Solved The Internal Rate Of Return Irr Refers To The Chegg

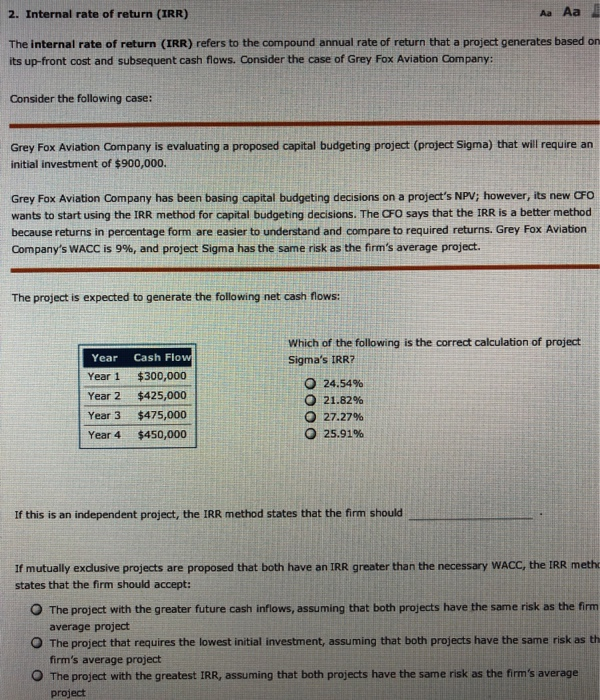

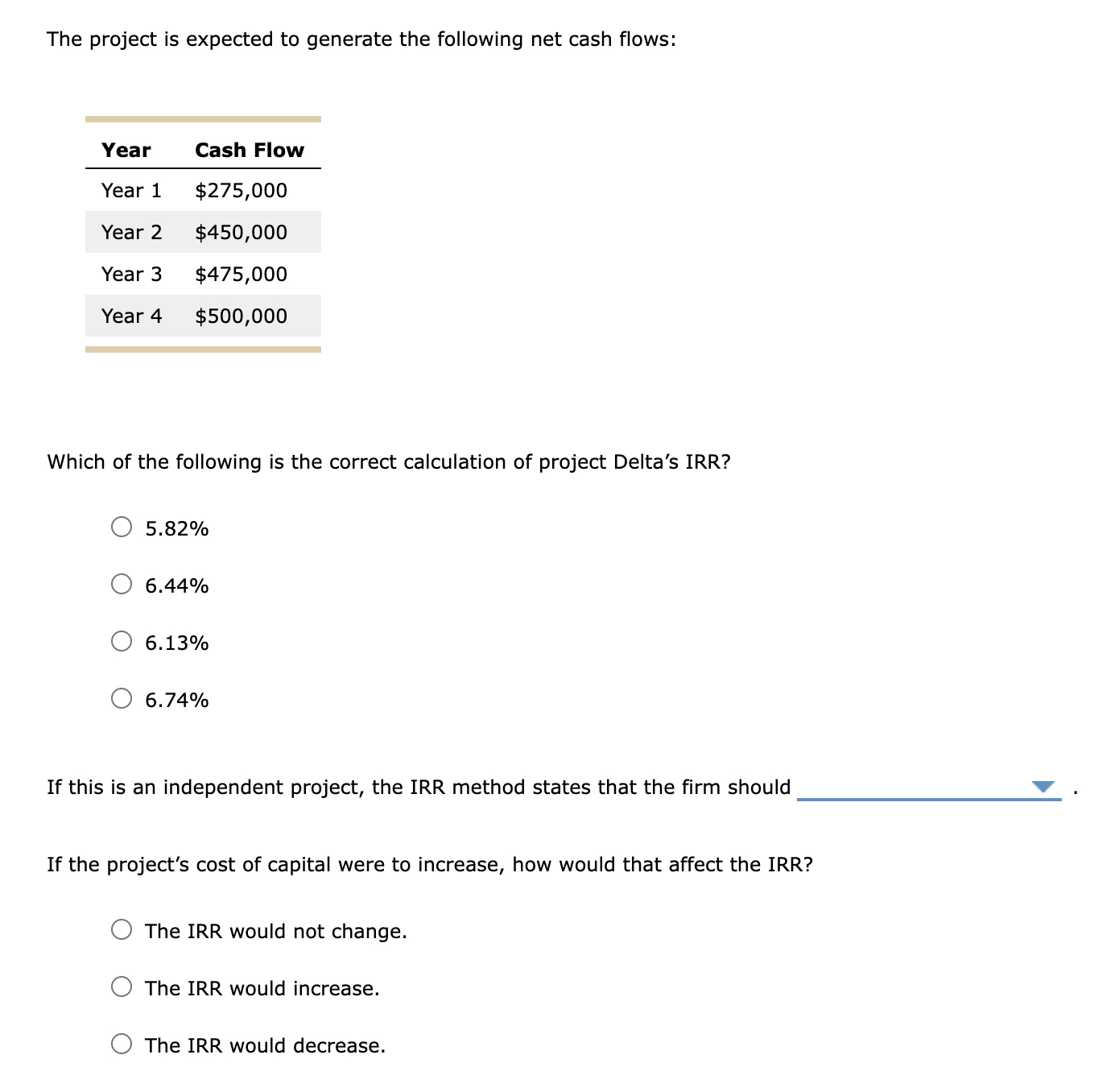

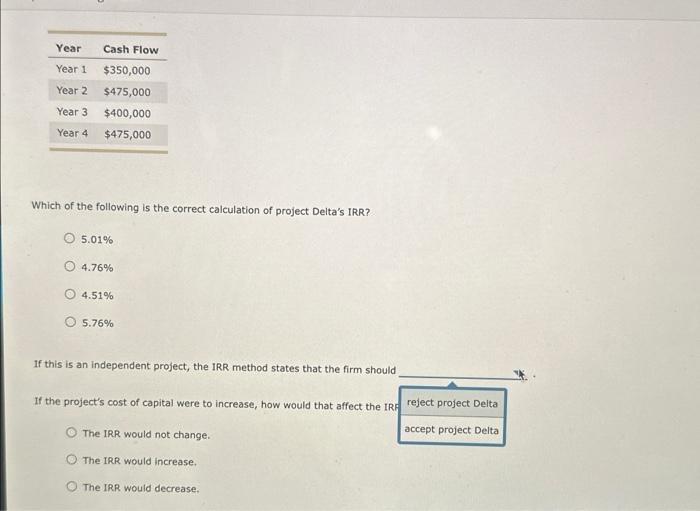

Solved 2 Internal Rate Of Return Irr The Internal Rate Of Chegg Internal rate of return (IRR) is one of several well-known formulas used to evaluate prospective investments, especially ones that generate cash flows, like in real estate Internal Rate of Return (IRR) is a formula used to evaluate the returns of a potential investment IRR calculates the projected annual growth rate of a specific investment over time

Solved Internal Rate Of Return Irr The Internal Rate Of Chegg In addition to the above ratios, the fund's internal rate of return (IRR) since inception, or SI-IRR, is a common formula potential private equity investors should recognize The average 401 (k) rate of return ranges from 5% to 8% per year for a portfolio that's 60% invested in stocks and 40% invested in bonds Of course, this is just an average that financial planners Journal of Financial Education, Vol 24 (SPRING 1998), pp 84-89 (6 pages) The concept of multiple internal rates of return (IRRs) has existed for 60 years However, contemporary financial management Key Takeaways The money-weighted rate of return (MWRR) evaluates investment performance by incorporating the size and timing of cash flows, ensuring the initial investment matches future cash flows

Solved 2 Internal Rate Of Return Irr The Internal Rate Of Chegg Journal of Financial Education, Vol 24 (SPRING 1998), pp 84-89 (6 pages) The concept of multiple internal rates of return (IRRs) has existed for 60 years However, contemporary financial management Key Takeaways The money-weighted rate of return (MWRR) evaluates investment performance by incorporating the size and timing of cash flows, ensuring the initial investment matches future cash flows The internal rate of return (IRR) is a venerable technique for evaluating deterministic cash flow streams Part of the difficulty in extending this measure to stochastic cash flows is the lack of

Solved 2 Internal Rate Of Return Irr The Internal Rate Of Chegg The internal rate of return (IRR) is a venerable technique for evaluating deterministic cash flow streams Part of the difficulty in extending this measure to stochastic cash flows is the lack of

Solved 2 Internal Rate Of Return Irr The Internal Rate Of Chegg

Solved 2 Internal Rate Of Return Irr The Internal Rate Of Chegg

Comments are closed.