Nvda Chart Reversal Explanation

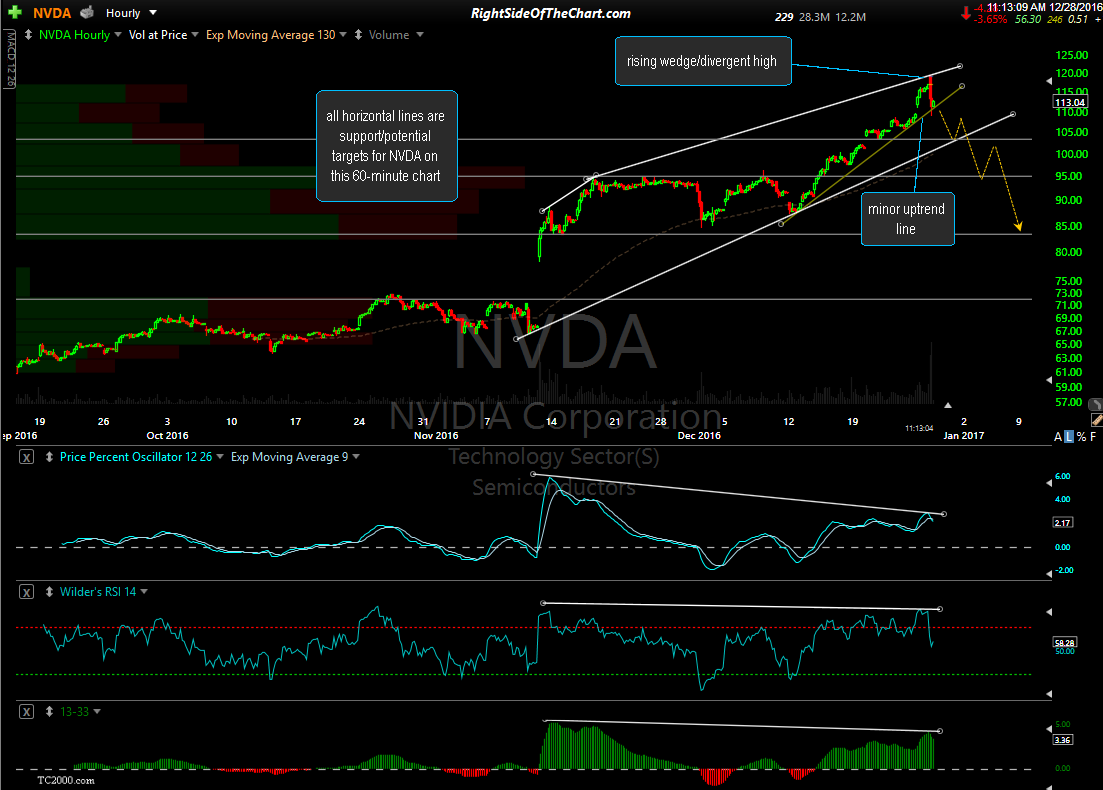

Nvda Setting Up For Potential Trend Reversal Right Side Of The Chart Nvda's share price rose by more than 200%, allowing nvidia's capitalization to exceed usd 1 trillion. however, a pattern is forming on the chart, warning that nvda's share price may decline. As the name implies, the bump and run reversal (barr) is a reversal pattern that forms after excessive speculation drives prices up too far, too fast. developed by thomas bulkowski. bulkowski identified three main phases to the pattern: lead in, bump and run.

Nvda Setting Up For Potential Trend Reversal Right Side Of The Chart Jim cramer cautioned investors about nvidia corp. (nasdaq: nvda) on monday, predicting a potential market correction for the semiconductor giant that has seen its value surge 174% this year. 2004 price on a lifetime membership: greatstockpix lifetime membership for 499. These changes have price action that tends to show up on a chart as a ‘rounded top’ or ‘rounded bottom’ pattern. sometimes the reversal is abrupt and takes place over a few time periods. This classic bearish formation suggests a potential reversal is looming. should the neckline at $137 break, nvidia could be vulnerable to a significant decline, with a target of $100 in sight.

Nvda Stock Analysis Reversal Pattern Forming On The Chart Market Pulse These changes have price action that tends to show up on a chart as a ‘rounded top’ or ‘rounded bottom’ pattern. sometimes the reversal is abrupt and takes place over a few time periods. This classic bearish formation suggests a potential reversal is looming. should the neckline at $137 break, nvidia could be vulnerable to a significant decline, with a target of $100 in sight. In fact, nvda’s pivot—down 7% on tuesday and up 11% on wednesday—was the chipmaker’s biggest two day reversal in more than four years. thursday may have caught some traders off guard, though. Enhance your success in trading nvda (nvidia) stocks by utilizing continuation patterns and recognizing morning and evening star patterns for trend reversals. furthermore, understand the significance of confirming signals in validating your analysis and gaining confidence in your trading decisions. Nvidia stock experienced a sharp reversal after news of a possible stock split. find out why the upcoming cpi report will be crucial. Stocks that retrace 38.2% or less of a trend will usually continue the trend. retracements exceeding 61.8% indicate a reversal. alerts will include abc's up down (multiple 38% retracements) and various reversal signals.

Nvidia And Semiconductors Etf Beware Of Bearish Engulfing Patterns In fact, nvda’s pivot—down 7% on tuesday and up 11% on wednesday—was the chipmaker’s biggest two day reversal in more than four years. thursday may have caught some traders off guard, though. Enhance your success in trading nvda (nvidia) stocks by utilizing continuation patterns and recognizing morning and evening star patterns for trend reversals. furthermore, understand the significance of confirming signals in validating your analysis and gaining confidence in your trading decisions. Nvidia stock experienced a sharp reversal after news of a possible stock split. find out why the upcoming cpi report will be crucial. Stocks that retrace 38.2% or less of a trend will usually continue the trend. retracements exceeding 61.8% indicate a reversal. alerts will include abc's up down (multiple 38% retracements) and various reversal signals.

Nvidia Nvda Major Breakdown Technical Analysis Signals This Target Nvidia stock experienced a sharp reversal after news of a possible stock split. find out why the upcoming cpi report will be crucial. Stocks that retrace 38.2% or less of a trend will usually continue the trend. retracements exceeding 61.8% indicate a reversal. alerts will include abc's up down (multiple 38% retracements) and various reversal signals.

Comments are closed.