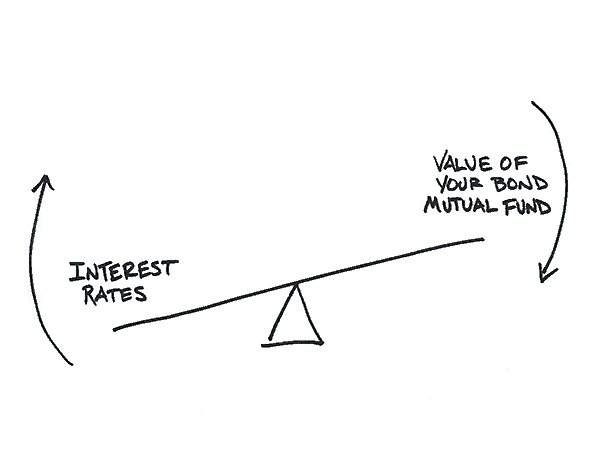

Bond Prices And Interest Rates Have An Inverse Relationship Bonds have an inverse relationship to interest rates. when interest rates rise, bond prices usually fall, and vice versa. to those unfamiliar with bond trading, the negative correlation. Bond prices and bond yields are always at risk of fluctuating in value, especially in periods of rising or falling interest rates. let's discuss the relationship between bond prices and.

Relationship Between Bond Prices And Interest Rates Not only can the inverse relationship between interest rates and bond prices affect individual investors, but it can also affect financial institutions as they struggle with a rapidly changing bond market. Understanding the relationship between interest rates and bonds is crucial for investors and individuals planning for their financial future. when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with higher yields. Bond prices and interest rates have an inverse relationship. when interest rates rise, newly issued bonds offer higher yields, making existing lower yielding bonds less attractive, which. Investment professionals rely on duration because it rolls up several bond characteristics (such as maturity date, coupon payments, etc.) into a single number that gives a good indication of how sensitive a bond's price is to interest rate changes.

Understanding The Relationship Between Bond Prices And Interest Rates Bond prices and interest rates have an inverse relationship. when interest rates rise, newly issued bonds offer higher yields, making existing lower yielding bonds less attractive, which. Investment professionals rely on duration because it rolls up several bond characteristics (such as maturity date, coupon payments, etc.) into a single number that gives a good indication of how sensitive a bond's price is to interest rate changes. To understand the differences between bond price vs interest rate, bond price is the amount that an investor pays to buy a bond. if you purchase a bond directly from an issuer, the face value and the price of the bond are the same. however, if you buy a bond through another investor, the bond price might differ from the face value. Interest rates and bond prices fluctuate in direct opposition to one another and have a direct impact on one another. bond prices decline as market interest rates rise, and they increase when market interest rates decline (increase). Learn how the bond market influences your investments. discover the relationship between bonds, yields, interest rates, and stock prices in this easy to understand guide for new investors. Discover how interest rates directly impact the bond market. learn about the inverse relationship between interest rates and bond prices, and how this affects.