Leveraging Ai To Tackle Banking The Future Of Finance Is Here Ai Driven With teams working remotely and workflows disrupted, banks had to reconsider digital solutions. as a result, the customer base leveraging moody’s ai financial spreading solution almost doubled in 2020 alone, reaching a 57% growth in customers by end of 2021. this rapid shift foreshadowed today’s broader embrace of genai in banking. This study highlights the significant role of banking and finance ai technology innovation in boosting banks' financial performance, while also emphasizing the necessity of integrating contextual factors such as economic growth, regulatory frameworks, and ict development to fully leverage ai's benefits.

Importance Of Leveraging Ai For Debt The Future Of Finance Is Here Ai In retail banking, the bank is harnessing ai to generate personalized nudges to help customers with investing and financial planning. in the small business segment, ai is helping to pinpoint which loans might go bad, enabling the bank to take steps to intervene and support the client. The integration of artificial intelligence (ai) into financial services represents a developmental shift in the industry, presenting unprecedented opportunities and challenges. this scientometric. As ai continues to evolve, it will play a crucial role in shaping the future of banking, making it more personalised, efficient, and inclusive. the integration of ai into financial services is not just about adopting new technology; it's about reimagining the entire banking experience. The future of ai in banking. as ai continues to transform the financial services industry, our experts agree that its impact will be far reaching. from enhancing customer service and improving fraud detection to streamlining regulatory compliance and boosting operational efficiency, ai is set to revolutionise every aspect of banking.

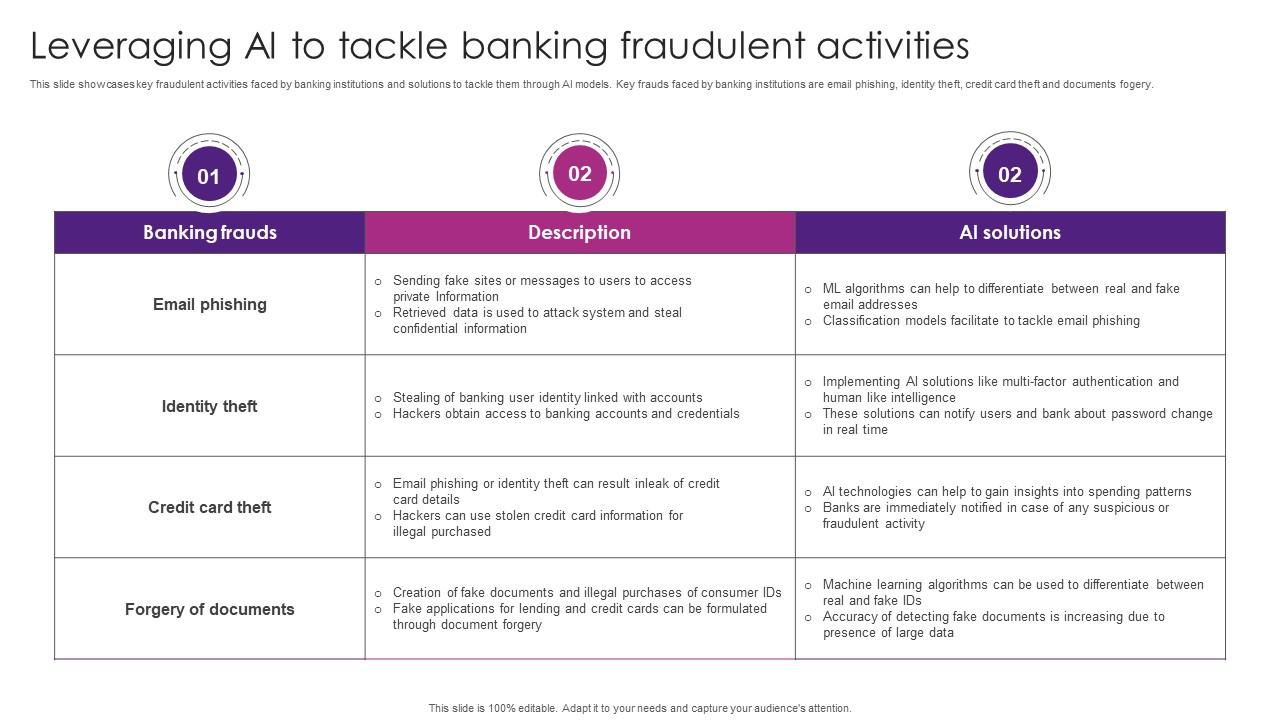

Leveraging Ai To Tackle Banking Fraudulent Activities Finance As ai continues to evolve, it will play a crucial role in shaping the future of banking, making it more personalised, efficient, and inclusive. the integration of ai into financial services is not just about adopting new technology; it's about reimagining the entire banking experience. The future of ai in banking. as ai continues to transform the financial services industry, our experts agree that its impact will be far reaching. from enhancing customer service and improving fraud detection to streamlining regulatory compliance and boosting operational efficiency, ai is set to revolutionise every aspect of banking. Ntt data underscores gen ai’s impact across all facets of banking: 49% of banks utilise gen ai to optimise working capital decisions. 44% observe ai driven improvements in checkout experiences and customer support automation. 69% of leaders recognise that gen ai enhances fraud detection accuracy. The future belongs to those who can bridge the gap between ai driven capabilities and user convenience, creating a digital experience that feels as intuitive as speaking, as natural as asking a question and as powerful as the technology that fuels it. jake fuchs helps lead the investment team at banktech ventures. The bank of england’s latest industry survey puts data protection, model explainability and talent shortages at the top of banks’ ai pain points, a hierarchy that neatly mirrors the mas findings.