Fill Free Fillable Hm Revenue Customs Pdf Forms Registering with hmrc is essential. learn how to set up for taxes as a sole trader or limited company. #ukbusiness #taxsetup. Sign in or set up a personal or business tax account, self assessment, corporation tax, paye for employers, vat and other services.

Do I Need To Register With The Hmrc Suefoster Info You must register for self assessment by 5 october if you need to complete a tax return and you have not sent one before. check how to register for self assessment. if you’re new to self. Step #1: visit the hmrc website head over to the hmrc website here and choose the option to register through your business tax account step #2: set up a government gateway account. How do i register online for self assessment if i'm self employed? watch this video for a step by step guide to registering online for self assessment if you're self employed. 0:00. When you set up your own business as a self employed sole trader or in a partnership, you need to register for self assessment with hm revenue & customs (hmrc). hmrc will set up the right tax.

Filing Crypto Taxes With Hmrc Uk Crypto Tax Guide How do i register online for self assessment if i'm self employed? watch this video for a step by step guide to registering online for self assessment if you're self employed. 0:00. When you set up your own business as a self employed sole trader or in a partnership, you need to register for self assessment with hm revenue & customs (hmrc). hmrc will set up the right tax. However, for other individuals registration can be done through the hmrc self assessment portal. once registered, you’ll receive your unique taxpayer reference (utr) via post within 10 working days. step 4: set up a government gateway account. after receiving your utr, create an account on the hmrc government gateway. this allows you to file. Step 4: complete the hmrc registration form. visit the hmrc website (gov.uk) and navigate to the appropriate registration section. you may need to set up a government gateway account if you don’t already have one. select the services you need to register for, which may include: self assessment; corporation tax; paye for employers; vat. To register for online filing you'll need your: unique taxpayer reference (utr) – the 10 digit number that appears on any correspondence from hmrc. national insurance number or postcode. if you don't have a utr, complete the registering for self assessment form. hmrc will then send you your utr. to register for online filing, follow these steps:. Step 1 visit the hmrc ‘register for self assessment’ page. step 2 select ‘register through your business tax account’ or follow this link. step 3 sign in with your government gateway account, you may need to create one if you don’t have one already. step 4 follow the questions and register your sole trader business.

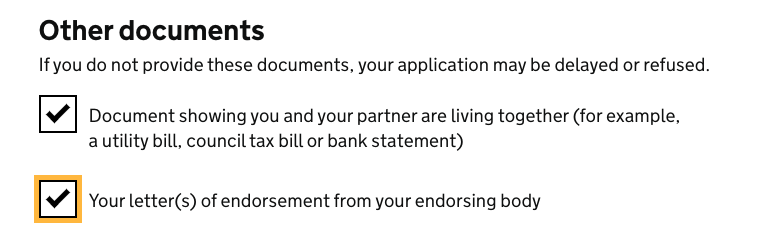

Stage 2 Filling Hmrc Form Stage 2 Uk Tech Nation Visa Forum However, for other individuals registration can be done through the hmrc self assessment portal. once registered, you’ll receive your unique taxpayer reference (utr) via post within 10 working days. step 4: set up a government gateway account. after receiving your utr, create an account on the hmrc government gateway. this allows you to file. Step 4: complete the hmrc registration form. visit the hmrc website (gov.uk) and navigate to the appropriate registration section. you may need to set up a government gateway account if you don’t already have one. select the services you need to register for, which may include: self assessment; corporation tax; paye for employers; vat. To register for online filing you'll need your: unique taxpayer reference (utr) – the 10 digit number that appears on any correspondence from hmrc. national insurance number or postcode. if you don't have a utr, complete the registering for self assessment form. hmrc will then send you your utr. to register for online filing, follow these steps:. Step 1 visit the hmrc ‘register for self assessment’ page. step 2 select ‘register through your business tax account’ or follow this link. step 3 sign in with your government gateway account, you may need to create one if you don’t have one already. step 4 follow the questions and register your sole trader business.

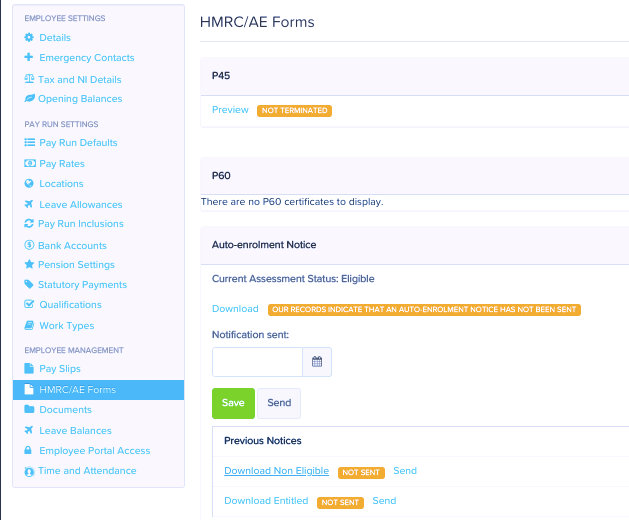

Hmrc Forms Your Payroll Uk To register for online filing you'll need your: unique taxpayer reference (utr) – the 10 digit number that appears on any correspondence from hmrc. national insurance number or postcode. if you don't have a utr, complete the registering for self assessment form. hmrc will then send you your utr. to register for online filing, follow these steps:. Step 1 visit the hmrc ‘register for self assessment’ page. step 2 select ‘register through your business tax account’ or follow this link. step 3 sign in with your government gateway account, you may need to create one if you don’t have one already. step 4 follow the questions and register your sole trader business.

Do I Need To Register With The Hmrc Sue Foster Ways To Make And