National Insurance For The Self Employed Explained Crestplus Class 2 contributions are treated as having been paid to protect your national insurance record. this means you do not have to pay class 2 contributions. if your profits are more. Class 2 ni are flat rate weekly payments made by most self employed individuals between 16 and the state pension age. these contributions entitle individuals to certain state benefits.

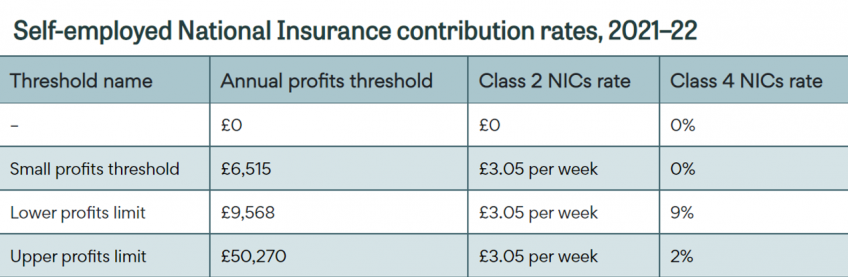

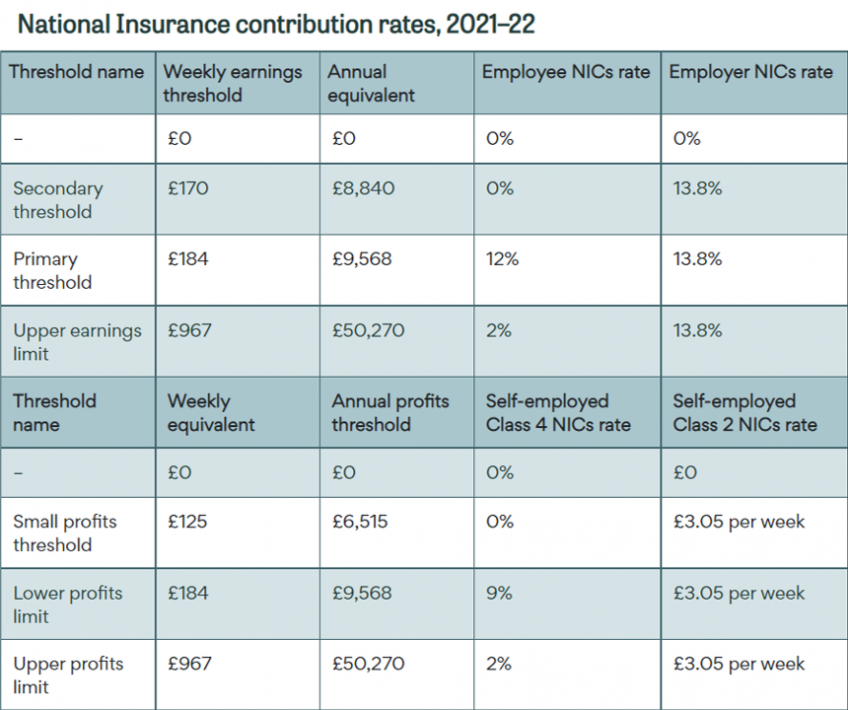

National Insurance Contributions Explained Ifs Taxlab As of april 2024, self employed people are no longer required to pay class 2 national insurance. if your profits are more than £6,725 a year, class 2 contributions are treated as having been paid to protect your national insurance record. If you're self employed, recent changes to national insurance contributions (nic) could impact how much you pay. for tax years before 2023, higher rates applied to both class 2 and class 4 nics. Learn about key 2024 national insurance changes for the self employed, including the abolition of class 2 nics and reduced class 4 rates. Class 2 national insurance contributions are paid by self employed individuals to qualify for certain state benefits, including the state pension, maternity allowance, and employment and support allowance. these contributions are fixed and are not based on your earnings.

National Insurance Contributions Explained Ifs Taxlab Learn about key 2024 national insurance changes for the self employed, including the abolition of class 2 nics and reduced class 4 rates. Class 2 national insurance contributions are paid by self employed individuals to qualify for certain state benefits, including the state pension, maternity allowance, and employment and support allowance. these contributions are fixed and are not based on your earnings. Self employed? read our in depth guide on class 2 national insurance contributions to learn about eligibility, payment methods, contributions and more. Class 2 national insurance contributionsfrom 6 april 2024, self employed individuals earning more than the small profit threshold will no longer need to pay class 2 nic but can still access contributory state benefits, including the state pension; those with profits below the small profit threshold of £6,845 can opt to voluntarily pay class 2. Class 2 national insurance contributions (nics) are payable by some self employed individuals. starting from the tax year 2022 23 self employed individuals will only be required to pay class 2 nic if their profits exceed the lower profits limit. Class 2 nics are paid by all self employed taxpayers unless they earn under the small profits threshold (spt), currently £6,725, which remove the necessity to pay nics. class 2 nics are currently payable at a flat weekly rate of £3.45 for the 2023 24 tax year.