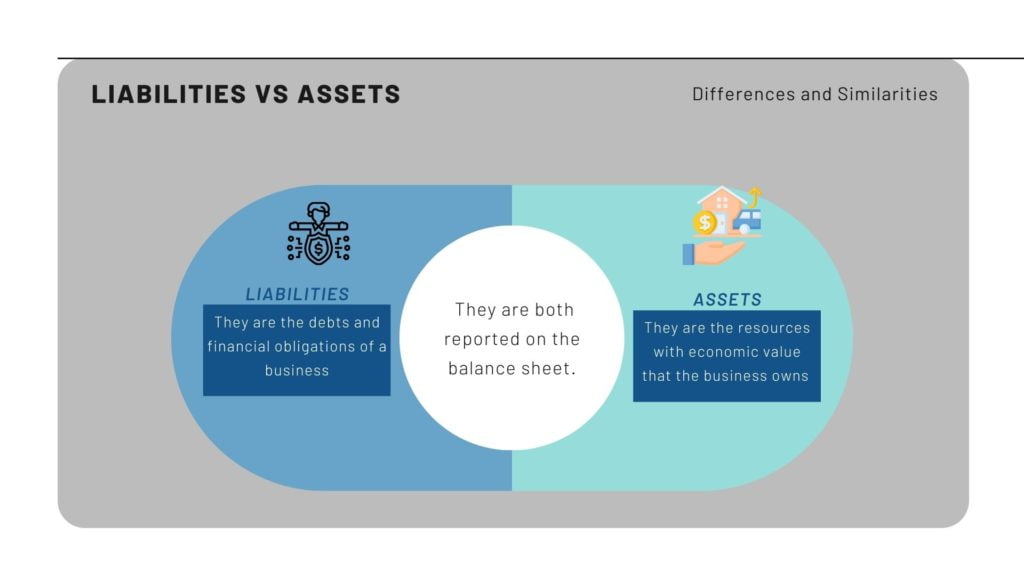

Liabilities Vs Assets Differences And Similarities Financial Falconet Liabilities vs assets differences. liabilities are existing debts that a business owes to another business, employee, vendor, lender, organization, or government agency whereas assets are items or resources of value that the business owns. Assets are a representation of things that are owned by a company and produce revenue. liabilities, on the other hand, are a representation of amounts owed to other parties. both assets and liabilities are broken down into current and noncurrent categories. in short, one is owned (assets) and one is owed (liabilities). what are assets?.

Liabilities Vs Assets Differences And Similarities Financial Falconet Expenses and liabilities represent two distinct components in a company’s financial statements. in this article, we see what these two items are, whether expenses are liabilities, and their comparison to show the areas in which they differ. are expenses liabilities? related: what type of account is cost of goods sold? what are expenses?. Assets bring future economic benefits to its owners, whereas liabilities are the obligations for future payments. therefore, the distinction between assets or liabilities depends on whether something will result in the inflow or outflow of economic benefits in the future. Assets affix a certain financial value to the balance sheet of a company while the liabilities take a toll on financial value or evade the funds. nonetheless, both assets, as well as liabilities, are greatly significant because they empower operations of business and profitability. Assets are items such as property, buildings which an organization. own and that can be transformed to cash. on the other hand, liabilities are the deb amounts that are to owed by the company to be settled within a future date. what is it?.

Liabilities Vs Assets Differences And Similarities Financial Falconet Assets affix a certain financial value to the balance sheet of a company while the liabilities take a toll on financial value or evade the funds. nonetheless, both assets, as well as liabilities, are greatly significant because they empower operations of business and profitability. Assets are items such as property, buildings which an organization. own and that can be transformed to cash. on the other hand, liabilities are the deb amounts that are to owed by the company to be settled within a future date. what is it?. As a business owner, you should understand the fundamental difference between assets vs. liabilities. the more you classify assets and liabilities properly, the more you can take informed business decisions that can increase and sustain the profitability of your company, and avoid debt and losses. To understand how the two differ, you have to know the liability vs. asset meaning: liabilities: existing debts a business owes to another business, vendor, employee, organization, lender, or government agency. liabilities can help owners finance their companies (e.g., loans). assets: items or resources of value that the business owns. The difference between these ratios is that the quick ratio evaluates the company’s ability to settle its short term liabilities using its most liquid assets while the current ratio measures the company’s ability to pay its short term or current liabilities with its short term or current assets. Key difference: an asset is something which is owned and controlled by an entity. it is capable of bringing some financial gain in the future. on the other hand, a liability is a present obligation which has to be settled in future.

Liabilities Vs Assets Differences And Similarities Financial Falconet As a business owner, you should understand the fundamental difference between assets vs. liabilities. the more you classify assets and liabilities properly, the more you can take informed business decisions that can increase and sustain the profitability of your company, and avoid debt and losses. To understand how the two differ, you have to know the liability vs. asset meaning: liabilities: existing debts a business owes to another business, vendor, employee, organization, lender, or government agency. liabilities can help owners finance their companies (e.g., loans). assets: items or resources of value that the business owns. The difference between these ratios is that the quick ratio evaluates the company’s ability to settle its short term liabilities using its most liquid assets while the current ratio measures the company’s ability to pay its short term or current liabilities with its short term or current assets. Key difference: an asset is something which is owned and controlled by an entity. it is capable of bringing some financial gain in the future. on the other hand, a liability is a present obligation which has to be settled in future.

Assets Liabilities Equity Comparison Financial Falconet The difference between these ratios is that the quick ratio evaluates the company’s ability to settle its short term liabilities using its most liquid assets while the current ratio measures the company’s ability to pay its short term or current liabilities with its short term or current assets. Key difference: an asset is something which is owned and controlled by an entity. it is capable of bringing some financial gain in the future. on the other hand, a liability is a present obligation which has to be settled in future.