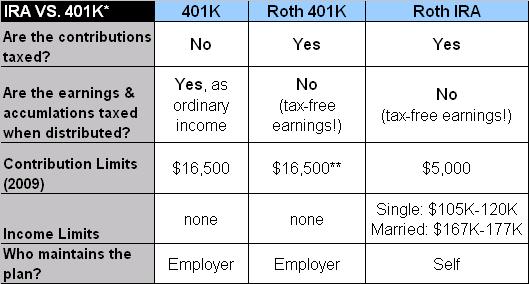

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club There is no one size fits all answer as to which is better, a roth 401 (k) or a roth individual retirement account (ira). it all depends on your unique financial profile: how old you. A roth ira is an account that allows you to save a certain amount each year for retirement. but what makes a roth ira one of the best retirement savings options is that it includes tax free growth and tax free withdrawals once you retire. a 401(k) is a retirement savings plan that’s sponsored by an employer.

Roth 401 K Vs Roth Ira Which Is Best For You The Motley Fool Roth 401 (k)s and roth iras let you save and invest dollars you've already paid taxes on and potentially make tax free withdrawals (including any investment earnings) once you're 59½ or older. Each has its pros and cons, but i must admit that i prefer a roth ira over a 401 (k) because of three key benefits: tax free withdrawals in retirement, tons of investment options, and early. However, if you prefer to be more hands on and tailor a retirement account to fit your goals and risk tolerance better, the options of a roth ira are right up your alley. ideally, any money you. Higher contribution limits: the roth 401 (k) allows for more significant deferral limits than a roth ira, meaning you can significantly boost your retirement savings annually. this is especially beneficial for those looking to maximize their retirement plans within an employer sponsored one.

Roth 401 K Vs Roth Ira What S The Difference However, if you prefer to be more hands on and tailor a retirement account to fit your goals and risk tolerance better, the options of a roth ira are right up your alley. ideally, any money you. Higher contribution limits: the roth 401 (k) allows for more significant deferral limits than a roth ira, meaning you can significantly boost your retirement savings annually. this is especially beneficial for those looking to maximize their retirement plans within an employer sponsored one. Though roth 401 (k)s and roth iras sound similar, these plans differ in several important ways. which one is the right fit for you depends on your employer, financial goals, and annual. There are two major types of roth accounts: the roth 401 (k) and the roth ira. these two accounts have some key similarities, including their tax advantages. however, they also differ when it comes to their contribution limits, investment options, withdrawal rules, and more. Understanding your retirement savings options is crucial for financial security. a roth ira is a distinctly structured retirement account that allows individuals to contribute post tax income, resulting in tax free withdrawals during retirement. Roth ira vs. 401(k): gainbridge® breaks down tax benefits, limits, and withdrawals to help you choose the right retirement savings plan for your goals. roth ira vs. traditional 401(k): 10 key differences. below is a quick overview of the differences between these accounts as well as an elaboration on each difference. we’ve focused on.

Roth Ira Vs Roth 401k Choose The Best Investluck Though roth 401 (k)s and roth iras sound similar, these plans differ in several important ways. which one is the right fit for you depends on your employer, financial goals, and annual. There are two major types of roth accounts: the roth 401 (k) and the roth ira. these two accounts have some key similarities, including their tax advantages. however, they also differ when it comes to their contribution limits, investment options, withdrawal rules, and more. Understanding your retirement savings options is crucial for financial security. a roth ira is a distinctly structured retirement account that allows individuals to contribute post tax income, resulting in tax free withdrawals during retirement. Roth ira vs. 401(k): gainbridge® breaks down tax benefits, limits, and withdrawals to help you choose the right retirement savings plan for your goals. roth ira vs. traditional 401(k): 10 key differences. below is a quick overview of the differences between these accounts as well as an elaboration on each difference. we’ve focused on.

Where Should I Put My Retirement Money Roth 401k Vs Roth Ira Vs 401k Understanding your retirement savings options is crucial for financial security. a roth ira is a distinctly structured retirement account that allows individuals to contribute post tax income, resulting in tax free withdrawals during retirement. Roth ira vs. 401(k): gainbridge® breaks down tax benefits, limits, and withdrawals to help you choose the right retirement savings plan for your goals. roth ira vs. traditional 401(k): 10 key differences. below is a quick overview of the differences between these accounts as well as an elaboration on each difference. we’ve focused on.