Pros And Cons Of Home Equity Loans Credello Home equity loans can be beneficial in certain circumstances. take a look at the pros and cons of a home equity loan to see if applying for one makes sense for you. there are other options to consider if you need cash but find that a home equity loan isn’t right for you. Home equity loans generally offer lower interest rates than other loans or credit cards—usually around 8% to 10%. this can make them an attractive option for borrowers, especially those.

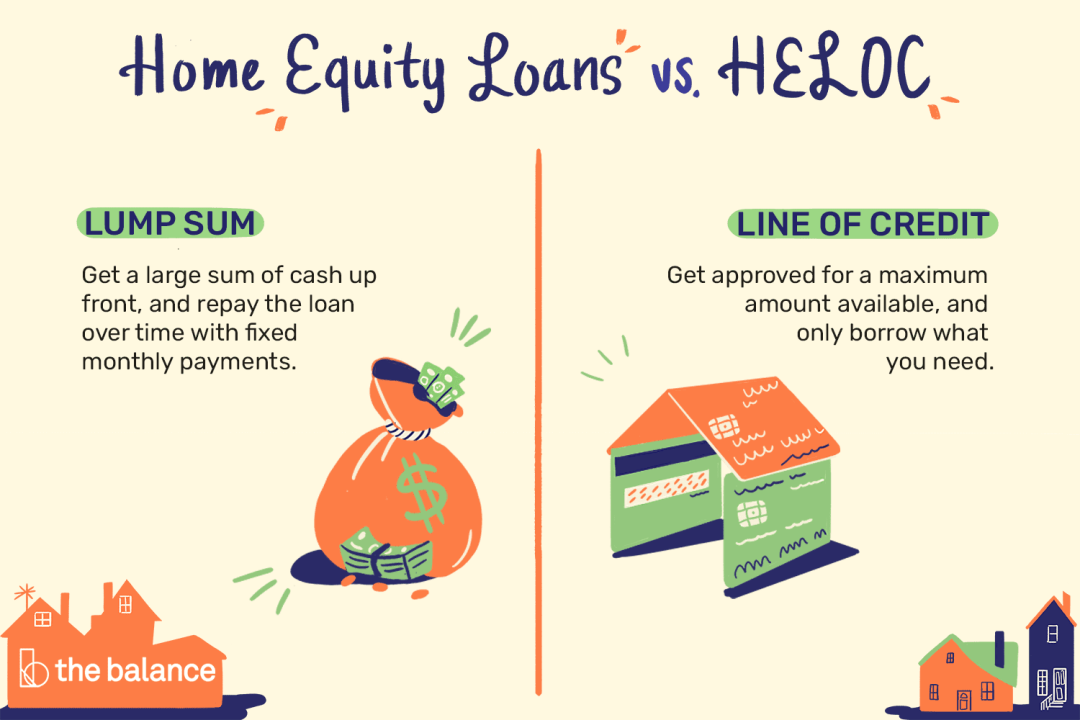

Getting A Home Equity Loan With Bad Credit Credello Find out the differences between home equity loans and helocs, and when you should consider each. is it smart to use a home equity loan to consolidate credit card debt? for homeowners with established equity in their homes, using a home equity loan or home equity. Variable or fixed rates: helocs have a variable interest rate; home equity loans have a fixed rate. ongoing or one time borrowing: helocs allow you to borrow as needed up to your credit. Home equity loans are a bit different – they allow you to borrow against the equity you have in your home. this means you can borrow a more significant amount of money and have a more extended repayment period. personal and home equity loans have pros and cons, so it’s essential to do your research before deciding which option is right for you. Will a home equity loan hurt my credit score? you should expect to see a very small decrease in your credit score from your home equity loan, but this dip will most likely be temporary. how long does it take to process a home equity loan? from application to closing, it can take anywhere from 2 to 4 weeks for a home equity loan to be processed.

Pros And Cons Of Home Equity Loans Home equity loans are a bit different – they allow you to borrow against the equity you have in your home. this means you can borrow a more significant amount of money and have a more extended repayment period. personal and home equity loans have pros and cons, so it’s essential to do your research before deciding which option is right for you. Will a home equity loan hurt my credit score? you should expect to see a very small decrease in your credit score from your home equity loan, but this dip will most likely be temporary. how long does it take to process a home equity loan? from application to closing, it can take anywhere from 2 to 4 weeks for a home equity loan to be processed. However, there are some pros and cons to using a home equity loan to pay off debt. if you're considering a home equity loan vs. a personal loan for debt consolidation , here are a few things you. Home equity loans let homeowners borrow a lump sum against their home’s equity—often at lower interest rates than unsecured loans. with predictable payments, they’re ideal for significant expenses, such as renovations, debt consolidation, or even medical expenses. A home equity loan, on the other hand, gives you a lump sum upfront with a fixed interest rate, usually over a 15 to 30 year term, making it more predictable, but less flexible then there’s. The right knowledge about this potential loan option can help you make the ideal decision for your situation. let’s review some of the pros and cons of a home equity loan. 8 pros of a home equity loan. there are many benefits of obtaining a home equity loan if you’re interested in using the funding to do home improvement projects.

Personal Loan Vs Home Equity Loan Credello However, there are some pros and cons to using a home equity loan to pay off debt. if you're considering a home equity loan vs. a personal loan for debt consolidation , here are a few things you. Home equity loans let homeowners borrow a lump sum against their home’s equity—often at lower interest rates than unsecured loans. with predictable payments, they’re ideal for significant expenses, such as renovations, debt consolidation, or even medical expenses. A home equity loan, on the other hand, gives you a lump sum upfront with a fixed interest rate, usually over a 15 to 30 year term, making it more predictable, but less flexible then there’s. The right knowledge about this potential loan option can help you make the ideal decision for your situation. let’s review some of the pros and cons of a home equity loan. 8 pros of a home equity loan. there are many benefits of obtaining a home equity loan if you’re interested in using the funding to do home improvement projects.

Pros And Cons Of Home Equity Loans Abcboyama A home equity loan, on the other hand, gives you a lump sum upfront with a fixed interest rate, usually over a 15 to 30 year term, making it more predictable, but less flexible then there’s. The right knowledge about this potential loan option can help you make the ideal decision for your situation. let’s review some of the pros and cons of a home equity loan. 8 pros of a home equity loan. there are many benefits of obtaining a home equity loan if you’re interested in using the funding to do home improvement projects.

Home Equity Loans Pros And Cons Prosper