Model Risk In Action Risk Insights

Model Risk In Action Risk Insights This case study highlights several crucial aspects of model risk management. first, model errors in long term business can create significant exposures before detection. Model risk refers to the potential for adverse outcomes stemming from models producing incorrect or misleading results. this risk originates not only from design flaws, data inaccuracies, or implementation errors but also significantly from the misuse of models.

Risk Insights In this publication, we take a closer look at mrm eight years after sr11 7, reflecting on how practice has evolved and the trends taking mrm into the future. In this insightful model risk management (mrm) webinar, our speakers agus sudjianto and ashin mukherjee explore three key pillars of modern model validation, highlight common pitfalls in model development, and share perspectives on the future of explainable ai in banking. We hope you enjoy this new platform and leverage as a go to resource to gain interactive insight across a range of formats. Model risk management is the process of identifying, gauging and controlling model risk. model risk occurs when a model is used to measure and predict quantitative information but the model performs inadequately.

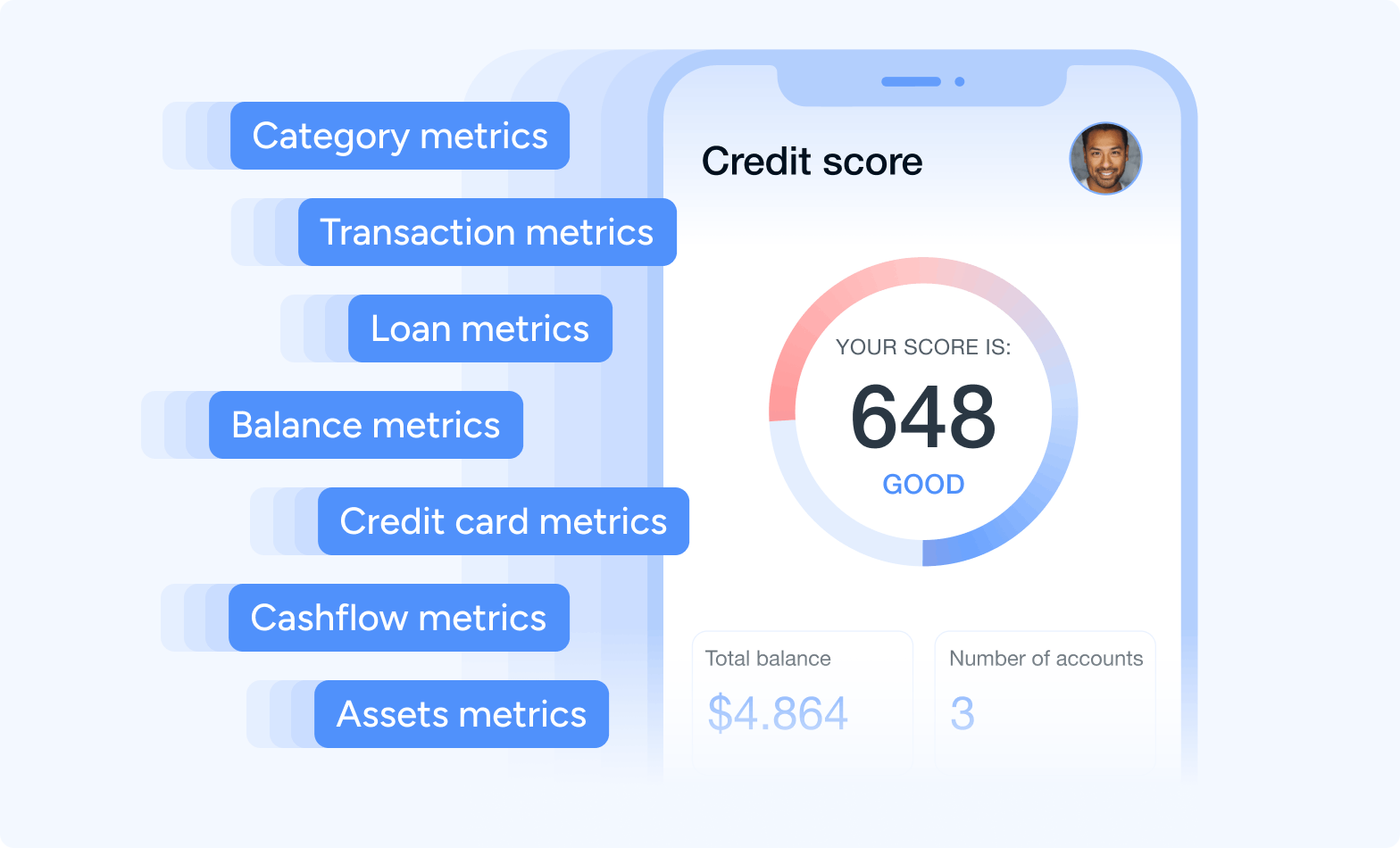

Model Risk Management The Latest Insights Into The Evolution Of Model We hope you enjoy this new platform and leverage as a go to resource to gain interactive insight across a range of formats. Model risk management is the process of identifying, gauging and controlling model risk. model risk occurs when a model is used to measure and predict quantitative information but the model performs inadequately. More than 150 model risk managers from nearly 100 institutions participated in the survey. the results showed three areas of focus: the impact of covid 19 on mrm, the evolutionary changes in mrm, and the challenges posed by models using artificial intelligence (ai) and machine learning (ml). Large language models are helping organizations move from insight to action—quantifying risk with context, scale, and speed. but with great power comes the need for robust governance and explainability. In this article, we provide key insights on market driven model risk analysis along with actionable strategies designed to optimize risk exposures. we discuss the importance of incorporating quantitative methods and the latest technology integration into robust risk management frameworks. Model risk appetite defines when, how and to what extent firms are required to take action in response to changes in model risk. this requires firms to have a connected approach to model monitoring alerts and downstream action planning, be that for model re calibration or risk mitigation.

See Risk Insights In Action Demo Visitor Management System Sign More than 150 model risk managers from nearly 100 institutions participated in the survey. the results showed three areas of focus: the impact of covid 19 on mrm, the evolutionary changes in mrm, and the challenges posed by models using artificial intelligence (ai) and machine learning (ml). Large language models are helping organizations move from insight to action—quantifying risk with context, scale, and speed. but with great power comes the need for robust governance and explainability. In this article, we provide key insights on market driven model risk analysis along with actionable strategies designed to optimize risk exposures. we discuss the importance of incorporating quantitative methods and the latest technology integration into robust risk management frameworks. Model risk appetite defines when, how and to what extent firms are required to take action in response to changes in model risk. this requires firms to have a connected approach to model monitoring alerts and downstream action planning, be that for model re calibration or risk mitigation.

A Comprehensive Guide To Boost Your Risk Models In this article, we provide key insights on market driven model risk analysis along with actionable strategies designed to optimize risk exposures. we discuss the importance of incorporating quantitative methods and the latest technology integration into robust risk management frameworks. Model risk appetite defines when, how and to what extent firms are required to take action in response to changes in model risk. this requires firms to have a connected approach to model monitoring alerts and downstream action planning, be that for model re calibration or risk mitigation.

Comments are closed.