Personal Consumption Expenditures Price Index U S Bureau Of Economic The pce price index, released each month in the personal income and outlays report, reflects changes in the prices of goods and services purchased by consumers in the united states. quarterly and annual data are included in the gdp release. Graph and download economic data for personal consumption expenditures: chain type price index (pcepi) from jan 1959 to feb 2025 about chained, headline figure, pce, consumption expenditures, consumption, personal, inflation, price index, indexes, price, and usa.

Price Indexes For Personal Consumption Expenditures U S Bureau Of The pce price index excluding food and energy, also known as the core pce price index, is released as part of the monthly personal income and outlays report. the core index makes it easier to see the underlying inflation trend by excluding two categories – food and energy – where prices tend to swing up and down more dramatically and more. The pce price index less food excluding food and energy is used primarily for macroeconomic analysis and forecasting future values of the pce price index. the pce price index is similar to the bureau of labor statistics' consumer price index for urban consumers. The personal consumption expenditures price index is a measure of the prices that people living in the united states, or those buying on their behalf, pay for goods and services. the change in the pce price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior. To measure inflation across the entire economy, economists produce price indexes to see how overall prices for goods and services are changing. two common price indexes are the consumer price index (cpi) and the personal consumption expenditures (pce) price index.

Personal Consumption Expenditures Price Index Excluding Food And The personal consumption expenditures price index is a measure of the prices that people living in the united states, or those buying on their behalf, pay for goods and services. the change in the pce price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior. To measure inflation across the entire economy, economists produce price indexes to see how overall prices for goods and services are changing. two common price indexes are the consumer price index (cpi) and the personal consumption expenditures (pce) price index. The personal consumption expenditure (pce) measure is the component statistic for consumption in gross domestic product (gdp) collected by the united states bureau of economic analysis (bea). Personal income increased $194.7 billion (0.8 percent at a monthly rate) in february, according to estimates released today by the u.s. bureau of economic analysis. Pce price index in the united states averaged 60.14 points from 1959 until 2025, reaching an all time high of 125.60 points in february of 2025 and a record low of 15.16 points in january of 1959. source: u.s. bureau of economic analysis. Personal income increased $194.7 billion (0.8 percent at a monthly rate) in february, according to estimates released today by the u.s. bureau of economic analysis. disposable personal income (dpi)—personal income less personal current taxes—increased $191.6 billion (0.9 percent) and personal consumption expenditures (pce) increased $87.8 billion (0.4 percent).

U S Personal Consumption Expenditures Pce Price Index Rises 3 In The personal consumption expenditure (pce) measure is the component statistic for consumption in gross domestic product (gdp) collected by the united states bureau of economic analysis (bea). Personal income increased $194.7 billion (0.8 percent at a monthly rate) in february, according to estimates released today by the u.s. bureau of economic analysis. Pce price index in the united states averaged 60.14 points from 1959 until 2025, reaching an all time high of 125.60 points in february of 2025 and a record low of 15.16 points in january of 1959. source: u.s. bureau of economic analysis. Personal income increased $194.7 billion (0.8 percent at a monthly rate) in february, according to estimates released today by the u.s. bureau of economic analysis. disposable personal income (dpi)—personal income less personal current taxes—increased $191.6 billion (0.9 percent) and personal consumption expenditures (pce) increased $87.8 billion (0.4 percent).

Personal Consumption Expenditures Price Index Update Seeking Alpha Pce price index in the united states averaged 60.14 points from 1959 until 2025, reaching an all time high of 125.60 points in february of 2025 and a record low of 15.16 points in january of 1959. source: u.s. bureau of economic analysis. Personal income increased $194.7 billion (0.8 percent at a monthly rate) in february, according to estimates released today by the u.s. bureau of economic analysis. disposable personal income (dpi)—personal income less personal current taxes—increased $191.6 billion (0.9 percent) and personal consumption expenditures (pce) increased $87.8 billion (0.4 percent).

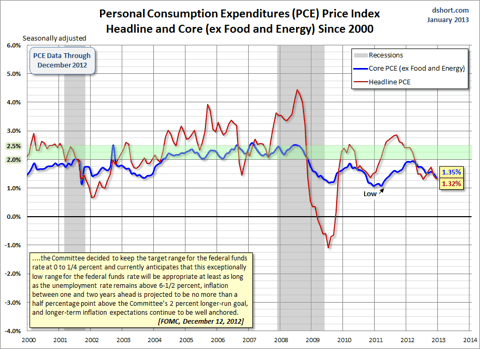

Personal Consumption Expenditures Pce By Bob Brinker