Solved Problem 7 Intro A New Company Is Offering Its Shares Chegg

Solved Problem 7 Intro A New Company Is Offering Its Shares Chegg Problem 7 intro a new company is offering its shares for sale in an initial public offering (ipo) through an auction. there is a 40% probability that the company will be very successful, in which case each share is worth $42. If the company succeeds, the investment will be worth $100,000, and if the company fails, it will be worth nothing. the probability of the company succeeding is 15%.

Solved Problem 4 Intro Your Company Is Evaluating A New Chegg The company will sell new shares of equity via a general cash offering to raise the needed funds. if the offer price is $21 per share and the company's underwriters charge a spread of 7 percent, how many shares need to be sold?. An initial public offering of shares of common stock of the cart company is being conducted. the company is offering 14,100,000 shares of common stock and the selling stockholders are offering an additional 7,900,000 shares of common stock. There will be 10,000 new shares offered at $50 each. a. what is the new market value of the company? (do not round intermediate calculations.) b. how many rights are associated with one of the new shares? (do not round intermediate calculations.) what is the ex rights price?. Search our library of 100m curated solutions that break down your toughest questions. ask one of our real, verified subject matter experts for extra support on complex concepts. test your knowledge anytime with practice questions. create flashcards from your questions to quiz yourself.

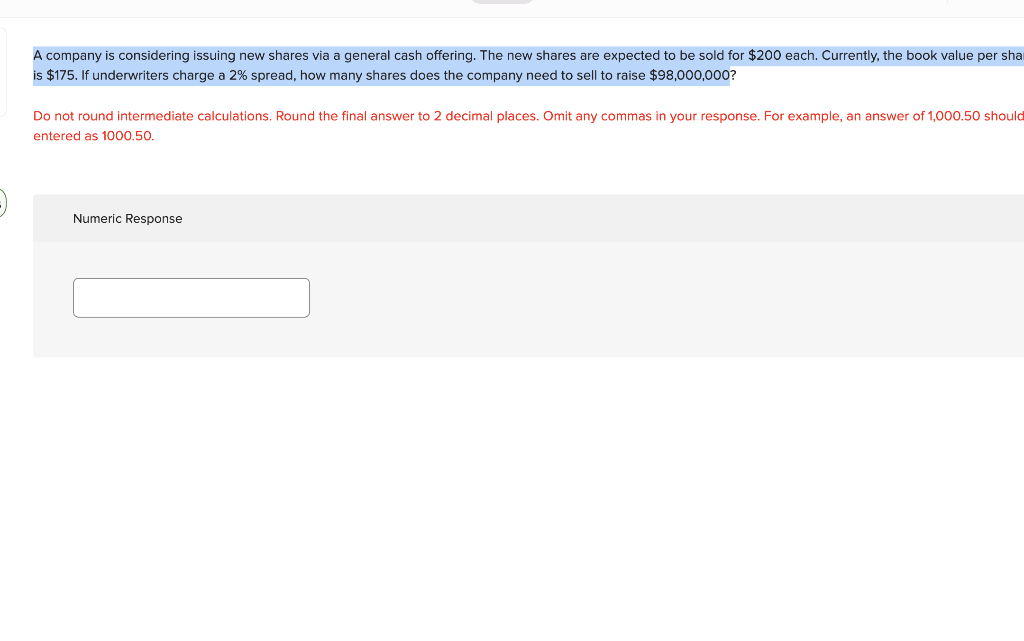

Solved A Company Is Considering Issuing New Shares Via A Chegg There will be 10,000 new shares offered at $50 each. a. what is the new market value of the company? (do not round intermediate calculations.) b. how many rights are associated with one of the new shares? (do not round intermediate calculations.) what is the ex rights price?. Search our library of 100m curated solutions that break down your toughest questions. ask one of our real, verified subject matter experts for extra support on complex concepts. test your knowledge anytime with practice questions. create flashcards from your questions to quiz yourself. Problem 7 intro a new company is offering its shares for sale in an initial public offering (ipo) through an auction. there is a 50% probability that the company will be very successful, in which case each share is worth $36. Draiman guitars is offering 135,000 shares of stock in an ipo by a general cash offer. the offer price is $44 per share and the underwriter's spread is 8 percent. Find the latest chegg, inc. (chgg) stock quote, history, news and other vital information to help you with your stock trading and investing. Problem #1 (6 marks) the creasthaven horses corporation needs $75 million to finance its expansion into new markets. the company will sell new shares of equity via a firm commitment offering to raise the needed funds.

Comments are closed.