Proof Of Reserves Who Is Still Hiding Something

Crypto Exchanges And Proof Of Reserves How It Protects Investors And Despite the many benefits that proof of reserves audits bring to the cryptocurrency industry, they still have some challenges and shortcomings. in this section, we’ll explore some of these issues. During an audit, the third party auditor obtains proof of reserves by taking an anonymized snapshot of user balances. they are typically calculated by hashing a user’s account balance with their unique id.

Proof Of Reserves Who Is Still Hiding Something Recent proof of reserves reports from kucoin, okx, and others show a new focus on transparency since ftx, but what do these audits really prove?. Enter proof of reserves (por), a method that promises to verify an exchange's holdings without revealing sensitive information. but is it really the silver bullet for trust in the crypto space?. Coinbase, one of the leading cryptocurrency exchanges, has opted not to implement traditional proof of reserves. instead, coinbase’s ceo, brian armstrong, asserts that the company adheres to. These companies appear to have a habit of hiding their reserves or outright lying about them. an exchange may have used your money to prop up its failing trading firm, as happened with ftx.

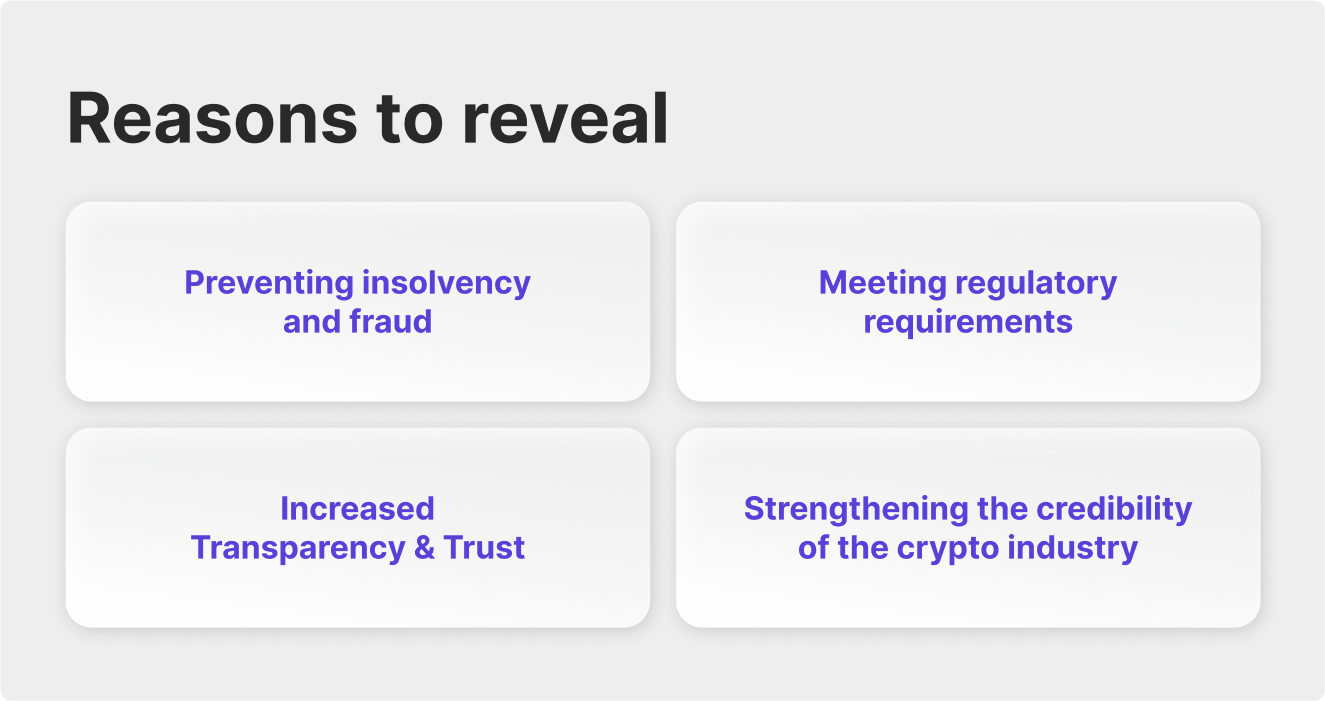

Proof Of Reserves Who Is Still Hiding Something Coinbase, one of the leading cryptocurrency exchanges, has opted not to implement traditional proof of reserves. instead, coinbase’s ceo, brian armstrong, asserts that the company adheres to. These companies appear to have a habit of hiding their reserves or outright lying about them. an exchange may have used your money to prop up its failing trading firm, as happened with ftx. Saylor argues that proof of reserves not only fails to show liabilities, one of the critical pillars of financial solvency, but also exposes firms to ai powered targeting and blockchain surveillance that could jeopardize treasury integrity. “the conventional way of issuing proof of reserves today is actually insecure,” saylor said. “it actually dilutes the security of the issuer, the custodians, the exchanges and the investors. it’s not a good idea, it’s a bad idea.”. In short, por is an effective way to confirm that the exchange isn’t hiding anything. proof of reserves gives you a verifiable way to check an exchange’s solvency. it helps make sure platforms aren’t secretly loaning out more than they own or mismanaging assets behind the scenes. Several players have been quick to propose using the transparency of public blockchains to demonstrate the existence of customers’ assets in an organisation’s custody via a so called «proof of reserves» (por) mechanism to reassure clients and investors that their funds are safe.

Comments are closed.