Schedule E Worksheet Simplify Your Tax Reporting Process

Schedule E Worksheet Pdf Master the schedule e worksheet to accurately report various income types and deductions, ensuring compliance and optimizing your tax strategy. understanding how to use the schedule e worksheet is essential for accurately reporting income from various sources on your tax return. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. you can attach your own schedule(s) to report income or loss from any of these sources. use the same format as on schedule e.

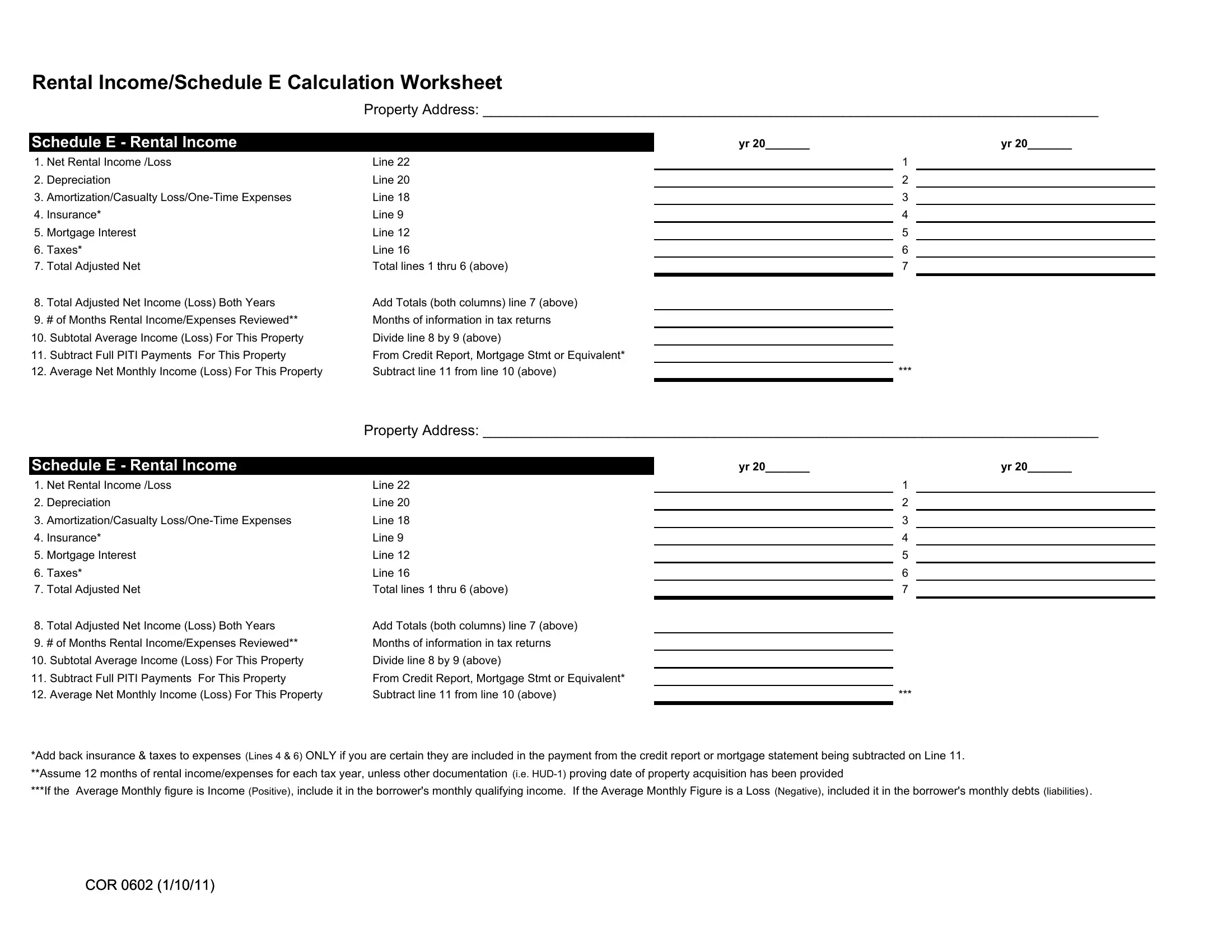

Schedule E Calculation Worksheet Pdf Form Formspal Discover how to streamline your tax reporting process with our comprehensive schedule e worksheet. learn how to organize rental income, expenses, and deductions efficiently to maximize your tax benefits. Simplify the preparation of schedule e (supplemental income and loss) for irs form 1040 with this dedicated template. designed for use with google sheets and excel, it helps landlords and real estate investors accurately report rental income and expenses. Learn how to file form 1040 schedule e with our detailed, step by step guide. optimize your supplemental income reporting and maximize deductions. Filling out form 1040: schedule e can seem daunting, but with the right guidance, it becomes manageable. this blog post will walk you through the process step by step, ensuring you understand how to report supplemental income or loss effectively.

Fillable Online Schedule E Worksheets Snyder Tax Service Fax Email Learn how to file form 1040 schedule e with our detailed, step by step guide. optimize your supplemental income reporting and maximize deductions. Filling out form 1040: schedule e can seem daunting, but with the right guidance, it becomes manageable. this blog post will walk you through the process step by step, ensuring you understand how to report supplemental income or loss effectively. This guide will explain what schedule e is, how to file it, and give line by line instructions to help you complete the form accurately. irs schedule e, titled “supplemental income and loss,” is a tax form attached to form 1040, 1040 sr, or 1040 nr. Master the schedule e worksheet to accurately report various income types and deductions, ensuring compliance and optimizing your tax strategy. use the rental unit expenses column to show expenses that pertain only to the rental portion of the property. This article deep dives into the key landlord tax form, the schedule e and shows you how you can leverage software like landlord studio to simplify your tax preparation and complete your schedule e form. What is a schedule e form? a schedule e form, officially known as form 1040 schedule e, is a supplemental tax form used by taxpayers to report their supplemental income or loss. it's most commonly associated with rental property income, but it covers more ground.

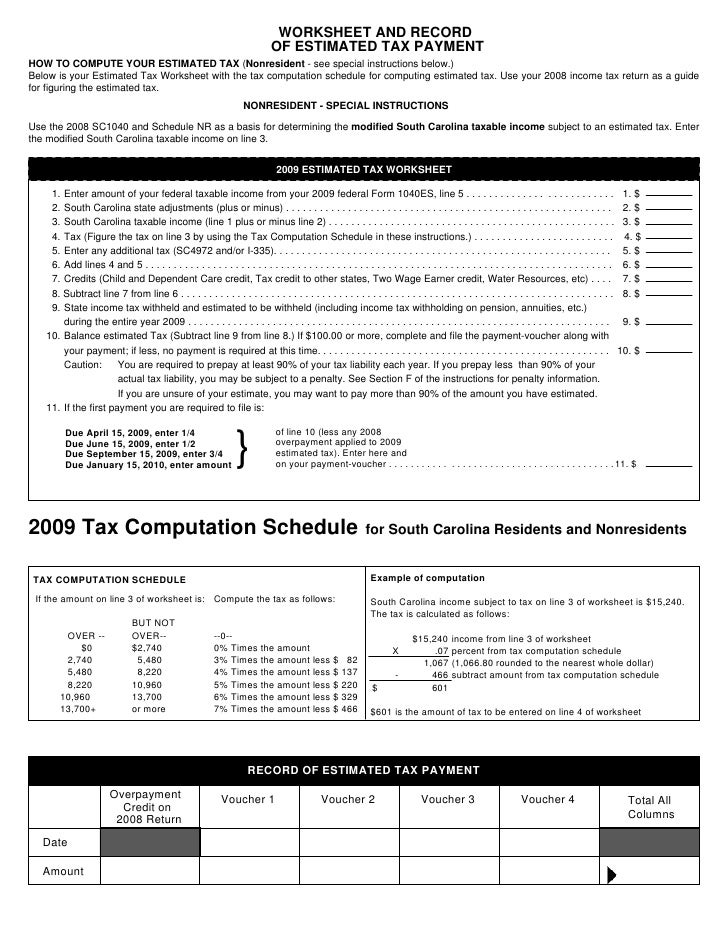

2014 Estimated Tax Worksheet The Best Worksheets Image Collection This guide will explain what schedule e is, how to file it, and give line by line instructions to help you complete the form accurately. irs schedule e, titled “supplemental income and loss,” is a tax form attached to form 1040, 1040 sr, or 1040 nr. Master the schedule e worksheet to accurately report various income types and deductions, ensuring compliance and optimizing your tax strategy. use the rental unit expenses column to show expenses that pertain only to the rental portion of the property. This article deep dives into the key landlord tax form, the schedule e and shows you how you can leverage software like landlord studio to simplify your tax preparation and complete your schedule e form. What is a schedule e form? a schedule e form, officially known as form 1040 schedule e, is a supplemental tax form used by taxpayers to report their supplemental income or loss. it's most commonly associated with rental property income, but it covers more ground.

Comments are closed.