Github Llalor Option Pricing Using Monte Carlo Methods In mathematical finance, a monte carlo option model uses monte carlo methods [notes 1] to calculate the value of an option with multiple sources of uncertainty or with complicated features. [1] the first application to option pricing was by phelim boyle in 1977 (for european options). Perhaps the most important tool for handling complicated probability calculations is monte carlo methods. in this lecture we introduce monte carlo methods for computing expectations, with some applications in finance.

Monte Carlo Methods For Option Pricing Quant Rl Option pricing models are mathematical models that use certain variables to calculate the theoretical value of an option. the theoretical value of an option is an estimate of what an option should be worth using all known inputs. in other words, option pricing models provide us a fair value of an option. Pricing options by monte carlo simulation is amongst the most popular ways to price certain types of financial options. this article will give a brief overview of the mathematics involved in simulating option prices using monte carlo methods, python code snippets and a few examples. Discover how monte carlo simulations enhance option pricing by modeling uncertainty, generating price paths, and estimating fair values in financial analysis. monte carlo simulation is widely used in financial modeling to value options when analytical solutions like black scholes are impractical. Assuming that the number of paths is much greater than the number of basis functions, the main cost is in approximating bψψ with a cost which is o(n r2). once we have the approximation for the continuation value, what do we do? – no loss of accuracy for paths which are not exercised.

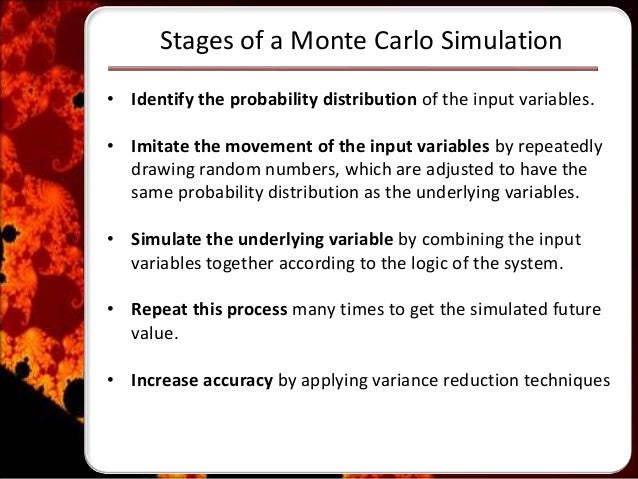

Monte Carlo Methods For Option Pricing Quant Rl Discover how monte carlo simulations enhance option pricing by modeling uncertainty, generating price paths, and estimating fair values in financial analysis. monte carlo simulation is widely used in financial modeling to value options when analytical solutions like black scholes are impractical. Assuming that the number of paths is much greater than the number of basis functions, the main cost is in approximating bψψ with a cost which is o(n r2). once we have the approximation for the continuation value, what do we do? – no loss of accuracy for paths which are not exercised. By simulating these scenarios, monte carlo methods for option pricing can estimate the expected value of an option, taking into account various factors such as volatility, interest rates, and time to expiration. Option price is expressed as an expectation of a random variable representing a payoff. thus we generate sufficiently many asset price paths using random number generators, and evaluate the average of the payoff. in this chapter we introduce efficient ways to apply the monte carlo method. One of the most popular approaches to option pricing is monte carlo simulation (mcs). this method allows for the estimation of option prices by generating multiple random paths for the underlying asset and computing the expected payoff at maturity. Monte carlo simulation offers a flexible and robust approach to option pricing. by simulating a large number of potential future price paths for the underlying asset, it provides a comprehensive view of the possible outcomes, allowing for a more accurate estimation of the option’s fair value.