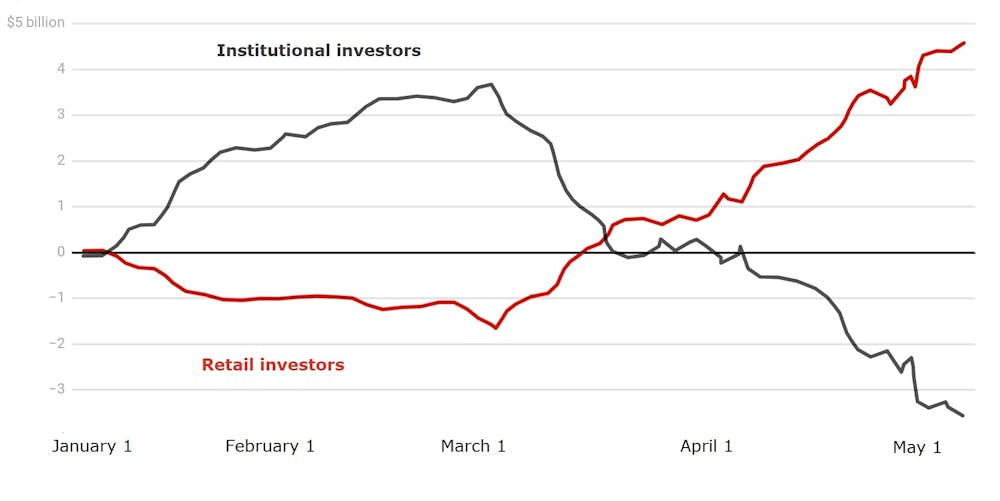

Retail Investors Are Buying While Professionals Are Selling Our analysis shows that from the start of the year to march 3 retail investors were net sellers, offloading about a$1.64 billion in stock. between march 3 and may 8 they became net buyers of stock, accumulating a$6.29 billion in stock. Between march 23 (when the stock market started rising) and may 2, retail investors were net buyers of a$3.57 billion. at the same time the “professional” institutional investors – including super funds – were net sellers of $3.27 billion.

Retail Investors Retail Investors Statistics Retail Investor Market Between 23 march (when the stock market started rising) and 2 may, retail investors were net buyers of $3.57 billion. at the same time the “professional” institutional investors – including super funds – were net sellers of $3.27 billion. That’s because institutional investors over the past 12 months have poured significantly more money into u.s. equity funds than retail investors have taken out. institutions have a. Retail investors bought $4.7 billion in stocks on thursday, the highest level over the past decade, jpmorgan said in a note on friday. Retail investors have been remarkably active in the stock market lately, according to a team of strategists at j.p. morgan. the vaunted magnificent seven tech stocks have struggled as a group.

Selling To Retail Buyers Retail Mba Retail investors bought $4.7 billion in stocks on thursday, the highest level over the past decade, jpmorgan said in a note on friday. Retail investors have been remarkably active in the stock market lately, according to a team of strategists at j.p. morgan. the vaunted magnificent seven tech stocks have struggled as a group. Retail investors were aggressive net sellers on monday following the sharp equities pullback, with most of the selling occurring in the first hour of trading, jpmorgan strategists noted. An unexpectedly large group of retail investors have been pushing their weight around on wall street, keeping at bay a buy the dip moment that bigger investors have been salivating for. What's happening: the contrast between professional and amateur investors could not be more stark. as the pros sold out of risky assets like stocks and oil and even safe havens like gold and treasury bonds, amateur traders were "maintaining a long term perspective despite the market turmoil," vanguard said. U.s. retail investors are growing increasingly uneasy about a plummet in the stock market, asking for more investment advice, questioning whether to buy the dip and looking for safer havens,.

Retail Selling Retail investors were aggressive net sellers on monday following the sharp equities pullback, with most of the selling occurring in the first hour of trading, jpmorgan strategists noted. An unexpectedly large group of retail investors have been pushing their weight around on wall street, keeping at bay a buy the dip moment that bigger investors have been salivating for. What's happening: the contrast between professional and amateur investors could not be more stark. as the pros sold out of risky assets like stocks and oil and even safe havens like gold and treasury bonds, amateur traders were "maintaining a long term perspective despite the market turmoil," vanguard said. U.s. retail investors are growing increasingly uneasy about a plummet in the stock market, asking for more investment advice, questioning whether to buy the dip and looking for safer havens,.