Solved A Company Manufactures And Sells Three Products The Chegg

Solved A Company Manufactures And Sells Three Products The Chegg Question: a company manufactures and sells three products. the products are all manufactured at the same facility. the controller of the company has decided to accumulate all budgeted overhead costs for the manufacturing facility into a single cost pool. The controller of the company has decided to accumulate all budgeted overhead costs for the manufacturing facility into a single cost pool. the cost pool is then allocated to the three products based on the direct labor hours used by each product.

Solved A Company Manufactures And Sells Three Products And Chegg For each of the three products (a, b, and c), calculate the differential benefit (loss) from processing the product after the split off point rather than selling the product at the split off point. Prescott corp, manufactures computer desks in its buffalo, new york, plant. the company uses activity based costing to allocate all manufacturing conversion costs (direct labor and manufacturing overhead). The highstep shoe company operates a chain of shoe stores that sell 10 different styles of inexpensive men's shoes with identical unit costs and selling prices. Colby company produces three products: product a, product b, and product c. data concerning these three products follow (per unit): 10 11 12 13 14 15 16 17 18 19 20 21 22 demand for the company's products is very strong, with far more orders each month than the company can produce with the available raw materials.

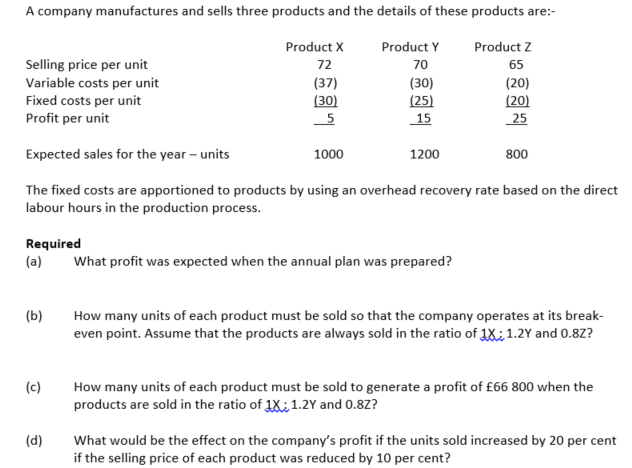

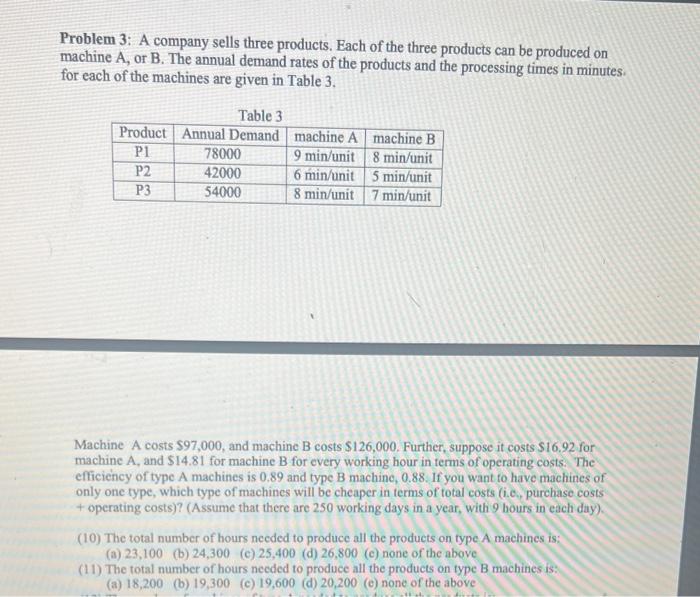

Solved Problem 3 A Company Sells Three Products Each Of Chegg The highstep shoe company operates a chain of shoe stores that sell 10 different styles of inexpensive men's shoes with identical unit costs and selling prices. Colby company produces three products: product a, product b, and product c. data concerning these three products follow (per unit): 10 11 12 13 14 15 16 17 18 19 20 21 22 demand for the company's products is very strong, with far more orders each month than the company can produce with the available raw materials. Factory overheads are the costs or expenses incurred in manufacturing the product excluding direct materials and direct labor. so, it includes the cost of indir …. Our expert help has broken down your problem into an easy to learn solution you can count on. here’s the best way to solve it. (a) product x product y product z total sales ($72 * 1000) =$72000 ($70 * 1200) =$84000 ($65 * 800) =$52000 $208000 …. Cynthia gao, procurement manager for wedlock engineered products in buffalo, new york, was reviewing a proposal recommending that the company change suppliers for a critical raw material. Owen comp. manufactures computer desks in its buffalo, new york, plant. the company uses activity based costing to allocate all manufacturing conversion costs (direct labor and manufacturing overhead).

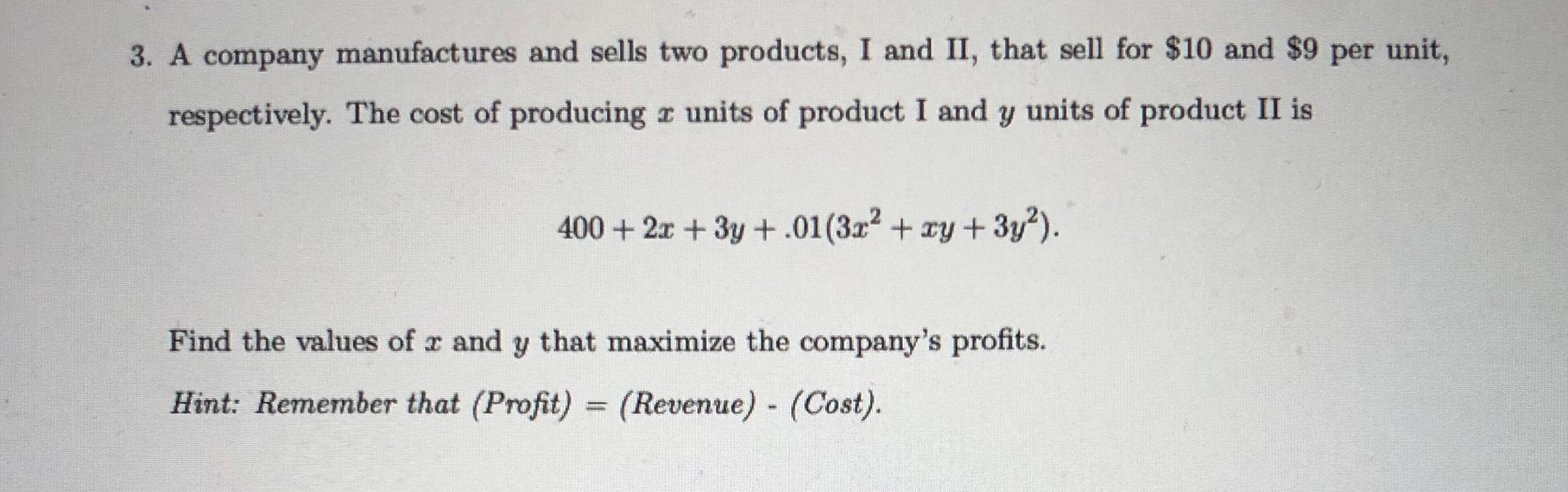

Solved 3 A Company Manufactures And Sells Two Products I Chegg Factory overheads are the costs or expenses incurred in manufacturing the product excluding direct materials and direct labor. so, it includes the cost of indir …. Our expert help has broken down your problem into an easy to learn solution you can count on. here’s the best way to solve it. (a) product x product y product z total sales ($72 * 1000) =$72000 ($70 * 1200) =$84000 ($65 * 800) =$52000 $208000 …. Cynthia gao, procurement manager for wedlock engineered products in buffalo, new york, was reviewing a proposal recommending that the company change suppliers for a critical raw material. Owen comp. manufactures computer desks in its buffalo, new york, plant. the company uses activity based costing to allocate all manufacturing conversion costs (direct labor and manufacturing overhead).

Solved Problem 3 A Company Sells Three Products Each Of Chegg Cynthia gao, procurement manager for wedlock engineered products in buffalo, new york, was reviewing a proposal recommending that the company change suppliers for a critical raw material. Owen comp. manufactures computer desks in its buffalo, new york, plant. the company uses activity based costing to allocate all manufacturing conversion costs (direct labor and manufacturing overhead).

Comments are closed.