Claim Process Pdf Life Insurance Insurance Understand the key steps in claiming a life insurance payout, including beneficiary rights, payout options, potential delays, and tax implications. The life insurance claim process is simple: gather documents (policy, real death certificate, claim form), notify the insurer, wait & receive the payout.

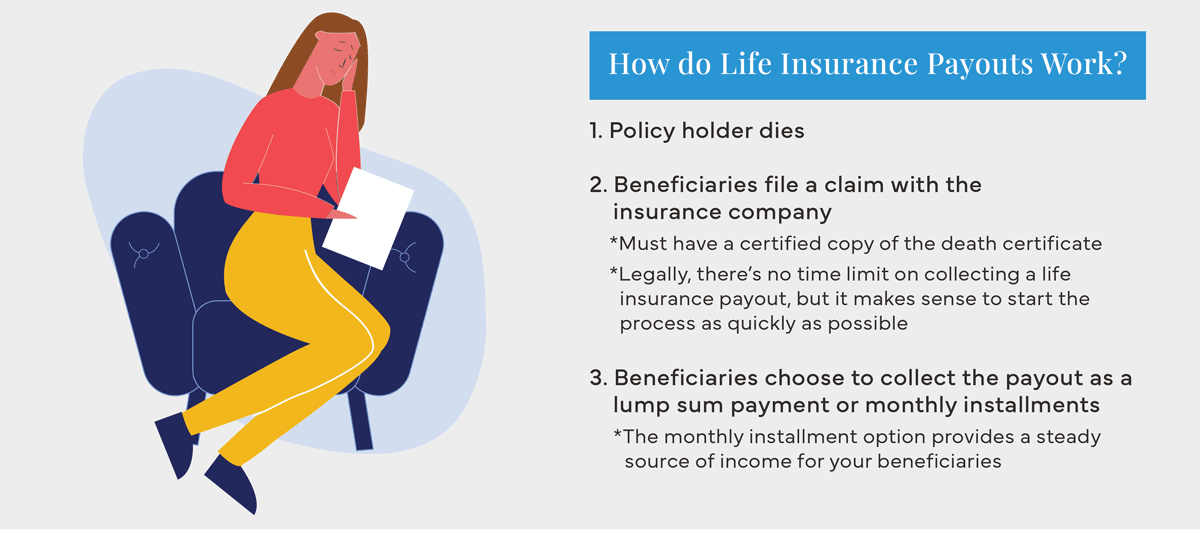

How Do Life Insurance Payouts Work Policybank Life insurance companies usually pay out within 60 days of receiving a death claim filing. beneficiaries must file a death claim and verify their identity before receiving payment. the benefit could be delayed or denied due to policy lapses, fraud, or certain causes of death. what is a life insurance payout?. This article explains the key aspects of life insurance payouts, detailing what beneficiaries need to know and do to claim their funds. how to initiate a claim. to begin a life insurance claim, beneficiaries must notify the insurance company of the policyholder’s death. this can typically be done via phone, email, or the insurer’s website. The first step in the claims process is to report the death to the insurance company and file the claim. you’ll typically be required to provide a copy of the life insurance policy, as well as a certified death certificate for the deceased. Learn the step by step process of claiming life insurance benefits, from verifying beneficiary status to receiving payment, while addressing key requirements. life insurance provides financial support to beneficiaries after the policyholder’s death, but claiming benefits can be complex.

How Do Life Insurance Payouts Work Policybank The first step in the claims process is to report the death to the insurance company and file the claim. you’ll typically be required to provide a copy of the life insurance policy, as well as a certified death certificate for the deceased. Learn the step by step process of claiming life insurance benefits, from verifying beneficiary status to receiving payment, while addressing key requirements. life insurance provides financial support to beneficiaries after the policyholder’s death, but claiming benefits can be complex. You’ll typically choose one of these ways to get a life insurance payout: a lump sum. a lump sum option gives you and other beneficiaries the whole amount all at once. no need to worry. Beneficiaries must file a claim, and the insurer can take some time to process and approve that claim. this article will explain how life insurance payouts work, including how long beneficiaries can expect to wait before approval and how to file a claim to receive the death benefit as soon as possible. How to claim life insurance in 5 steps. getting a life insurance payout shouldn't be extremely complicated, no matter if the policyholder had term or whole life insurance. follow these steps to make the process as smooth as possible. get copies of the death certificate. Follow the steps below to ensure you receive your life insurance payout as quickly as possible. if you're filing an insurance claim, you may have options for how to receive the payout. most claims are paid out as a lump sum (all at once), or you may be able to receive it in annual installments.