taxpayers. The report, released thursday by the government accountability office, noted that the irs set a 13 day processing goal for individual paper returns but instead averaged 20 in 2024. in addition, irs responses to taxpayer mail continued to be delayed, with 66% of them considered to be late at the end of filing season.

Irs Delays Tax Filing Deadline Alltop Viral Employee layoffs at the internal revenue service (irs) could impact the timely return of tax refunds and other services, experts have said. newsweek has contacted the irs for comment via email. While the internal revenue service has made significant progress in slashing the backlog of tax returns from 2021, it is now processing the filings at a slower clip and taxpayers are facing. The irs says it expects to tax refunds to be sent out on time. but experts say the disruption and backlog that the government shutdown created could cause delays for taxpayers. The report, released thursday by the government accountability office, noted that the irs set a 13 day processing goal for individual paper returns but instead averaged 20 in 2024. in addition, irs responses to taxpayer mail continued to be delayed, with 66% of them considered to be late at the end of filing season.