Solved Given The Valuation Measures For Company X And Chegg

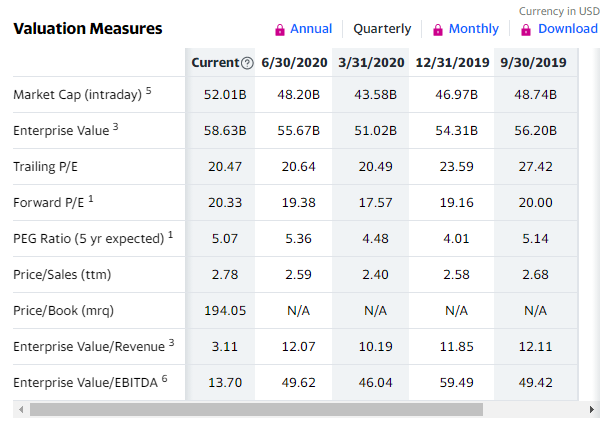

Solved Given The Valuation Measures For Company X And Chegg Question: given the valuation measures for company x and company y: say a few good things about each company. (i.e. pick a few measures for each company and explain why how their values are good for the company, or maybe why how it is a bad thing). An analyst tells you that he uses price earnings multiples, rather than discounted cash flow valuation, to value stocks, because he does not like making assumptions about fundamentals growth, risk, and payout ratios.

Solved If The Total Valuation Of A Company Today Is 50m Chegg What should be the value of the stock if its earnings and dividends are growing annually at 5 percent? the required rate of return is k = rf (rm rf)beta = .07 (.13 .07)1.3 = .148 = 14.8% thus, the valuation is v = $1(1 .05) = $10.71 .148 .05. Prior to the split, the company had a market value of $10 billion with 120 million shares outstanding. assuming that the split conveys no new information about the company, what is the value of the company, the number of shares outstanding, and price per share after the split?. Suppose you purchased one of these bonds at par value ($1,000) when it was issued. right after your purchase, market interest rates jumped, and the ytm (interest rate) on your bond rose to six percent. Value investors look at the difference between a company's market capitalization and its going concern value to determine whether the company's stock is currently a good buy.

Solved 3 Stocks And Their Valuation Corporate Valuation Chegg Suppose you purchased one of these bonds at par value ($1,000) when it was issued. right after your purchase, market interest rates jumped, and the ytm (interest rate) on your bond rose to six percent. Value investors look at the difference between a company's market capitalization and its going concern value to determine whether the company's stock is currently a good buy. Market multiple analysis is also used to calculate the value of a company, which is further used to calculate the intrinsic value per share of the firm.suppose you have the information given in the following table for company x. There are 3 steps to solve this one. the cost of equity (k e) is the amount a firm should pay to its equity investors not the question you’re looking for? post any question and get expert help quickly. Our expert help has broken down your problem into an easy to learn solution you can count on. question: company x acquires an asset for which it measures the market value discounting the future cash flows of the asset. which of the following responses best describes this approach to fair value?. Question: given the following information for company x and company y: say a few good things about each company. (i.e. pick a few measures for each company and explain why how their values are good for the company).

Comments are closed.