Role Of Asset Allocation In Portfolio Management Pdf Asset Explore assetplus's guide to asset allocation strategies to maximize your investment portfolio's performance. learn how to balance risk and return, diversify investments, and adapt to market changes. perfect for investors seeking to enhance their financial strategy and achieve long term growth. In this contribution we introduce a new approach for optimal asset allocation, proposing a strategy that combines equity , commodity , and bond index futures, and that controls the risk propagation amongst markets.

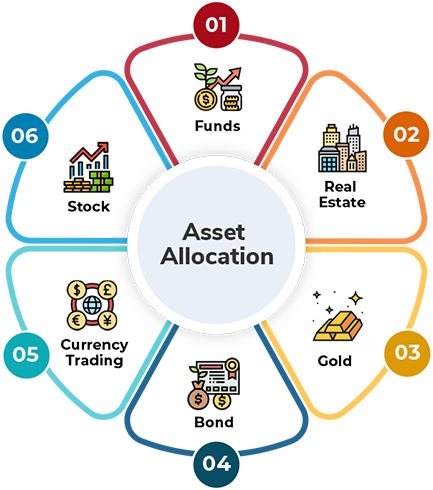

Asset Allocation Pdf Modern Portfolio Theory Asset Allocation Asset allocation involves several strategies to optimize a portfolio. some of these include: strategic asset allocation: this involves setting a baseline mix of assets that aligns with the expected returns of each asset class. constant weighting asset allocation: this strategy maintains a fixed proportion of various assets. We analyze whether industry or country allocations generate superior performance. we investigate 1 n, risk parity, min var, mean variance, bayes stein. black litterman. the analysis includes different investment styles and sub periods. industry portfolios outperform yielding higher sharpe ratios and higher alphas. This study explores whether optimal asset allocation strategies, defined by permutations and combinations of different predictor variables, produce consistently superior performance for investors. we extend the literature by exploring whether such strategies benefit investors over the entire investment period or whether investors are forced to. Asset allocation is often heralded as the most critical decision in the investment process, overshadowing even the selection of individual securities. it's the strategic blueprint that guides investors in distributing their investment capital among different asset categories such as stocks, bonds, real estate, and cash.

Asset Allocation Strategies To Create And Balance A Portfolio This study explores whether optimal asset allocation strategies, defined by permutations and combinations of different predictor variables, produce consistently superior performance for investors. we extend the literature by exploring whether such strategies benefit investors over the entire investment period or whether investors are forced to. Asset allocation is often heralded as the most critical decision in the investment process, overshadowing even the selection of individual securities. it's the strategic blueprint that guides investors in distributing their investment capital among different asset categories such as stocks, bonds, real estate, and cash. The goal of asset allocation is to deliver optimal returns adjusted for risk by giving exposure to a variety of asset classes in the hope that they perform different to each other over different market conditions; the traditional methods of asset allocation include strategic, dynamic and tactical asset allocation. When it comes to mastering asset allocation, implementing effective strategies is crucial for building a robust and balanced investment portfolio. this section will delve into three key aspects of successful asset allocation: determining your risk tolerance and investment goals, diversifying across asset classes, and rebalancing your portfolio. Master the art of asset allocation with our comprehensive guide. learn how to optimize your investment portfolio for long term growth and balance risk. Asset allocation is a strategic approach that investors use to distribute their investment portfolio among various asset classes. this includes equities (stocks), fixed income assets (bonds), and cash and its equivalents. the core aim of asset allocation is to balance the risks and rewards in accord.

6 Asset Allocation Strategies For Successful Portfolio Management The goal of asset allocation is to deliver optimal returns adjusted for risk by giving exposure to a variety of asset classes in the hope that they perform different to each other over different market conditions; the traditional methods of asset allocation include strategic, dynamic and tactical asset allocation. When it comes to mastering asset allocation, implementing effective strategies is crucial for building a robust and balanced investment portfolio. this section will delve into three key aspects of successful asset allocation: determining your risk tolerance and investment goals, diversifying across asset classes, and rebalancing your portfolio. Master the art of asset allocation with our comprehensive guide. learn how to optimize your investment portfolio for long term growth and balance risk. Asset allocation is a strategic approach that investors use to distribute their investment portfolio among various asset classes. this includes equities (stocks), fixed income assets (bonds), and cash and its equivalents. the core aim of asset allocation is to balance the risks and rewards in accord.

6 Asset Allocation Strategies For Successful Portfolio Management Master the art of asset allocation with our comprehensive guide. learn how to optimize your investment portfolio for long term growth and balance risk. Asset allocation is a strategic approach that investors use to distribute their investment portfolio among various asset classes. this includes equities (stocks), fixed income assets (bonds), and cash and its equivalents. the core aim of asset allocation is to balance the risks and rewards in accord.

.jpg)

Portfolio Optimization And Asset Allocation Strategies To Maximize