Irs Update Schedule R Irs Information about schedule r (form 1040), credit for the elderly or the disabled, including recent updates, related forms, and instructions on how to file. use schedule r (form 1040) to figure the credit for the elderly or the disabled. For the latest information about developments related to schedule r (form 1040) and its instructions, such as legislation enacted after they were published, go to irs.gov scheduler.

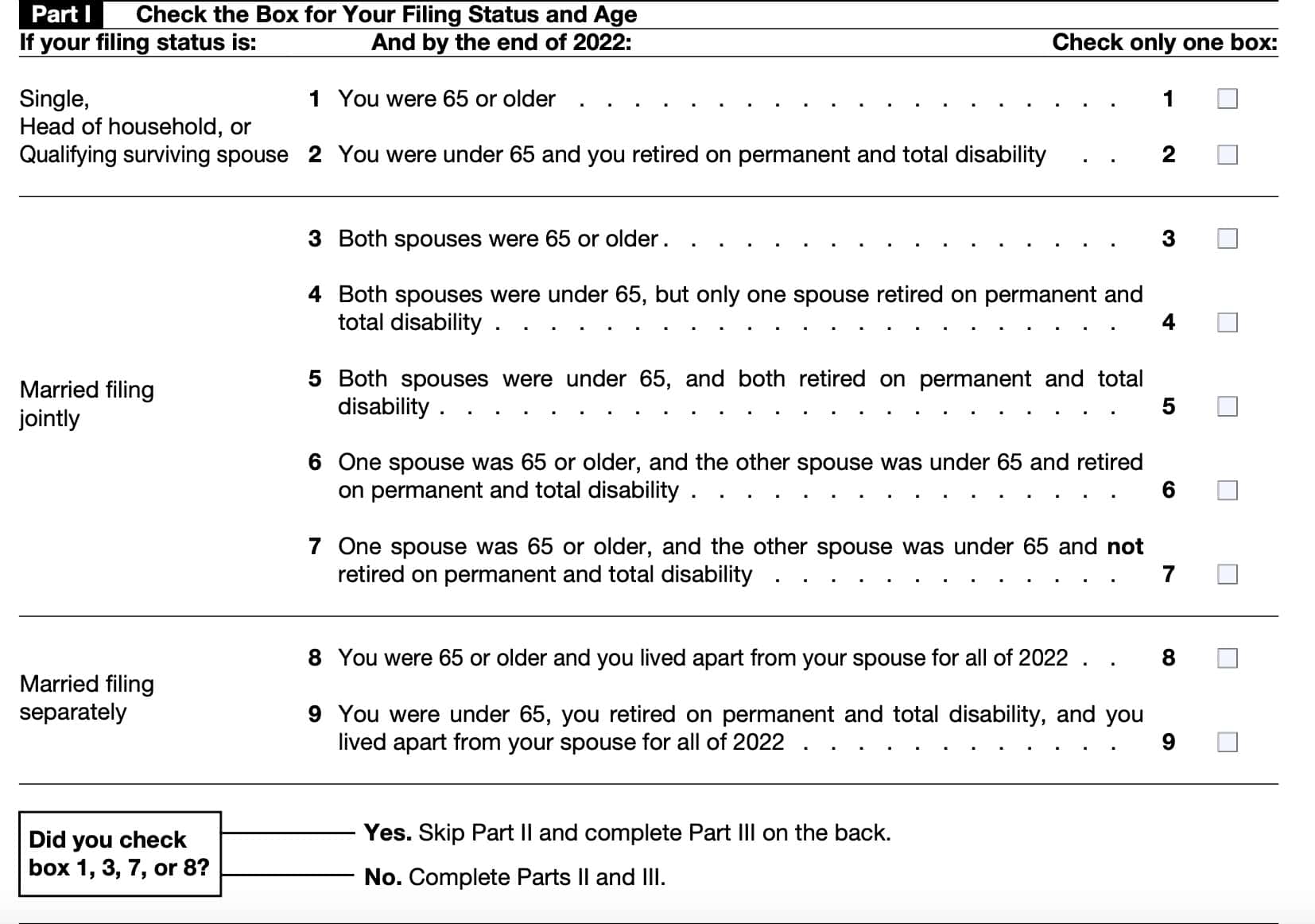

Irs Update R Irs Go to irs.gov scheduler for instructions and the latest information. • you were age 65 or older or • you were under age 65, you retired on permanent and total disability, and you received taxable disability income. but you must also meet other tests. see instructions. tip in most cases, the irs can figure the credit for you. The irs is distributing $2.4 billion worth of stimulus checks to taxpayers who didn't claim the recovery rebate credit on their 2021 tax returns. According to the irs refunds will generally be paid within 21 days. this includes accepting, processing and disbursing approved refund payments via direct deposit or check. this is regular days, not business days. If you meet the irs qualifications, you’ll need to complete schedule r to claim your credit. in part 1 of schedule r, answer the form questions relating to your age and disability status.

Irs Update Daily Calendar Trying To Prevent Confusion R Irs According to the irs refunds will generally be paid within 21 days. this includes accepting, processing and disbursing approved refund payments via direct deposit or check. this is regular days, not business days. If you meet the irs qualifications, you’ll need to complete schedule r to claim your credit. in part 1 of schedule r, answer the form questions relating to your age and disability status. View the latest federal tax forms available and updated for h&r block tax prep software. keep your software current and stay ready for federal tax filing. The internal revenue service (irs) has issued program manager technical advice (ptma 2025 001) addressing the validity of employee retention credit (erc) claims submitted by third party payers (tpps) on aggregate employment tax returns or claims for refund when the required allocation schedule, schedule r (form 941), is not attached. this guidance, dated february 13, 2025, responds to a. Eligible taxpayers use irs schedule r to calculate and tax a tax credit to help lower their tax liability when they file their irs form 1040. in this article, we’ll help you walk through schedule r, including: let’s start with a comprehensive review of schedule r itself. how do i complete schedule r? where can i find schedule r? what do you think?. The articles below explain specific changes to forms, instructions, or publications after they are available on irs.gov. such changes are often the result of new tax legislation, new irs guidance, clarifications, corrections, updates of mailing addresses or phone numbers, and other revisions.

Irs Update Suncoast Cpa Group View the latest federal tax forms available and updated for h&r block tax prep software. keep your software current and stay ready for federal tax filing. The internal revenue service (irs) has issued program manager technical advice (ptma 2025 001) addressing the validity of employee retention credit (erc) claims submitted by third party payers (tpps) on aggregate employment tax returns or claims for refund when the required allocation schedule, schedule r (form 941), is not attached. this guidance, dated february 13, 2025, responds to a. Eligible taxpayers use irs schedule r to calculate and tax a tax credit to help lower their tax liability when they file their irs form 1040. in this article, we’ll help you walk through schedule r, including: let’s start with a comprehensive review of schedule r itself. how do i complete schedule r? where can i find schedule r? what do you think?. The articles below explain specific changes to forms, instructions, or publications after they are available on irs.gov. such changes are often the result of new tax legislation, new irs guidance, clarifications, corrections, updates of mailing addresses or phone numbers, and other revisions.

рџћљ Update R Irs Eligible taxpayers use irs schedule r to calculate and tax a tax credit to help lower their tax liability when they file their irs form 1040. in this article, we’ll help you walk through schedule r, including: let’s start with a comprehensive review of schedule r itself. how do i complete schedule r? where can i find schedule r? what do you think?. The articles below explain specific changes to forms, instructions, or publications after they are available on irs.gov. such changes are often the result of new tax legislation, new irs guidance, clarifications, corrections, updates of mailing addresses or phone numbers, and other revisions.

Irs Schedule R Instructions Credit For The Elderly Or Disabled