Solved Inflation And Money A I End Of Chapter Problemthe Cpi Chegg

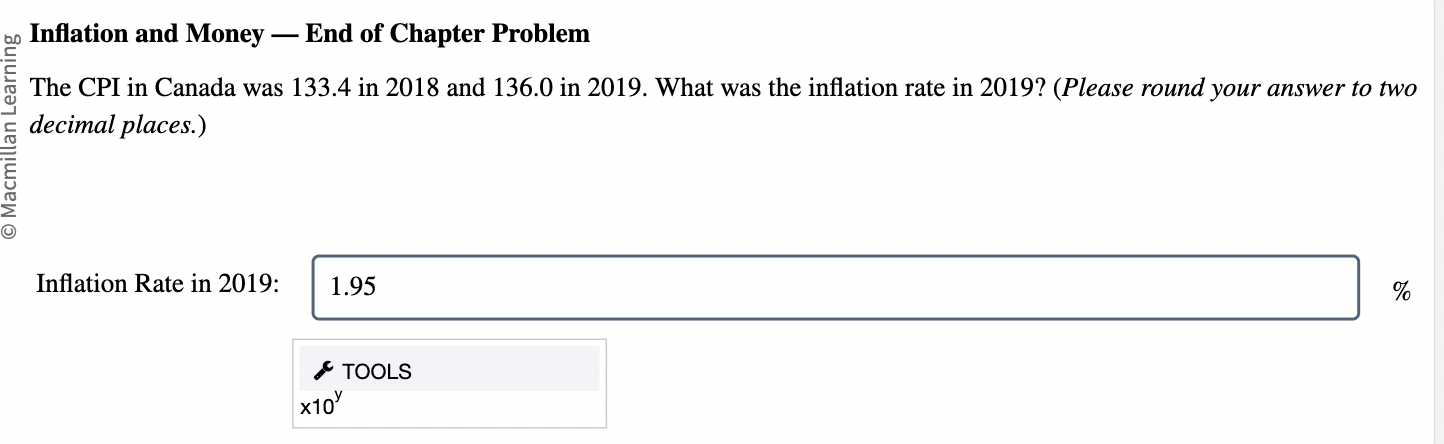

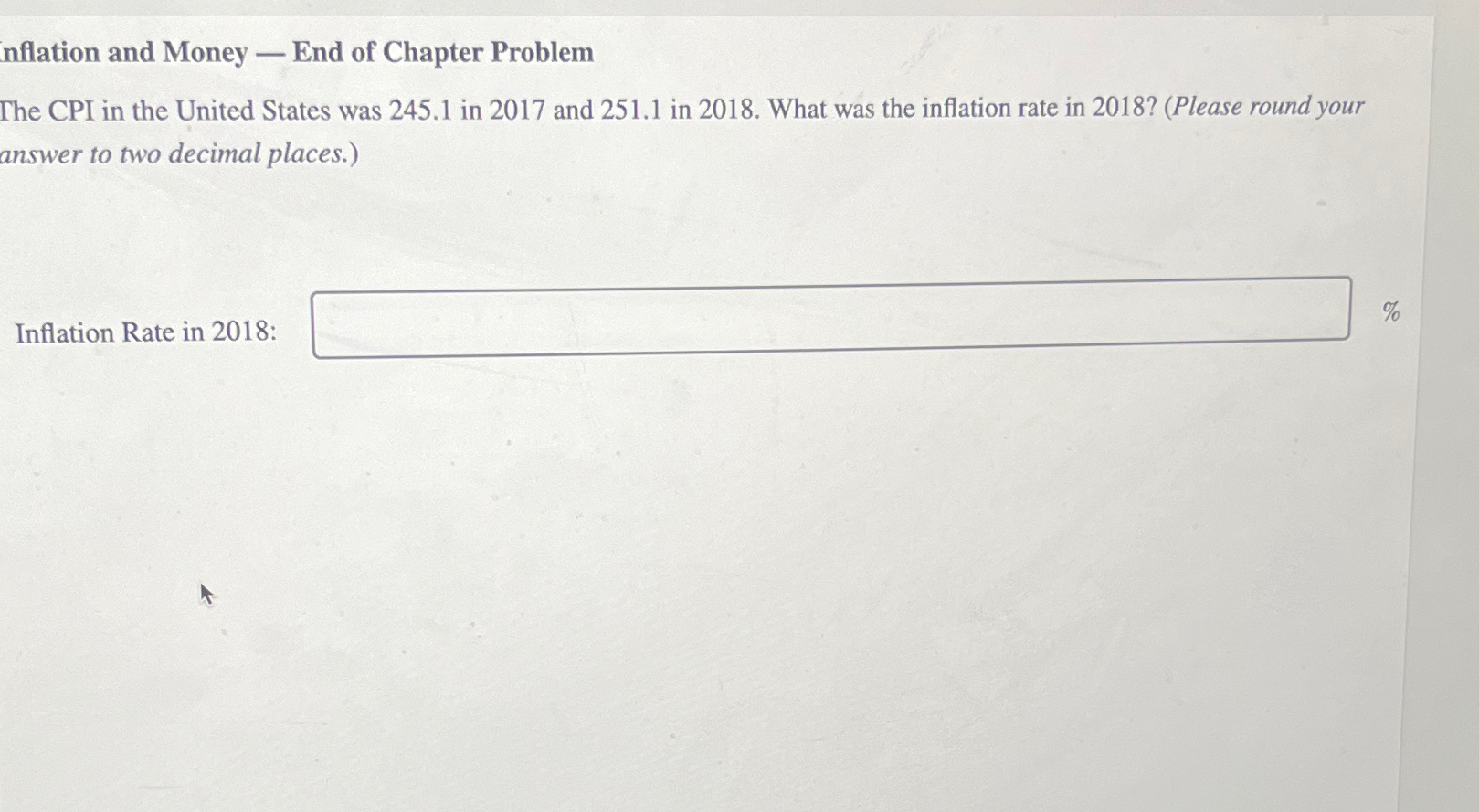

Solved Inflation And Money â ï End Of Chapter Problemthe Cpi Chegg Inflation and money end of chapter problemthe cpi in the united states was 245.1 in 2017 and 251.1 in 2018. what was the inflation rate in 2018 (please round your answer to two decimal places.)inflation rate in 2018: your solution’s ready to go!. The question asks for the inflation rate in 2020, given the cpi (consumer price index) in 2019 and 2020. the inflation rate is calculated as the percentage change in the cpi from one year to the next.

Solved Inflation And Money ï End Of Chapter Problemthe Cpi Chegg One of the primary expenses in a student's basket is tuition, which is also included in the bls calculation of the cpi. consider the portion of total expenditure tuition accounts for in a student's budget versus a typical household's budget. Suppose the cpi was 100 last year and is 112 this year. the 1 year inflation rate equals: check out free spanish lessons, curated flashcard sets, and in depth resources to practice and improve your fluency. It is important to identify signs of inflation to understand its impact on purchasing power and economic stability. in this response, we will analyze each of the provided statements to determine whether they are indicative of inflation. The cpi is a price index and so more accurately captures true inflation, whereas the gdp deflator captures not only price increases but increases in real output.

Solved Inflation And Money â ï End Of Chapter Problemthe Cpi Chegg It is important to identify signs of inflation to understand its impact on purchasing power and economic stability. in this response, we will analyze each of the provided statements to determine whether they are indicative of inflation. The cpi is a price index and so more accurately captures true inflation, whereas the gdp deflator captures not only price increases but increases in real output. Convert the average income in 1975 to 2018 dollars. the cpi was 251.1 in 2018. = round your answer to the nearest cent. 1975 income in 2018 dollars: $ i. 😉 want a more accurate answer? get step by step solutions within seconds. This problem has been solved! you'll get a detailed solution from solvely that helps you learn core concepts. Suppose that instead of a constant money demand function, the velocity of money in this economy was growing steadily due to financial innovation. assuming everything else was unchanged, how would that affect the inflation rate?. Money illusion: people focus on the nominal change (a decrease) without considering the decline in purchasing power due to inflation. this makes the decrease seem larger in real terms than it actually is.

Solved Stion 11 ï Of 22inflation And Money ï End Of Chapter Chegg Convert the average income in 1975 to 2018 dollars. the cpi was 251.1 in 2018. = round your answer to the nearest cent. 1975 income in 2018 dollars: $ i. 😉 want a more accurate answer? get step by step solutions within seconds. This problem has been solved! you'll get a detailed solution from solvely that helps you learn core concepts. Suppose that instead of a constant money demand function, the velocity of money in this economy was growing steadily due to financial innovation. assuming everything else was unchanged, how would that affect the inflation rate?. Money illusion: people focus on the nominal change (a decrease) without considering the decline in purchasing power due to inflation. this makes the decrease seem larger in real terms than it actually is.

Comments are closed.