Solved Inflation And Interest Rates Assume The Expected Chegg

Solved Inflation And Interest Rates Assume The Expected Chegg Our expert help has broken down your problem into an easy to learn solution you can count on. question: (inflation and interest rates) assume the expected inflation rate is3.6percent. if the current real rate of interest is6.6 percent, what should the nominal rate of interest be?. Suppose that the inflation rate increases and the federal reserve responds by taking actions to raise the short term nominal interest rate. which of the following best describes the impact of the fed's actions on the money market graph?.

Solved Inflation And Interest Rates Assume The Expected Chegg If investors in early 1981 expected the inflation rate for every future year to be 10% (i.e., it = it 1 = 10% for t = 1 to ∞), what would the yield curve have looked like?. Expected inflation and interest rates when the actual and expected (or anticipated) inflation rates are both zero, the nominal interest rate must equal the real interest rate. how might inflation affect the nominal interest rate? the nominal interest rate is determined by the forces of supply and demand in the loanable funds market (in millions of dollars). the following graph input tool shows. Video answer: we're given a nominal interest rate of 6 percent and then we're told that the rate of inflation is 3.8. we have to find the real interest rates to answer the question. If we observe a risk free nominal interest rate of 5% per year and a risk free real rate of 1.5% on inflation indexed bonds, can we infer that the market's expected rate of inflation is 3.5% per year?.

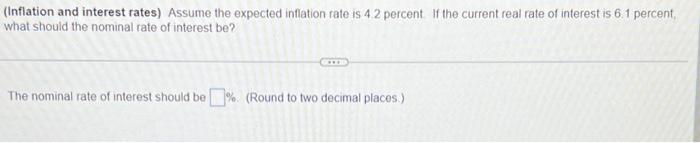

Solved Inflation And Interest Rates Assume The Expected Chegg Video answer: we're given a nominal interest rate of 6 percent and then we're told that the rate of inflation is 3.8. we have to find the real interest rates to answer the question. If we observe a risk free nominal interest rate of 5% per year and a risk free real rate of 1.5% on inflation indexed bonds, can we infer that the market's expected rate of inflation is 3.5% per year?. (inflation and interest rates) assume the expected inflation rate is 3.8 percent. if the current real rate of interest is 6.5 percent, what should the nominal rate of interest be? the nominal rate of interest should be %. (round to two decimal places.) your solution’s ready to go!. Assume that the expected rate of inflation is a function of past year's inflation. also assume that the unemployment rate has greater than the natural rate of unemployment for a number of years. based on this information, what can we conclude?. Our expert help has broken down your problem into an easy to learn solution you can count on. question: (inflation and interest rates) assume the expected inflation rate to be 4.2%. if the current real rate of interest is 6.1%, what is the nominal rate of interest?the nominal rate of interest is%. (round to two decimal places.). Solved: inflation and interest rates: assume the expected inflation rate to be 3.5%. if the current real rate of interest is 6.1%, what is the nominal rate of interest?.

Comments are closed.