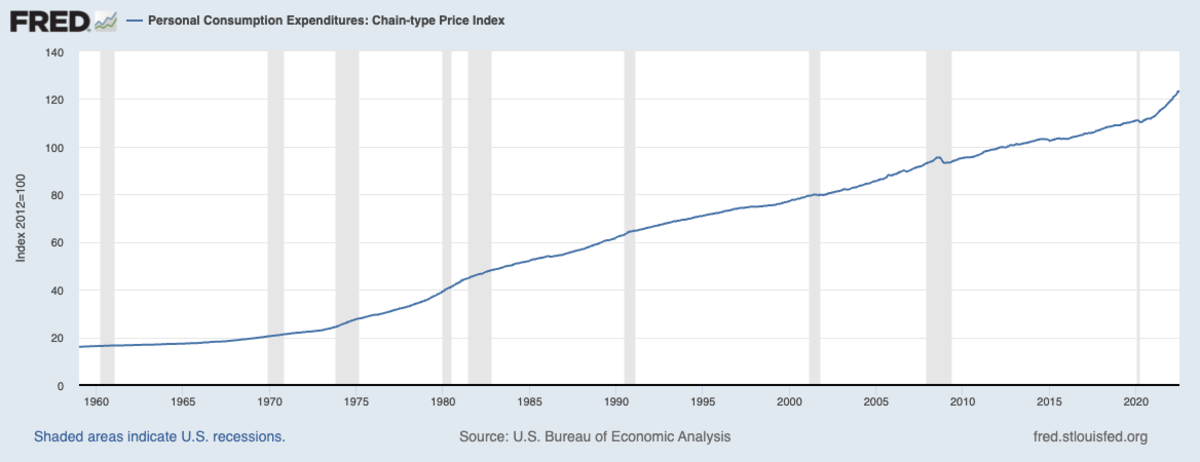

Personal Consumption Expenditures Pce Price Index The personal consumption expenditures price index is a measure of the prices that people living in the united states, or those buying on their behalf, pay for goods and services. the change in the pce price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior. The personal consumption expenditure (pce) measure is the component statistic for consumption in gross domestic product (gdp) collected by the united states bureau of economic analysis (bea). it consists of the actual and imputed expenditures of households and includes data pertaining to durable and non durable goods and services .

Pce Price Index Personal Consumption Expenditures Stock Illustration The personal consumption expenditures price index, commonly known as the pce price index, is one of the main measures of inflation and consumer spending in the u.s. A measure of prices that people living in the united states, or those buying on their behalf, pay for goods and services. it's sometimes called the core pce price index, because two categories that can have price swings – food and energy – are left out to make underlying inflation easier to see. Disposable personal income (dpi)— personal income less personal current taxes—increased $194.3 billion (0.9 percent) and personal consumption expenditures (pce) decreased $30.7 billion (0.2 percent). personal outlays—the sum of pce, personal interest payments, and personal current transfer payments—decreased $52.7 billion in january. Personal consumption expenditures is a measure of consumer spending. pce is constructed and reported by the bureau of economic analysis, along with personal income and the pce price.

What Is The Personal Consumption Expenditures Index Pce Why Is It Disposable personal income (dpi)— personal income less personal current taxes—increased $194.3 billion (0.9 percent) and personal consumption expenditures (pce) decreased $30.7 billion (0.2 percent). personal outlays—the sum of pce, personal interest payments, and personal current transfer payments—decreased $52.7 billion in january. Personal consumption expenditures is a measure of consumer spending. pce is constructed and reported by the bureau of economic analysis, along with personal income and the pce price. Displayed are the 12 month inflation rates of personal consumption expenditure price index (pcepi), core pcepi (this excludes food and energy), and the median inflation rate across personal consumption expenditure categories. Personal consumption expenditures (pce) includes a measure of consumer spending on goods and services among households in the u.s. the pce is used as a mechanism to gauge how much earned income of households is being spent on current consumption for various goods and services. The personal consumption expenditures price index is a measure of the prices that people living in the united states, or those buying on their behalf, pay for goods and services. the change in the pce price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.