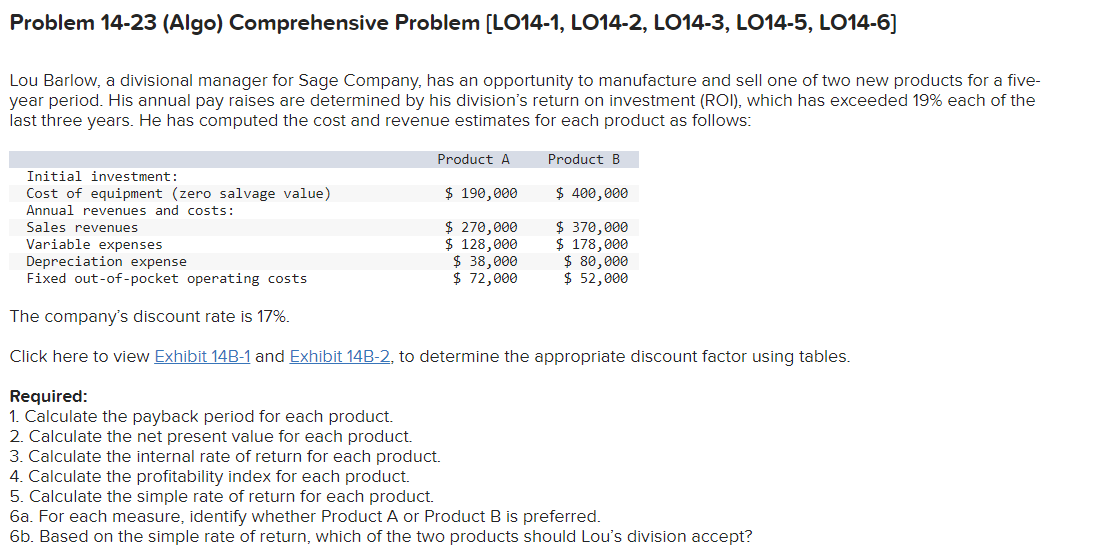

Solved Problem 4 16 Algo ï Comprehensive Chegg Click here to view exhibit 14b 1 and exhibit 14b 2, to determine the appropriate discount factor using tables. required: 1. calculate the payback period for each product. 2. calculate the net present value for each product. 3. calculate the internal rate of return for each product. 4. calculate the profitability index for each product. 5. Problem 14 23 (algo) comprehensive problem [lo14 1, lo14 2, lo14 3, lo14 5, lo14 6] lou barlow, a divisional manager for sage company, has an opportunity to manufacture and sell one of two new products for a five year period.

Solved Problem 12 23 Algo Comprehensive Problem Lo12 1 Chegg Problem 14 23 (algo) comprehensive problem [lo14 1, lo14 2, lo14 3, lo14 5, lo14 6] lou barlow, a divisional. There are 2 steps to solve this one. to solve this problem, we will go step by step to calculate the required financial metrics for both not the question you’re looking for? post any question and get expert help quickly. Problem 14 23 (algo) comprehensive problem [lo14 1, lo14 2, lo14 3, lo14 5, lo answered over 90d ago q on january 1, 2020, mcilroy, inc., acquired a 60 percent interest in the common stock of stinson, inc., for $346,200. Click here to view exhibit 14b 1 and exhibit14b 2, to determine the appropriate discount factor usingtables. required: 1. calculate the payback period for each product. 2. calculate the net present value for each product. 3. calculate the internal rate of return for each product. 4. calculate the profitability index for each product. 5.

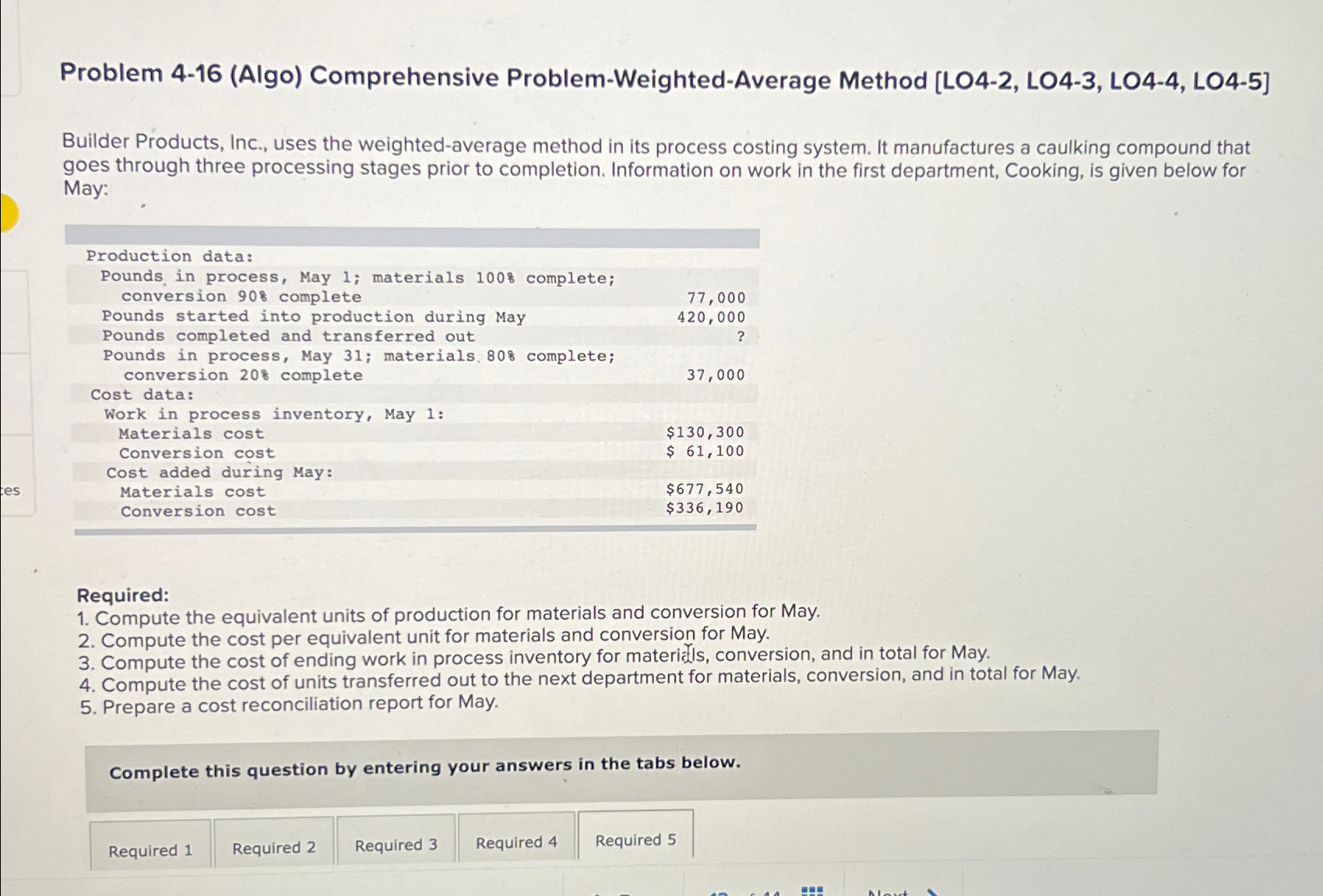

Solved Problem 4 16 Algo Comprehensive Chegg Problem 14 23 (algo) comprehensive problem [lo14 1, lo14 2, lo14 3, lo14 5, lo answered over 90d ago q on january 1, 2020, mcilroy, inc., acquired a 60 percent interest in the common stock of stinson, inc., for $346,200. Click here to view exhibit 14b 1 and exhibit14b 2, to determine the appropriate discount factor usingtables. required: 1. calculate the payback period for each product. 2. calculate the net present value for each product. 3. calculate the internal rate of return for each product. 4. calculate the profitability index for each product. 5. Answer to help needed with this accounting problem. problem 14 23 (algo). Click here to view exhibit 14b 1 and exhibit 14b 2, to determine the appropriate discount factor using tables. required: 1. calculate the payback period for each product. 2. calculate the net present value for each product. 3. calculate the internal rate of return for each product. 4. calculate the profitability index for each product. 5. Click here to view exhibit 14b 1 and exhibit 14b 2, to determine the appropriate discount factor using tables. required: 1. calculate the payback period for each product. 2. calculate the net present value for each product. 3. calculate the internal rate of return for each product. product a req 1 req 2 $ 370,000 $ 400,000 $ 180,000 req 3 4. Problem 14 1 determining the price of bonds; discount and premium; issuer and investor [lo14 2] on january 1, 2018, instaform, inc., issued 14% bonds with a face amount of $50 million, dated january 1. the bonds mature in 2037 (20 years). the market yield for bonds of similar risk and maturity is 16%. interest is paid semiannually.

Solved Problem 14 23 Algo Comprehensive Problem Lo14 1 Chegg Answer to help needed with this accounting problem. problem 14 23 (algo). Click here to view exhibit 14b 1 and exhibit 14b 2, to determine the appropriate discount factor using tables. required: 1. calculate the payback period for each product. 2. calculate the net present value for each product. 3. calculate the internal rate of return for each product. 4. calculate the profitability index for each product. 5. Click here to view exhibit 14b 1 and exhibit 14b 2, to determine the appropriate discount factor using tables. required: 1. calculate the payback period for each product. 2. calculate the net present value for each product. 3. calculate the internal rate of return for each product. product a req 1 req 2 $ 370,000 $ 400,000 $ 180,000 req 3 4. Problem 14 1 determining the price of bonds; discount and premium; issuer and investor [lo14 2] on january 1, 2018, instaform, inc., issued 14% bonds with a face amount of $50 million, dated january 1. the bonds mature in 2037 (20 years). the market yield for bonds of similar risk and maturity is 16%. interest is paid semiannually.