Solved Multiple Product Break Even Analysis Joe S Tax Chegg

Solved Multiple Product Break Even Analysis Joe S Tax Chegg Multiple product break even analysis joe's tax service prepares tax returns for low to middle income taxpayers. its service operates january 2 through april 15 at a counter in a local grocery store. Super answer offers 95% accuracy with key concepts and common mistakes analysis. calculating break even point and margin of safety in sales dollars for a business with multiple products.

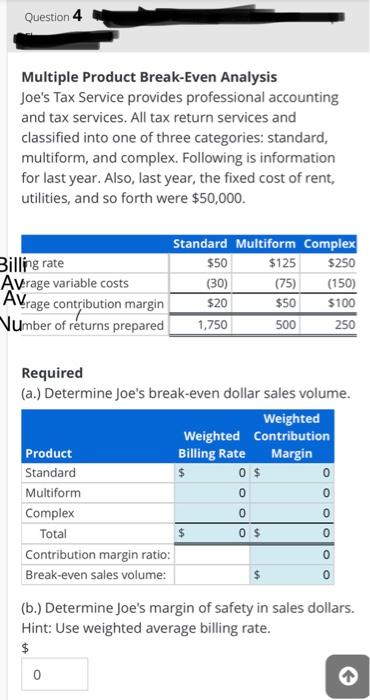

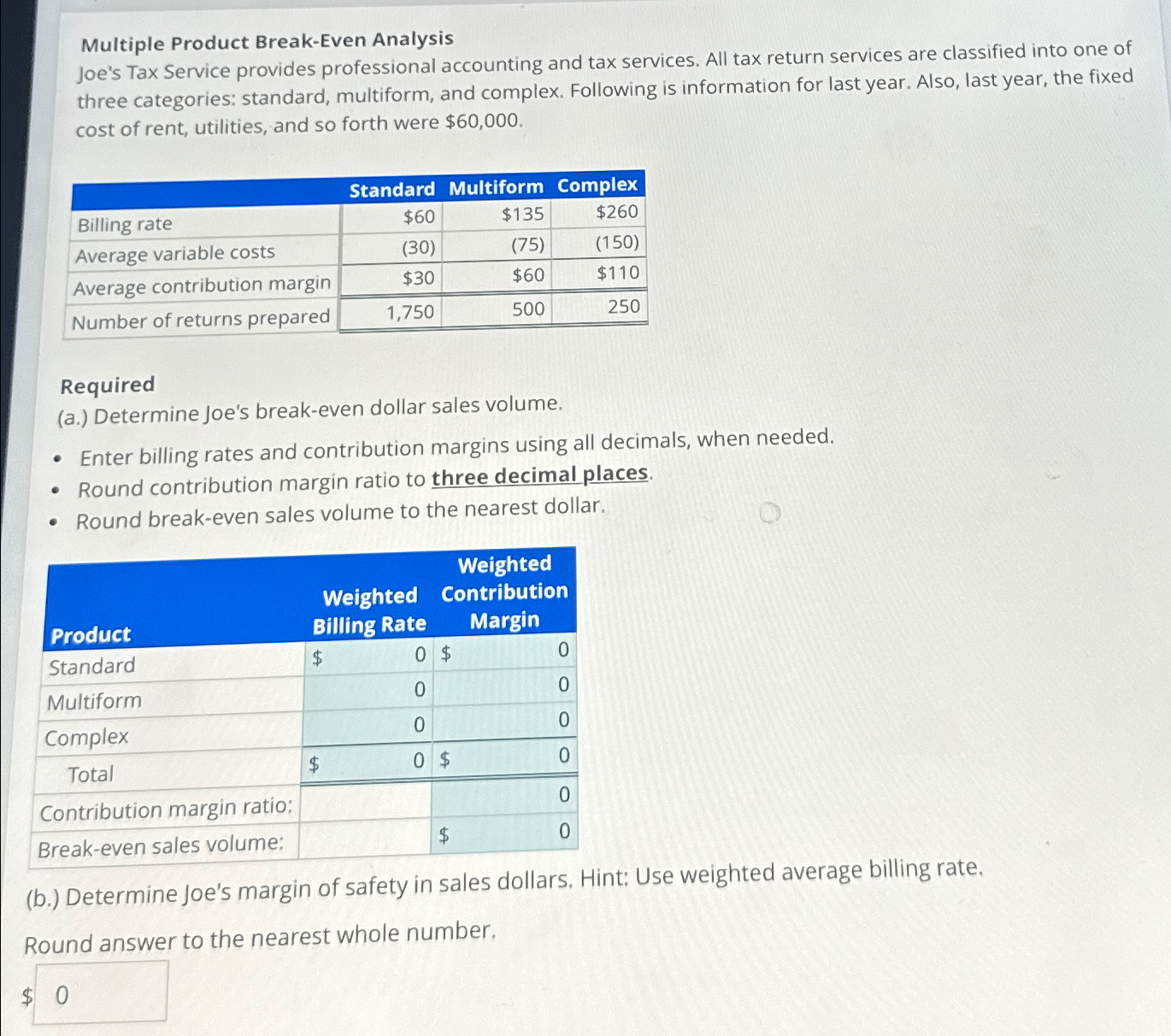

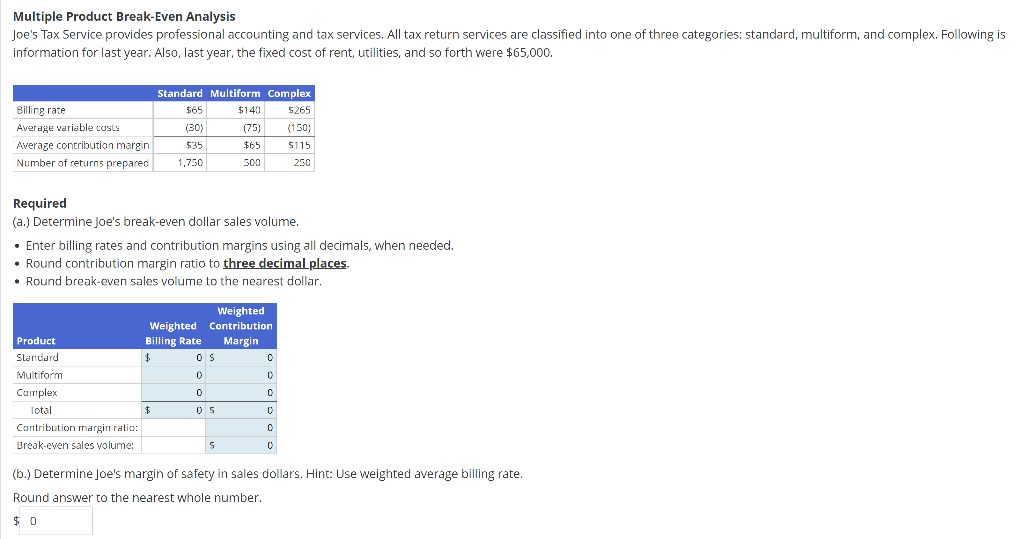

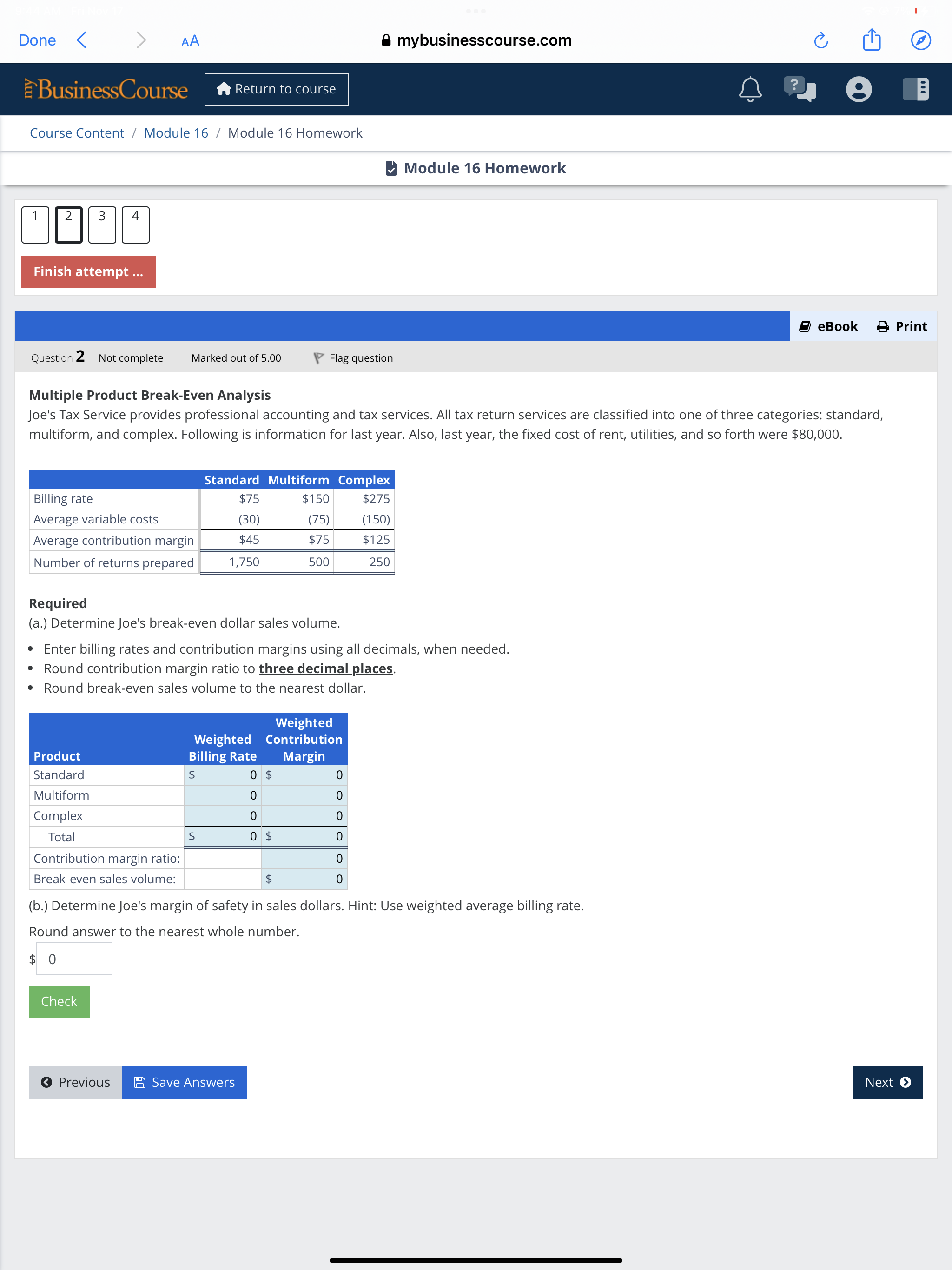

Solved Multiple Product Break Even Analysisjoe S Tax Service Chegg Note : above value of break even sales volume has been calculated taking contribution margin ratio up to 3 decimal places whereas in explanation below no rounding off has been done in intermediate calculation. To calculate the weighted average contribution margin, we need to first calculate the proportion of each category's sales to the total sales. let's assume the sales mix for standard, multiform, and complex services is 40%, 30%, and 30% respectively. Multiple product break even analysis joe's tax service provides professional accounting and tax services. all tax return services are classified into one of three categories: standard, multiform, and complex. Determine joe's break even dollar sales volume. enter billing rates and contribution margins using all decimals, when needed. round contribution margin ratio to three decimal places. round break even sales volume to the nearest dollar. (b.) determine joe's margin of safety in sales dollars. hint: use weighted average billing rate.

Solved Multiple Product Break Even Analysis Joe S Tax Chegg Multiple product break even analysis joe's tax service provides professional accounting and tax services. all tax return services are classified into one of three categories: standard, multiform, and complex. Determine joe's break even dollar sales volume. enter billing rates and contribution margins using all decimals, when needed. round contribution margin ratio to three decimal places. round break even sales volume to the nearest dollar. (b.) determine joe's margin of safety in sales dollars. hint: use weighted average billing rate. Multiple product break even analysis joe's tax service provides professional accounting and tax services. all tax return services are classified into one of three categories: standard, multiform, and complex. The weighted average contribution margin ratio is used to determine the break even sales volume. the margin of safety indicates the cushion joe's tax service has before incurring losses. Determine joe's break even dollar sales volume. enter billing rates and contribution margins using all decimals, when needed. round contribution margin ratio to three decimal places. round break even sales volume to the nearest dollar. Multiple product break even analysis joe's tax service provides professional accounting and tax services. all tax return services are classified into one of three categories: standard, multiform, and complex.

Solved Multiple Product Break Even Analysisjoe S Tax Service Chegg Multiple product break even analysis joe's tax service provides professional accounting and tax services. all tax return services are classified into one of three categories: standard, multiform, and complex. The weighted average contribution margin ratio is used to determine the break even sales volume. the margin of safety indicates the cushion joe's tax service has before incurring losses. Determine joe's break even dollar sales volume. enter billing rates and contribution margins using all decimals, when needed. round contribution margin ratio to three decimal places. round break even sales volume to the nearest dollar. Multiple product break even analysis joe's tax service provides professional accounting and tax services. all tax return services are classified into one of three categories: standard, multiform, and complex.

Comments are closed.