Solved A Portfolio Manager Wants To Estimate The Interest Chegg

Solved A Portfolio Manager Wants To Estimate The Interest Chegg Use the estimates above to determine the change in this portfolio value if interest rates decrease by 50 basis points. here’s the best way to solve it. this ai generated tip is based on chegg's full solution. sign up to see more!. Estimate the change in the market value of the bond portfolio for a parallel shift in interest rates of 250 basis points. comment on this duration based estimate of the market value change.

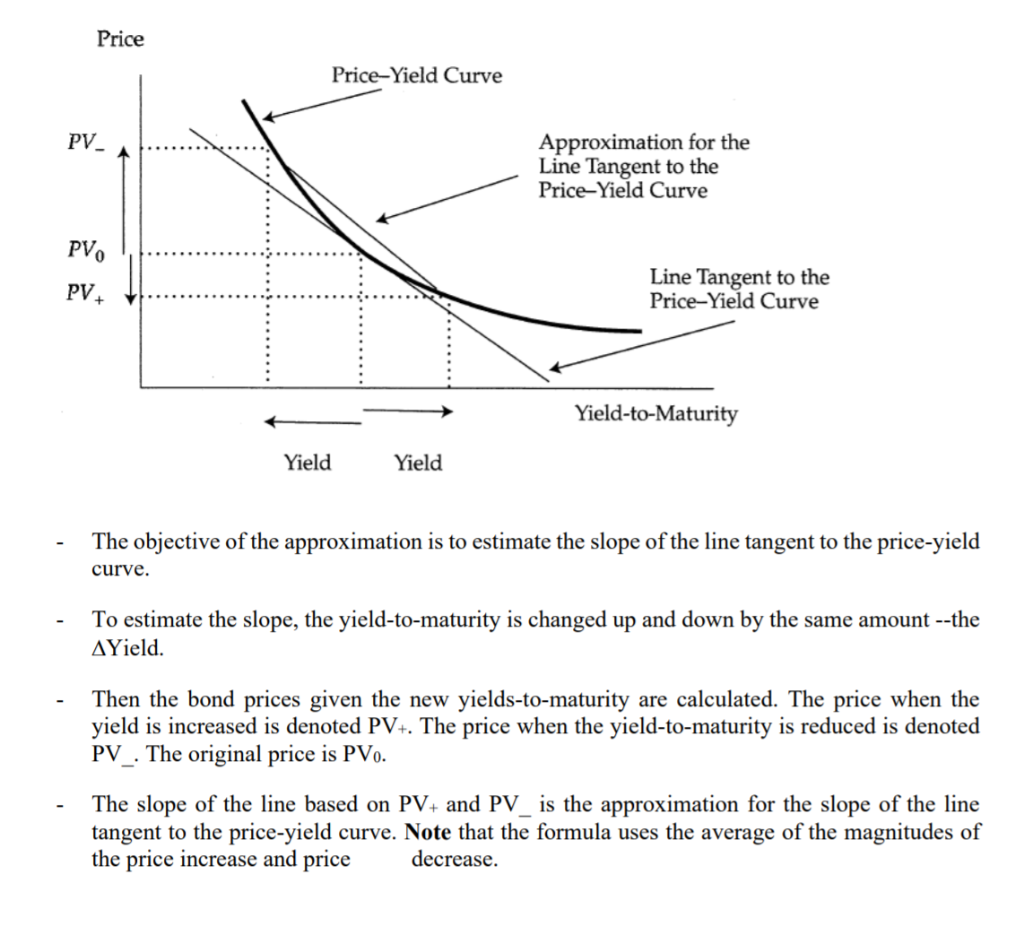

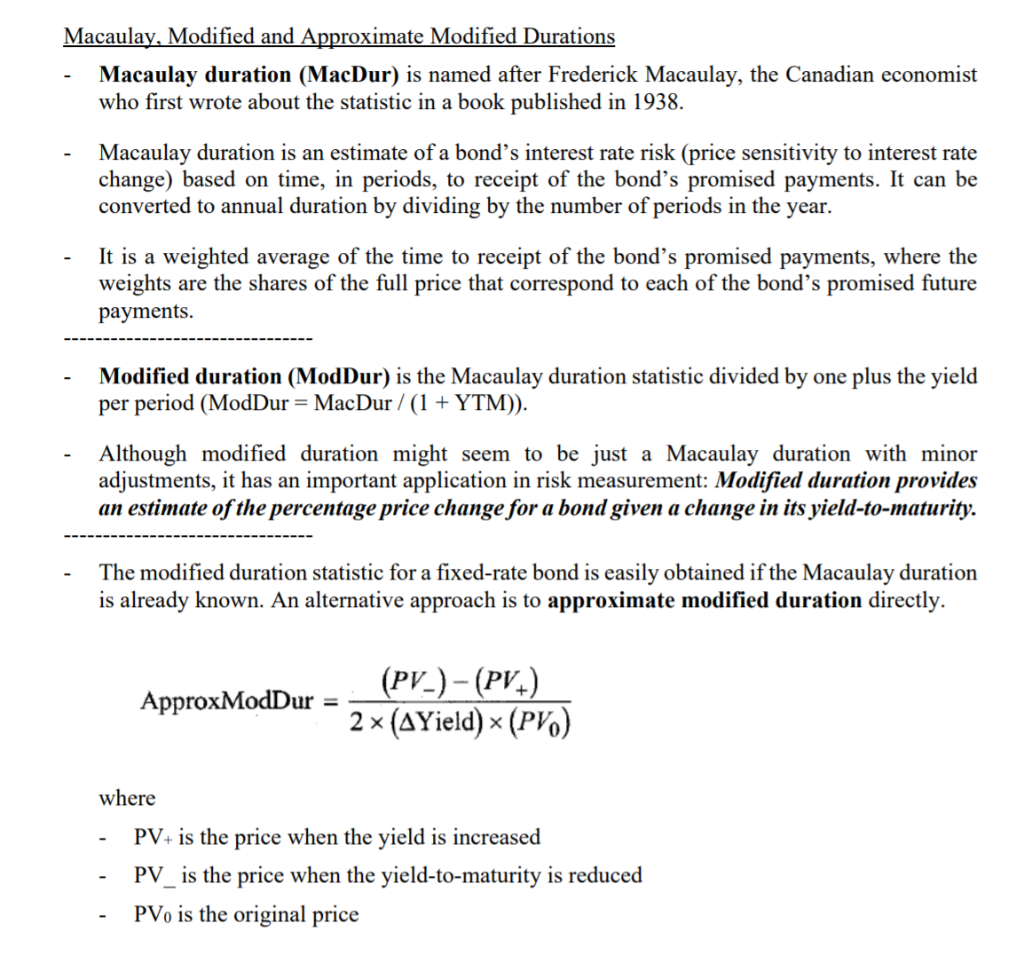

Solved A Portfolio Manager Wants To Estimate The Interest Chegg A valuation model found that if interest rate decline by 30 basis points the price will be 83.5 and if rates increase by 30 basis points the price will decline to 80.75. We don't know the yield to maturity, but we can assume it is constant for small changes in interest rates. so, we can use the midpoint of the two prices (pv and pv ) as an estimate for the current price at the new yield level. To estimate the effective duration of the bond, we need to calculate the percentage change in price for a given change in interest rates. A bond manager wants to calculate the duration of a bond currently priced at $82 using changes in price from 30 basis point decreases and increases in interest rates. the model shows the price would increase to $83.50 with a lower rate and decrease to $80.75 with a higher rate.

Solved Suppose A Portfolio Manager Wants To Estimate The Chegg To estimate the effective duration of the bond, we need to calculate the percentage change in price for a given change in interest rates. A bond manager wants to calculate the duration of a bond currently priced at $82 using changes in price from 30 basis point decreases and increases in interest rates. the model shows the price would increase to $83.50 with a lower rate and decrease to $80.75 with a higher rate. Our expert help has broken down your problem into an easy to learn solution you can count on. question: a portfolio manager wants to estimate the interest rate risk of a bond using duration. the current price of the bond is 82. Julie is a portfolio manager at know better plc. she wants to estimate the interest rate risk of assets of the company consisting of 1 million sharesof bond a, 2 million shares of bond b, and 2 million shares of bond c. To use the portfolio's duration as an estimate of interest rate risk, it is assumed that when interest rates change, the interest rate for all maturities change by the same number of basis points. A portfolio manager uses her valuation model to estimate the value of a bond as 125.482. using the same model, she estimates that the value would increase to 127.723 if interest rates fell 30 bps and would decrease to 122.164 if interest rates rose.

Solved An Asset Manager Wants To Hedge A Portfolio Of Shares Chegg Our expert help has broken down your problem into an easy to learn solution you can count on. question: a portfolio manager wants to estimate the interest rate risk of a bond using duration. the current price of the bond is 82. Julie is a portfolio manager at know better plc. she wants to estimate the interest rate risk of assets of the company consisting of 1 million sharesof bond a, 2 million shares of bond b, and 2 million shares of bond c. To use the portfolio's duration as an estimate of interest rate risk, it is assumed that when interest rates change, the interest rate for all maturities change by the same number of basis points. A portfolio manager uses her valuation model to estimate the value of a bond as 125.482. using the same model, she estimates that the value would increase to 127.723 if interest rates fell 30 bps and would decrease to 122.164 if interest rates rose.

Comments are closed.