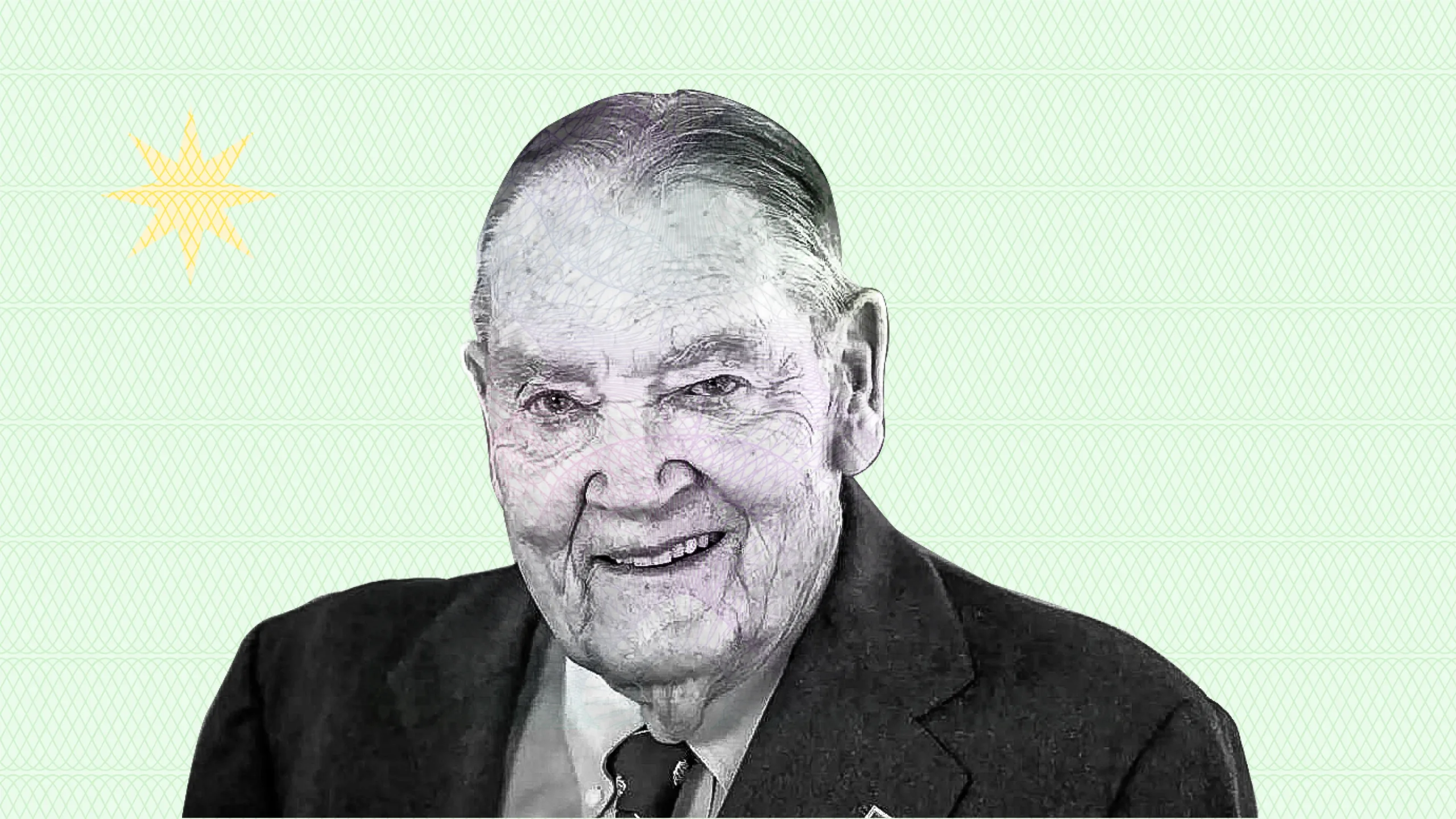

Jack Bogle How To Create Unbeatable Asset Allocation John C Bogle

John Bogle How To Build A Winning Mf Portfolio Unovest Ebook Pdf Jack: directed by francis ford coppola. with robin williams, diane lane, brian kerwin, jennifer lopez. because of an unusual disorder that has aged him four times faster than a typical human being, a boy looks like a 40 year old man as he starts fifth grade at public school after being homeschooled. Jack is a 1996 american coming of age comedy drama film co produced and directed by francis ford coppola. the film stars robin williams, diane lane, jennifer lopez, brian kerwin, fran drescher, and bill cosby.

John C Bogle 20 Things You Didn T Know About The Father Of Index Funds The meaning of jack is a game played with a set of small objects that are tossed, caught, and moved in various figures. how to use jack in a sentence. Discover jack in the box's menu, locations, and online ordering options for delicious fast food meals and snacks. Jack is often used as a boy name. learn more about the meaning, origin, and popularity of the name jack. Jack definition: any of various portable devices for raising or lifting heavy objects short heights, using various mechanical, pneumatic, or hydraulic methods.

Jack Bogle Follow These 4 Investing Rules Ignore The Rest Jack is often used as a boy name. learn more about the meaning, origin, and popularity of the name jack. Jack definition: any of various portable devices for raising or lifting heavy objects short heights, using various mechanical, pneumatic, or hydraulic methods. In his wildest role ever, williams takes you on a hilarious ride as jack explores the ups and downs of life from a kid's point of view! with bill cosby, and sexy fran drescher, diane lane, and jennifer lopez join the millions of moviegoers who loved this outrageous comedy hit!. Since the late 20th century, jack has become one of the most common names for boys in many english speaking countries. jack is also used to a lesser extent as a female given name, often as a shortened version of jacqueline. [3]. Jack (robin williams) is next seen ten years later as a ten year old boy in the body of a forty year old man. four boys lurk outside his house, swapping rumors of a "monstrosity" of a boy their age who can't go to school. Look up jack or jack in wiktionary, the free dictionary.

50 John C Bogle Stock Photos High Res Pictures And Images Getty Images In his wildest role ever, williams takes you on a hilarious ride as jack explores the ups and downs of life from a kid's point of view! with bill cosby, and sexy fran drescher, diane lane, and jennifer lopez join the millions of moviegoers who loved this outrageous comedy hit!. Since the late 20th century, jack has become one of the most common names for boys in many english speaking countries. jack is also used to a lesser extent as a female given name, often as a shortened version of jacqueline. [3]. Jack (robin williams) is next seen ten years later as a ten year old boy in the body of a forty year old man. four boys lurk outside his house, swapping rumors of a "monstrosity" of a boy their age who can't go to school. Look up jack or jack in wiktionary, the free dictionary.

50 John C Bogle Stock Photos High Res Pictures And Images Getty Images Jack (robin williams) is next seen ten years later as a ten year old boy in the body of a forty year old man. four boys lurk outside his house, swapping rumors of a "monstrosity" of a boy their age who can't go to school. Look up jack or jack in wiktionary, the free dictionary.

Asset Allocation Model Unconventional Success

Comments are closed.