Major Asset Class In Investment Portfolio Strategies To Enhance By diversifying across asset classes, regions, industries, company sizes, investment styles, and timelines, you can reduce risk and improve the likelihood of achieving consistent, long term returns. In our recently published 2025 diversification landscape report, we examined a more diversified portfolio spanning 11 different asset classes. we allocated 20% of the portfolio to larger cap.

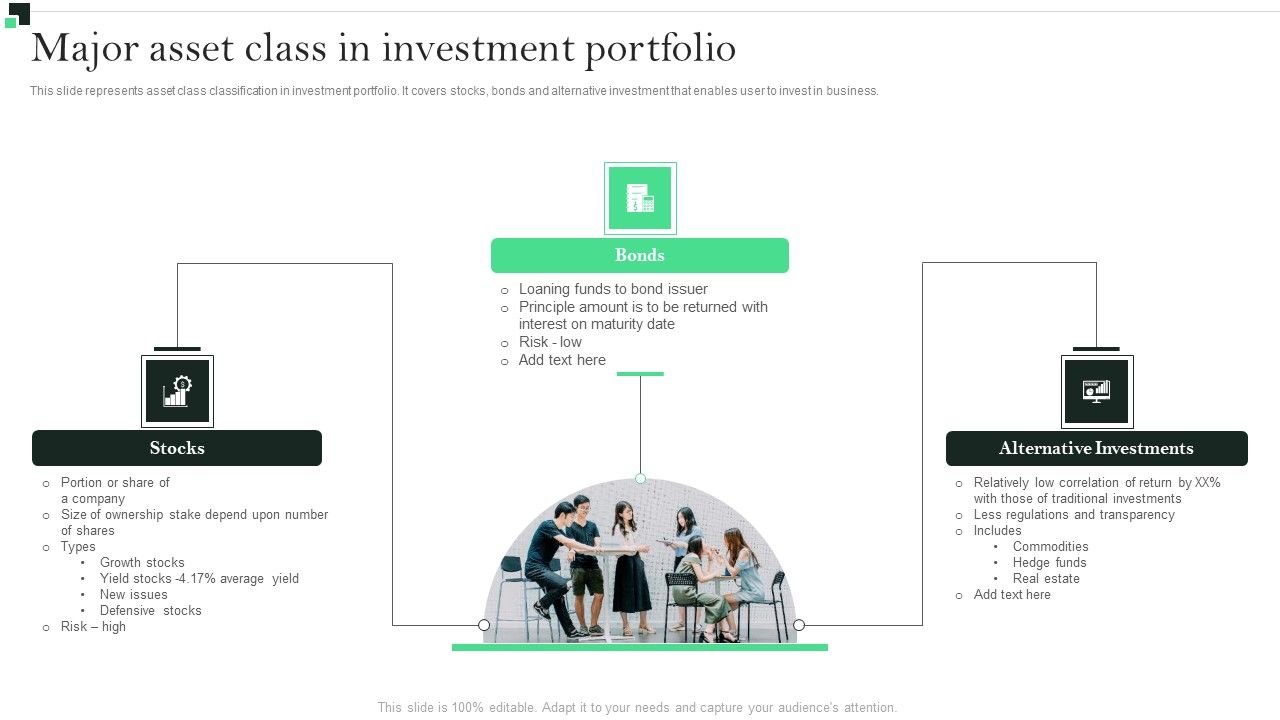

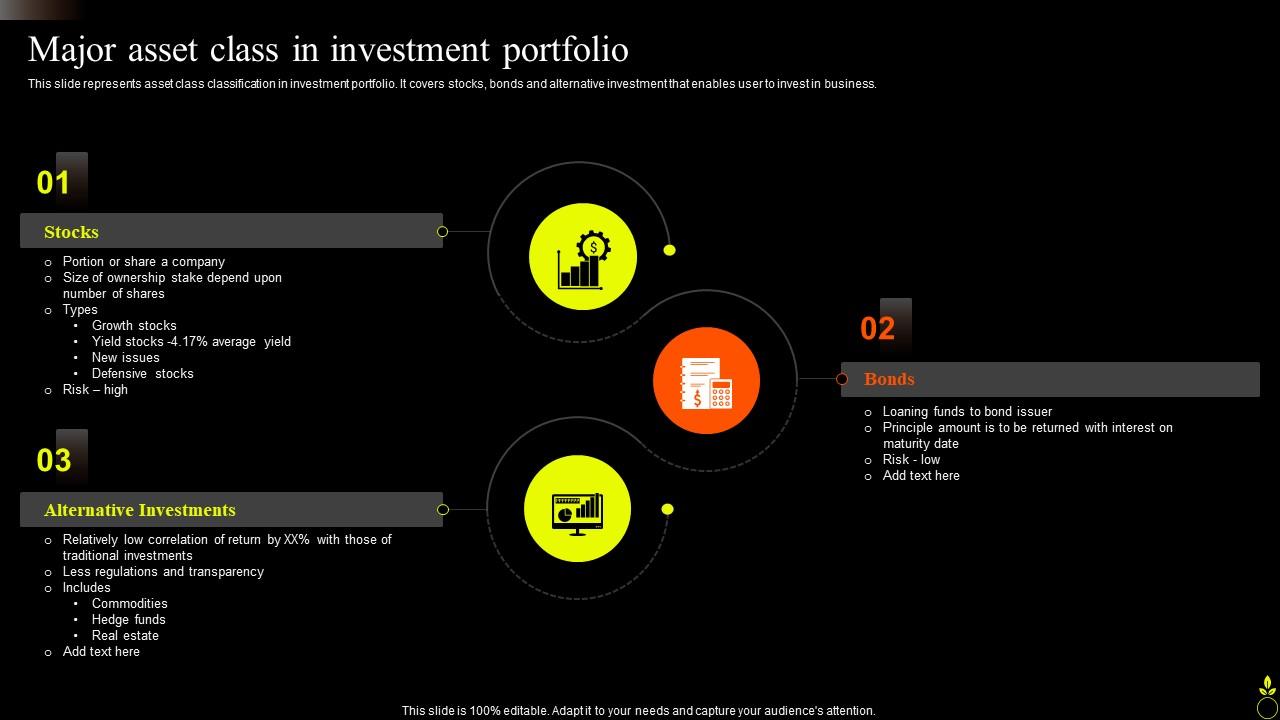

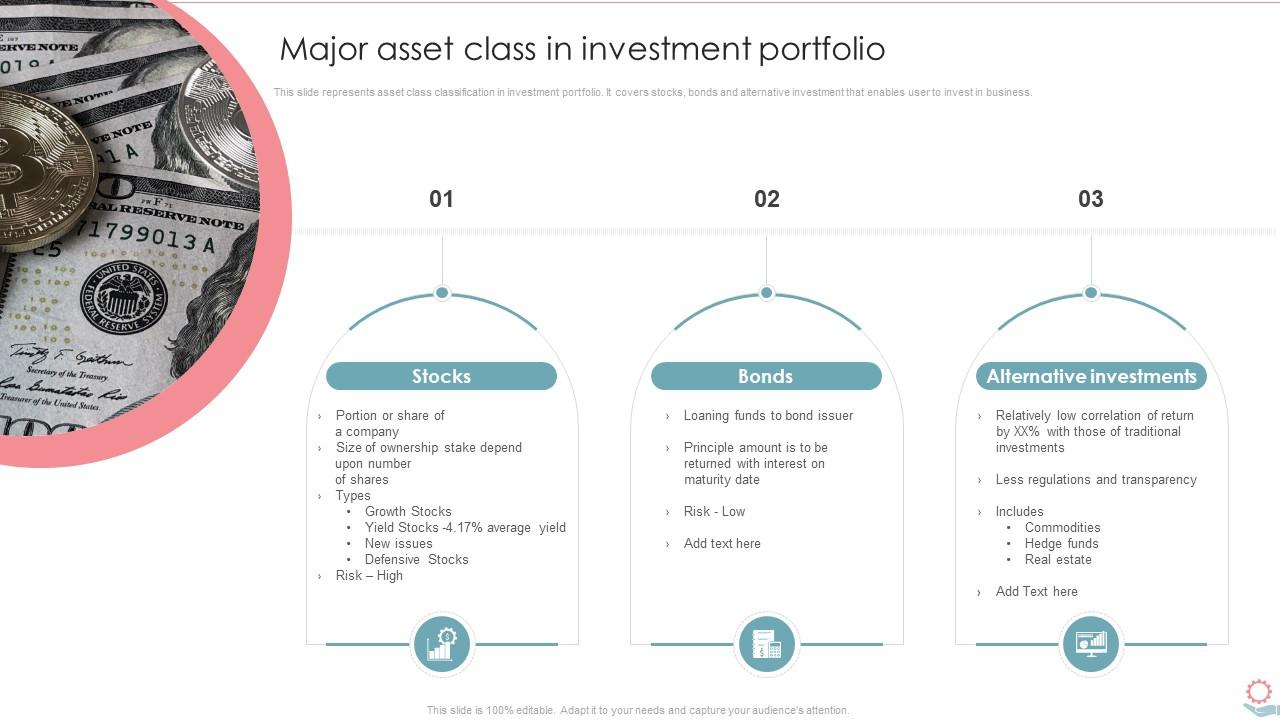

Asset Portfolio Growth Major Asset Class In Investment Portfolio Explore diverse portfolio weighting strategies to optimize asset allocation and enhance investment performance through informed decision making. Here are six key strategies that can improve your investment portfolio. strategic allocation is a long term approach that involves defining a target mix of asset classes based on an investor’s risk tolerance, goals, and time horizon. Insured asset allocation is a strategy that integrates investment with risk management by establishing a portfolio’s value “floor” below which the investor is not willing to allow the total asset value to fall. it combines elements of strategic allocation with a built in safety mechanism, ensuring that if the value of the portfolio. Portfolio diversification strategies work through several key mechanisms: 1. asset class diversification. one of the most fundamental portfolio diversification strategies involves spreading investments across different asset classes: traditional asset classes. stocks; bonds; real estate; cash and equivalents; alternative asset classes.

Major Asset Class In Investment Portfolio Financial Investment Insured asset allocation is a strategy that integrates investment with risk management by establishing a portfolio’s value “floor” below which the investor is not willing to allow the total asset value to fall. it combines elements of strategic allocation with a built in safety mechanism, ensuring that if the value of the portfolio. Portfolio diversification strategies work through several key mechanisms: 1. asset class diversification. one of the most fundamental portfolio diversification strategies involves spreading investments across different asset classes: traditional asset classes. stocks; bonds; real estate; cash and equivalents; alternative asset classes. Discover the importance of understanding asset classes and sectors in building a diversified investment portfolio. this informative guide explores different asset classes, the risks associated with non diversified strategies, and best practices for achieving a balanced portfolio. Asset allocation is a foundational investment strategy that involves dividing your portfolio among different asset classes—such as stocks, bonds, real estate, and alternative investments —to achieve a balance between risk and return. Portfolio management is a key aspect of personal and institutional finance, involving the strategic allocation of assets to achieve specific financial goals. it encompasses strategies tailored to different investment objectives, risk tolerances, and time horizons. Understanding these asset classes helps you mix them effectively to create a diversified portfolio, balancing growth and income with an appropriate level of risk. strategic asset allocation.

Major Asset Class In Investment Portfolio Portfolio Investment Discover the importance of understanding asset classes and sectors in building a diversified investment portfolio. this informative guide explores different asset classes, the risks associated with non diversified strategies, and best practices for achieving a balanced portfolio. Asset allocation is a foundational investment strategy that involves dividing your portfolio among different asset classes—such as stocks, bonds, real estate, and alternative investments —to achieve a balance between risk and return. Portfolio management is a key aspect of personal and institutional finance, involving the strategic allocation of assets to achieve specific financial goals. it encompasses strategies tailored to different investment objectives, risk tolerances, and time horizons. Understanding these asset classes helps you mix them effectively to create a diversified portfolio, balancing growth and income with an appropriate level of risk. strategic asset allocation.