Gctfcu Blog Step By Step Guide To Auto Loan Pre Approval Unsecured & secured auto loans: which loan is best for you? the article provides a complete comparison of unsecured and secured auto loans to help you make a we step by step guide to auto loan pre approval. Read step by step guide to auto loan pre approval by greater central texas federal credit union on issuu and browse thousands of other publications.

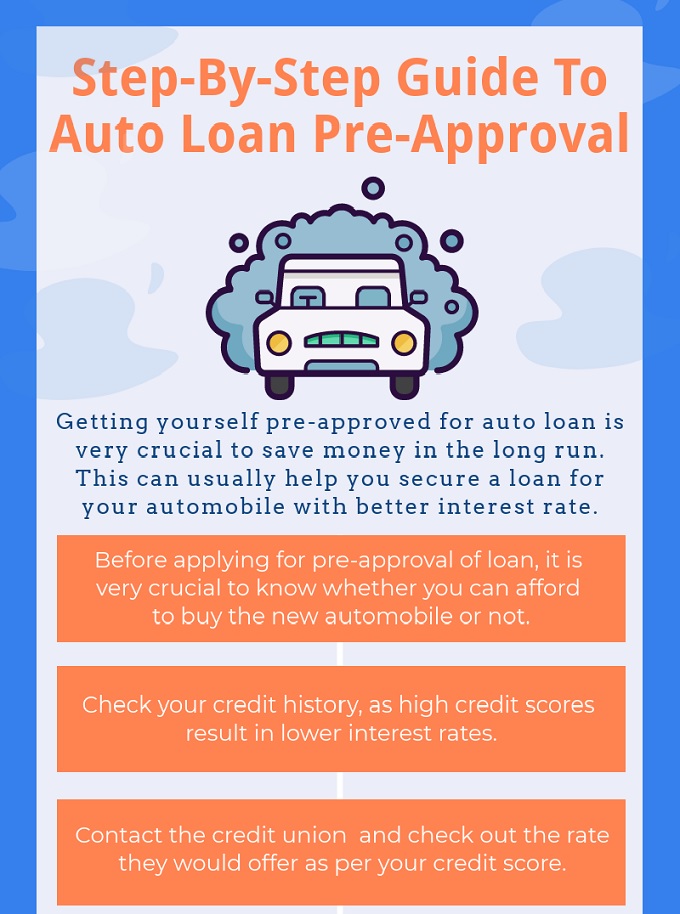

Step By Step Guide To Auto Loan Pre Approval Before applying for pre approval of loan, it is very crucial to know whether you can afford to buy the new automobile or not. check your credit history, as high credit scores result in lower interest rates. Members of credit unions can easily get pre approved for the loan. they generally approve the loan application within 24 48 hours of document verification. the whole process is quite flexible & hassle free. Here are four general steps for how to apply for an auto loan pre approval. keep in mind the process varies by lender. decide if you want to purchase a new or used vehicle. this will help loan officers determine the circumstances of your pre approval. consider your lending options. Four easy steps to buying a used car. step 1: getting pre approved. having a pre approved loan allows you to concentrate on finding a good vehicle and not worrying about the pitfalls of third party financing. contact the credit union's loan department at 800.749.9732 or get pre approved online for a used car loan before you look at vehicles.

Auto Loan Pre Approval Great Lakes Credit Union Here are four general steps for how to apply for an auto loan pre approval. keep in mind the process varies by lender. decide if you want to purchase a new or used vehicle. this will help loan officers determine the circumstances of your pre approval. consider your lending options. Four easy steps to buying a used car. step 1: getting pre approved. having a pre approved loan allows you to concentrate on finding a good vehicle and not worrying about the pitfalls of third party financing. contact the credit union's loan department at 800.749.9732 or get pre approved online for a used car loan before you look at vehicles. Determine your budget: start with making a budget so as to choose the right auto loan in terms of pricing (monthly payments). get pre approved: even though your credit union will conduct a credit score check on its own, it is advisable to get the loan pre approved from the credit union. Getting pre approved for an auto loan before purchasing a car is a great way to better understand the optimal price range for your vehicle. once you have been pre approved by loan officers, your loan pre approval will last for up to 30 days. One of the best ways to simplify the process and gain an advantage when negotiating with dealerships is by getting pre approved for an auto loan. pre approval gives you a clear budget,. Pre approval, like the name suggests, equips you with proof of your financial ability to gain an auto loan before you start shopping. it fully prepares you to efficiently choose your new vehicle, sign the papers and jump into your new ride.

How Long Does Auto Loan Pre Approval Last Financing Determine your budget: start with making a budget so as to choose the right auto loan in terms of pricing (monthly payments). get pre approved: even though your credit union will conduct a credit score check on its own, it is advisable to get the loan pre approved from the credit union. Getting pre approved for an auto loan before purchasing a car is a great way to better understand the optimal price range for your vehicle. once you have been pre approved by loan officers, your loan pre approval will last for up to 30 days. One of the best ways to simplify the process and gain an advantage when negotiating with dealerships is by getting pre approved for an auto loan. pre approval gives you a clear budget,. Pre approval, like the name suggests, equips you with proof of your financial ability to gain an auto loan before you start shopping. it fully prepares you to efficiently choose your new vehicle, sign the papers and jump into your new ride.

Fillable Online Auto Loan Pre Approval Letter Template Auto Loan Pre One of the best ways to simplify the process and gain an advantage when negotiating with dealerships is by getting pre approved for an auto loan. pre approval gives you a clear budget,. Pre approval, like the name suggests, equips you with proof of your financial ability to gain an auto loan before you start shopping. it fully prepares you to efficiently choose your new vehicle, sign the papers and jump into your new ride.

Auto Loan Preapproval Everything You Need To Know Autotrader